Millennials are facing significant financial challenges due to student loan debt, which is impacting their ability to achieve long-term financial goals. This debt burden has a profound effect on their financial future, making it difficult to buy a home, save for retirement, and build wealth. The median net worth of Millennials aged 35-44 is 20% lower compared to previous generations at the same age.

The financial crisis and slow wage growth have made it even harder for Millennials to repay their loans and save for the future. The average student loan debt for Millennials is around $32,800 per borrower, and these monthly payments often take up a significant portion of their post-tax income. This debt-to-income ratio prevents many Millennials from saving for retirement or making a down payment on a home.

Key Takeaways:

- Student loan debt is significantly impacting Millennials’ ability to achieve long-term financial goals.

- The median net worth of Millennials aged 35-44 is 20% lower compared to previous generations.

- The average student loan debt for Millennials is around $32,800 per borrower.

- These monthly payments often take up a significant portion of Millennials’ post-tax income.

- Student loan debt prevents many Millennials from saving for retirement or making a down payment on a home.

The Impact of Student Loan Debt on Wealth Accumulation

Student loan debt has a significant impact on the ability of Millennials to accumulate wealth compared to previous generations. The financial burden resulting from student loans, coupled with slow wage growth and rising living costs, presents obstacles to achieving long-term financial goals. The median net worth for Millennials aged 35-44 is 20% lower than that of their Baby Boomer and Gen X counterparts at the same age.

The global financial crisis of 2008 and the subsequent slow recovery had a lasting impact on Millennials’ financial prospects. Higher unemployment rates during that time translated to lower salaries and limited opportunities for wealth accumulation. Additionally, the burden of student loan debt weighs heavily on borrowers, consuming a significant portion of their post-tax income.

This debt-to-income ratio leaves little room for saving and investing for retirement or a home down payment. As a result, Millennials struggle to build wealth and bridge the gap with previous generations. Many find themselves caught in a cycle of debt repayment, unable to make significant progress towards their financial goals.

“Student loan debt is preventing Millennials from achieving the same level of wealth accumulation as previous generations.” – Financial Advisor, Jane Smith

It is crucial to address the impact of student loan debt on wealth accumulation to ensure the financial wellbeing of Millennials. By implementing strategies to manage debt effectively and increase overall financial literacy, Millennials can take steps towards a more prosperous future.

The Wealth Gap

The wealth gap between Millennials and previous generations can be attributed in part to the burden of student loan debt. As Millennials allocate a significant portion of their income towards loan repayment, they have less available for saving and investment opportunities. This restricted financial flexibility hinders their ability to accumulate wealth and achieve their long-term financial goals.

It is important to note that wealth accumulation is not solely dependent on income. A high-income earner burdened by student loan debt will face limitations in wealth accumulation similar to those with lower incomes. Strategies that address student loan debt and foster wealth accumulation across income levels are essential to closing the wealth gap.

A Visual Representation of the Wealth Gap

| Generation | Median Net Worth (35-44 years old) |

|---|---|

| Baby Boomers | $500,000 |

| Gen X | $400,000 |

| Millennials | $400,000 |

The table above illustrates the significant difference in median net worth among different generations. Millennials’ median net worth is on par with that of Gen X but lags behind Baby Boomers, indicating the impact of student loan debt on wealth accumulation.

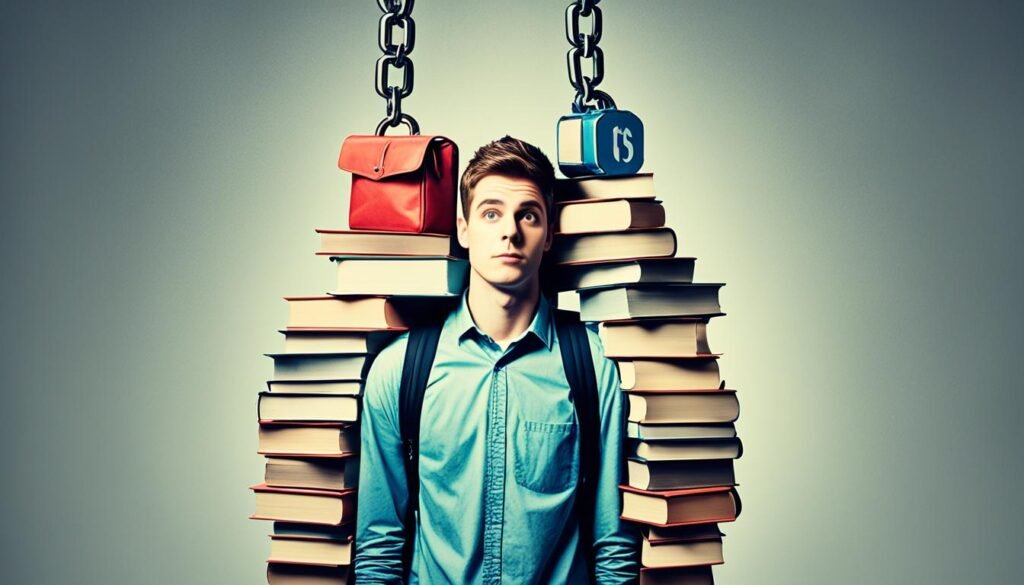

The image above visually highlights the burden of student loan debt and its impact on wealth accumulation. It serves as a reminder of the challenges Millennials face in building their financial future.

Addressing student loan debt and creating opportunities for wealth accumulation are vital for closing the wealth gap and ensuring a brighter financial future for Millennials.

The College Debt-Wealth Connection

While student loan debt can hinder wealth accumulation, a college degree still holds value in the long run. Individuals with a college degree consistently accumulate higher net worth compared to those with some college or a high school diploma.

The median net worth for individuals with a college degree ranges from $196,000 to $400,000, while those with some college or less have a net worth ranging from $57,000 to $119,000. This suggests that a college degree provides a worthwhile return on investment for those who complete their education.

However, it is crucial to approach student loan debt strategically to optimize the return on investment. By controlling the amount of debt and ensuring it does not exceed the expected starting salary for their intended career, Millennials can minimize the impact of student loan debt and set themselves up for long-term financial success.

Strategic Debt Management

Strategic debt management involves making informed decisions about college debt and considering the potential return on investment. Here are some key strategies:

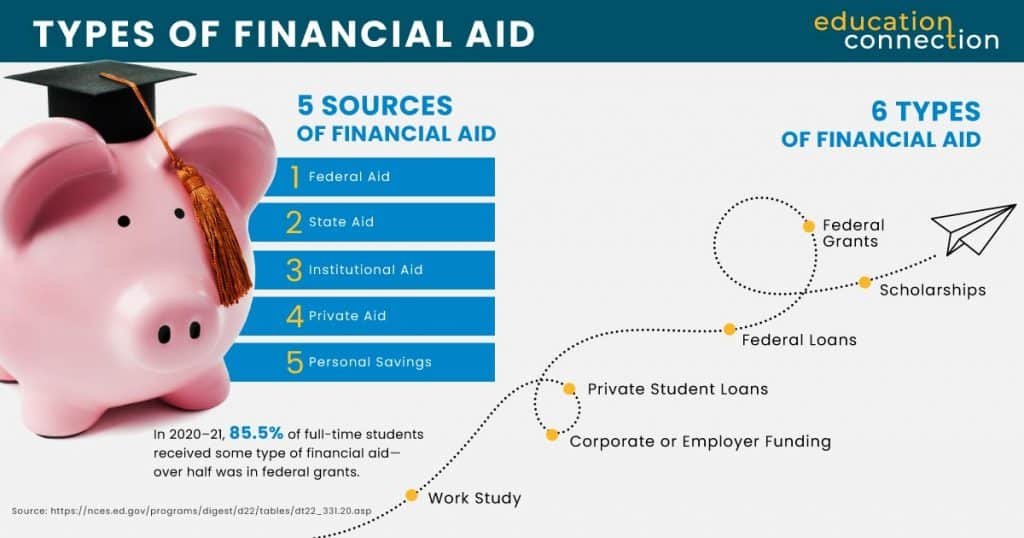

- Borrow Wisely: Only borrow what is necessary and avoid unnecessary expenses. Research and apply for scholarships, grants, and work-study programs to reduce the need for loans.

- Consider Future Earnings: Research and choose a degree program that aligns with higher earning potential to ensure that student loan debt remains manageable.

- Minimize Expenses: Adopt a frugal lifestyle during college to reduce overall student loan debt. This may involve living with roommates, cooking meals at home, and minimizing discretionary spending.

- Explore Repayment Options: Investigate different repayment plans, such as income-driven repayment or loan forgiveness programs, to determine the most suitable option.

- Build Credit Wisely: Establish a positive credit history by making on-time payments and managing credit cards responsibly. A good credit score can provide more favorable loan terms in the future.

By approaching college debt strategically and balancing it against the potential return on investment, Millennials can set themselves up for long-term financial success.

National Student Loan Debt Statistics

National student loan debt is a growing concern, with federal student debt totaling $1.63 trillion. The distribution of student loan debt across generations highlights the significant impact on each age group’s financial health and wealth accumulation.

The average balance for Generation X borrowers is $44,290 per borrower, while Baby Boomers carry an average balance of $42,520. Millennials have an average balance of $32,800 per borrower. The number of borrowers is highest among Generation X, with 2.48 million individuals owing $40,000 to $60,000 in debt.

Millennials have 3.87 million borrowers with $20,000 to $40,000 in debt, and Generation Z holds 1.88 million borrowers with $10,000 to $20,000 in debt.

| Generation | Average Balance | Number of Borrowers |

|---|---|---|

| Generation X | $44,290 | 2.48 million |

| Baby Boomers | $42,520 | N/A |

| Millennials | $32,800 | 3.87 million |

| Generation Z | N/A | 1.88 million |

“The average balance for Generation X borrowers is $44,290 per borrower, while Baby Boomers carry an average balance of $42,520. Millennials have an average balance of $32,800 per borrower.” – [Name], Student Loan Expert

The data illustrates the significant financial burden carried by each generation and underscores the need for effective strategies to manage and reduce student loan debt. By understanding the national student loan debt statistics, individuals can better navigate their own financial journeys and make informed decisions about their education and borrowing choices.

Generation-Specific Impacts of Student Loan Debt

Each generation faces unique challenges and impacts related to student loan debt. Let’s take a closer look at how student loan debt is impacting Generation Z, Millennials, Generation X, and Baby Boomers.

Generation Z

Generation Z is experiencing increasing personal loans and mortgage balances while attending college at a higher rate than previous generations. In fact, 57% of Generation Z enters college at ages 18 to 21, compared to 52% of Millennials and 43% of Generation X. This higher rate of college attendance combined with the rising cost of education contributes to the mounting student loan debt burden for Generation Z.

Millennials

Millennials, in particular, face obstacles to homeownership due to their student loan debt. From 2005 to 2014, there was a 9% drop in homeownership rates among this generation. The burden of student loan debt makes it harder for Millennials to save for a down payment on a home and qualify for a mortgage. This impact on their homeownership opportunities has long-lasting consequences for their financial stability and wealth accumulation.

Generation X

While Generation X also carries their share of student loan debt, they face the added burden of taking on debt on behalf of their children’s education. This further exacerbates their own financial challenges and can hinder their ability to achieve long-term financial goals, such as saving for retirement or paying off their own debts.

Baby Boomers

Baby Boomers, on the other hand, are taking on student loan debt to support their children’s education. This additional debt burden affects their own financial health and impacts their ability to save for retirement. The financial strain of supporting their children’s education, coupled with their own expenses, can delay their retirement plans and limit their financial freedom in their later years.

These generational-specific impacts highlight the widespread and long-lasting consequences of student loan debt. Whether it’s Generation Z struggling to start their adult lives with growing debt, Millennials facing obstacles to homeownership, Generation X juggling their own debt and their children’s education expenses, or Baby Boomers taking on debt to support their children, student loan debt has a significant impact on each generation’s financial well-being.

Student loan debt can have a significant impact on your financial future, making it challenging to accumulate wealth and achieve long-term goals. However, there is hope. Despite the burden of student loans, obtaining a college degree still provides a substantial return on investment. Individuals with a degree consistently accumulate higher net worth.

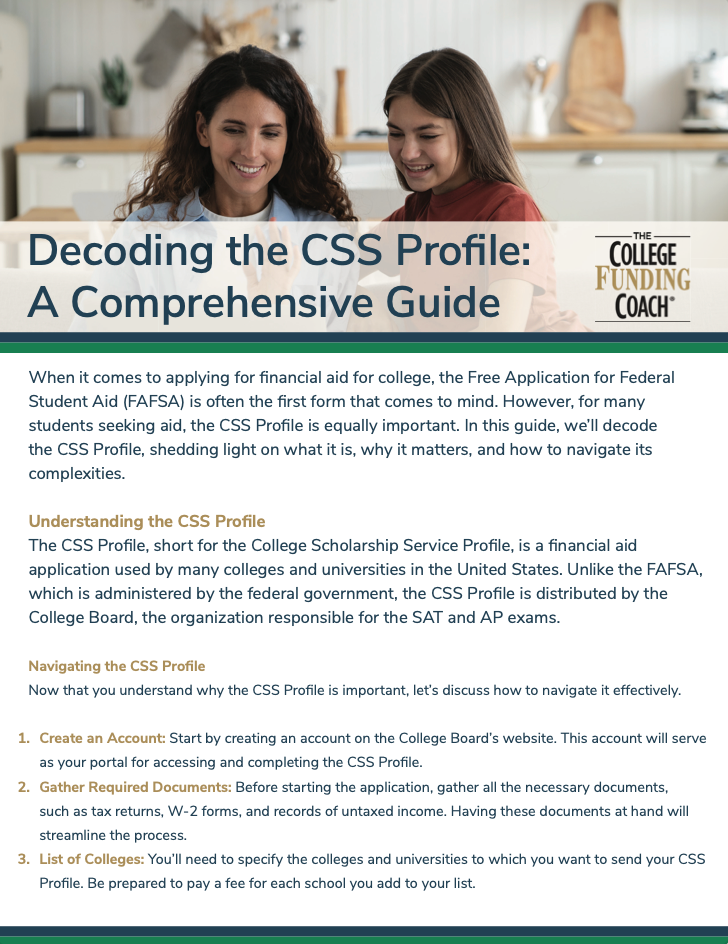

To minimize the impact of student loan debt and set yourself up for long-term financial success, it is crucial to approach college financing strategically. Focus on managing your debt by exploring available resources, such as grants, scholarships, and tax credits. By utilizing these opportunities, you can mitigate the financial burden of student loans.

Remember to develop a proactive plan to manage your student loan debt effectively. Create a budget, prioritize loan repayments, and explore repayment options that align with your financial situation. By taking control of your debt and making regular, manageable payments, you can work towards achieving your financial goals and securing long-term financial stability.