Considering whether student loans are a good idea? In this article, we’ll explore the pros and cons of student loans, helping you make an informed decision about your education financing.

Evaluating the Pros and Cons of Student Loans: Is It the Right Choice for Your Education?

Evaluating the Pros and Cons of Student Loans: Is It the Right Choice for Your Education?

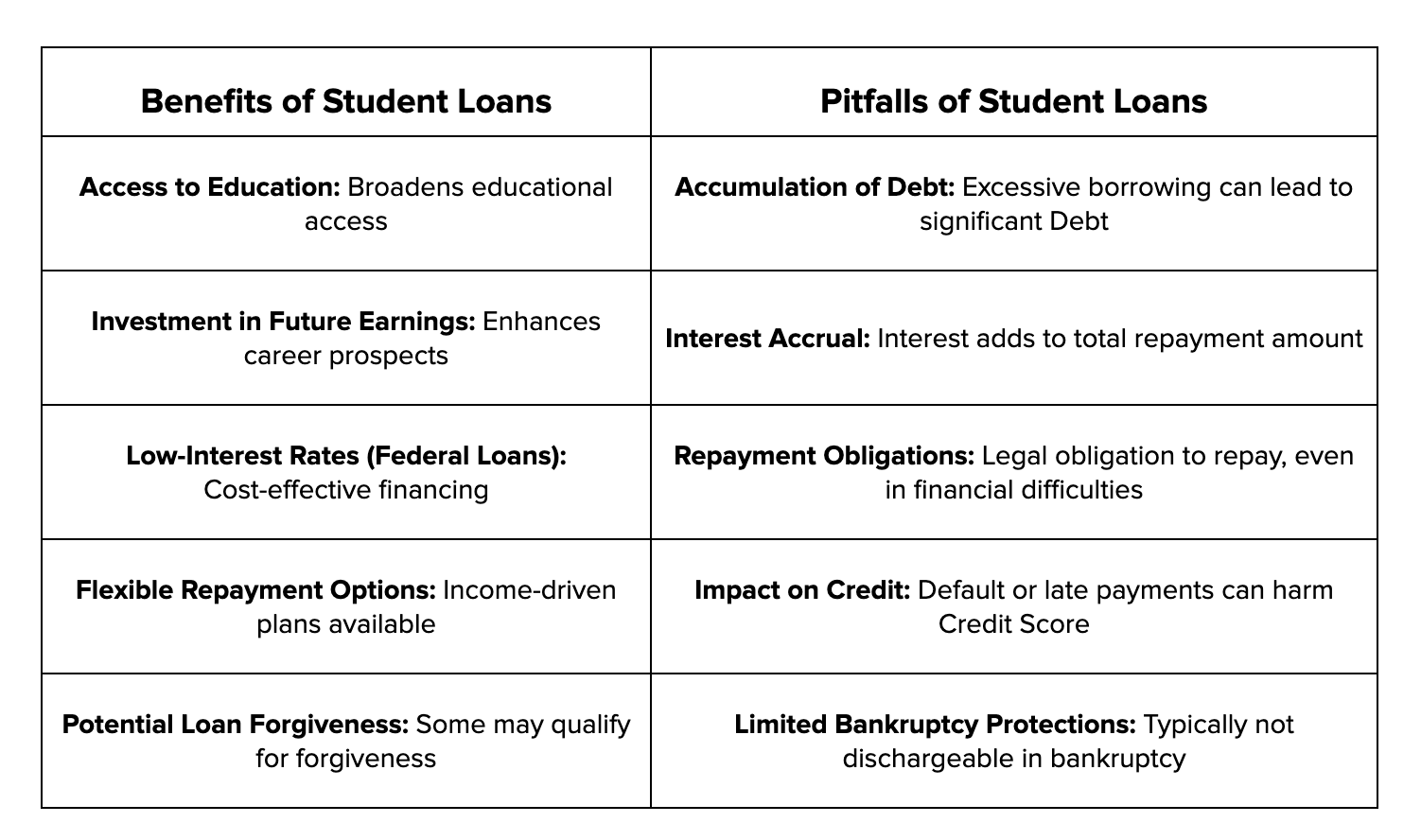

When considering whether or not to take out student loans, it’s essential to weigh both the advantages and disadvantages.

Pros of Student Loans:

1. Access to Higher Education: Student loans make it possible for many students to attend college who otherwise could not afford it.

2. Investment in Your Future: Education can significantly improve your earning potential over a lifetime.

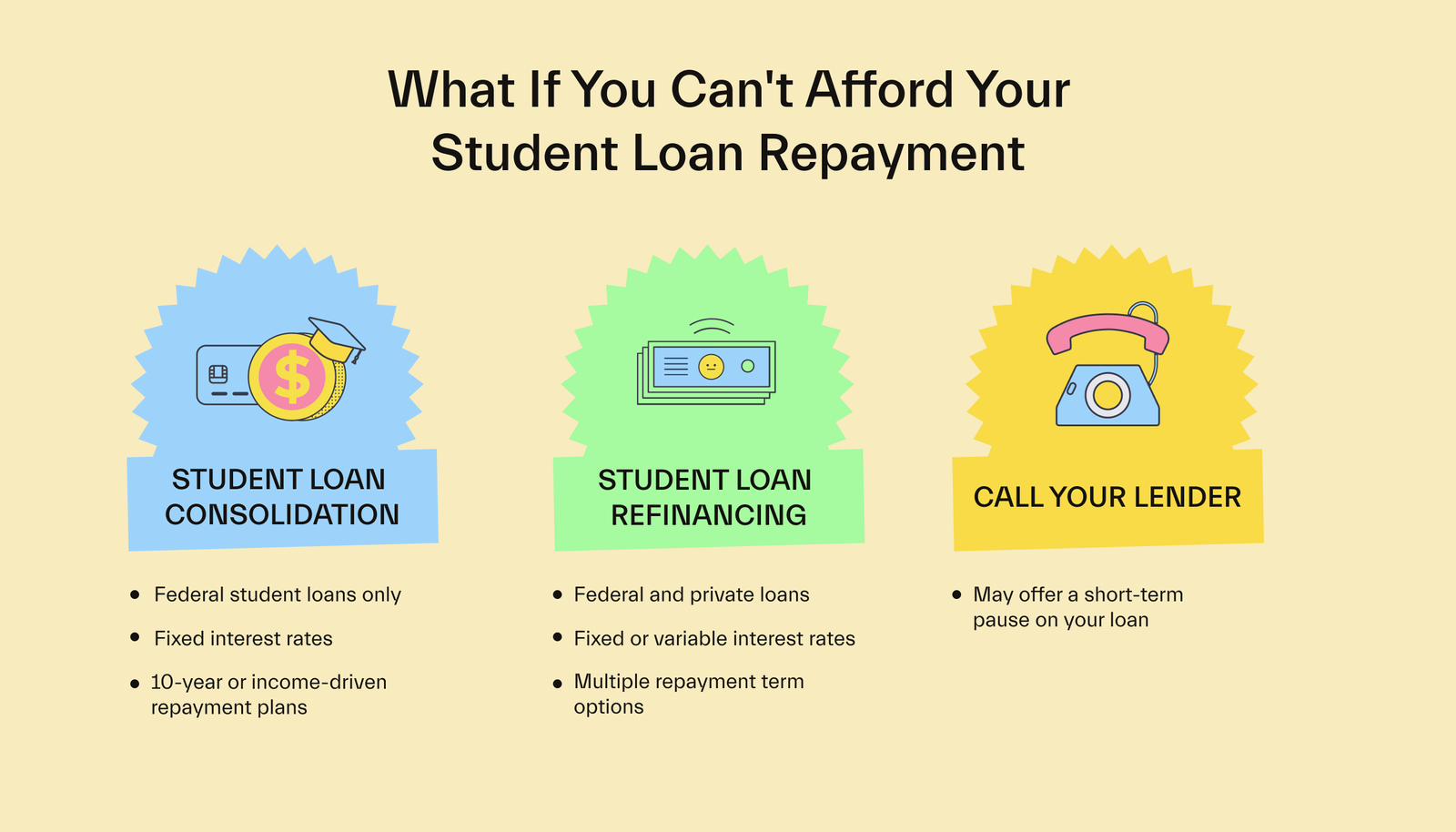

3. Flexible Repayment Options: Federal student loans often come with options such as income-driven repayment plans that adjust based on your income.

4. Building Credit: Successfully managing student loan debt can help you build good credit, which is beneficial for future financial endeavors.

Cons of Student Loans:

1. Debt Burden: Taking on loans means committing to repay them, which can be a substantial burden post-graduation.

2. Interest Accumulation: Interest accrues over time, meaning you’ll end up paying back more than you initially borrowed.

3. Impact on Financial Freedom: Having to make regular loan payments can restrict your financial freedom and career choices.

4. Defaults and Credit Impacts: Failure to repay loans can lead to default, negatively impacting your credit score and financial future.

In conclusion, student loans are a tool that can provide significant opportunities but also come with responsibilities and long-term financial implications.

The Advantages of Student Loans

Student loans can offer several advantages to students who are looking to pursue higher education but lack the necessary funds. One of the primary benefits is that they provide immediate access to education, allowing students to enroll in programs without having to delay their studies to save money. This can be crucial for career progression and personal growth.

Additionally, many student loans come with relatively low interest rates compared to other types of loans, which can make them a more financially manageable option. Moreover, federal student loans often offer flexible repayment options and even income-driven repayment plans that adjust your monthly payments based on your income, providing a safety net for recent graduates who may not have high-paying jobs right away. Some student loans also come with benefits like deferment and forbearance options, which can temporarily pause payments if you’re facing financial hardships.

The Drawbacks of Student Loans

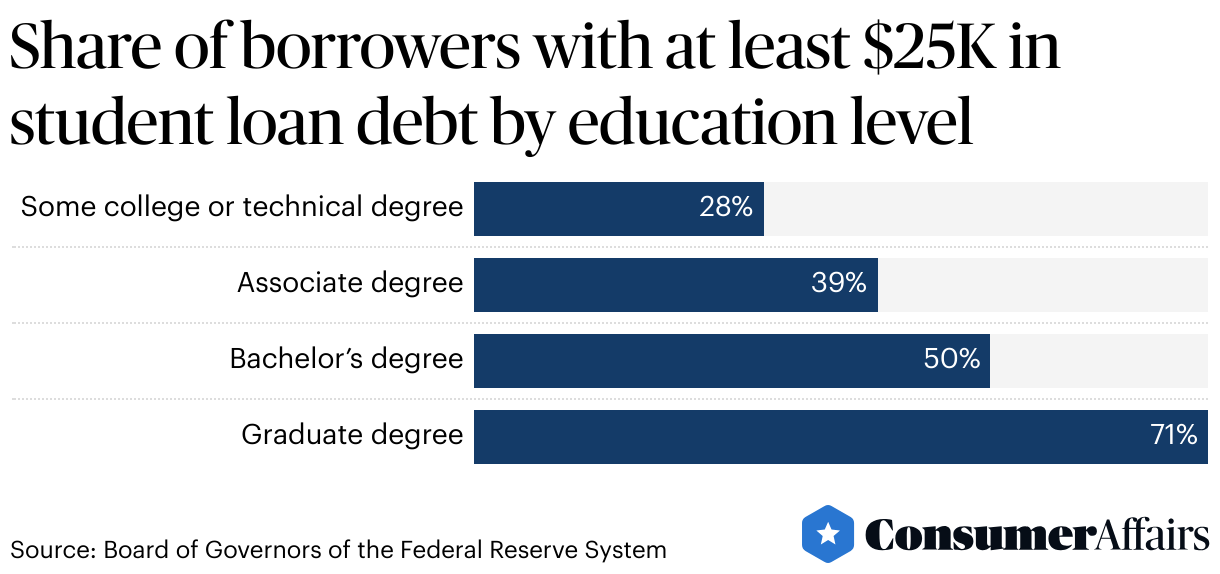

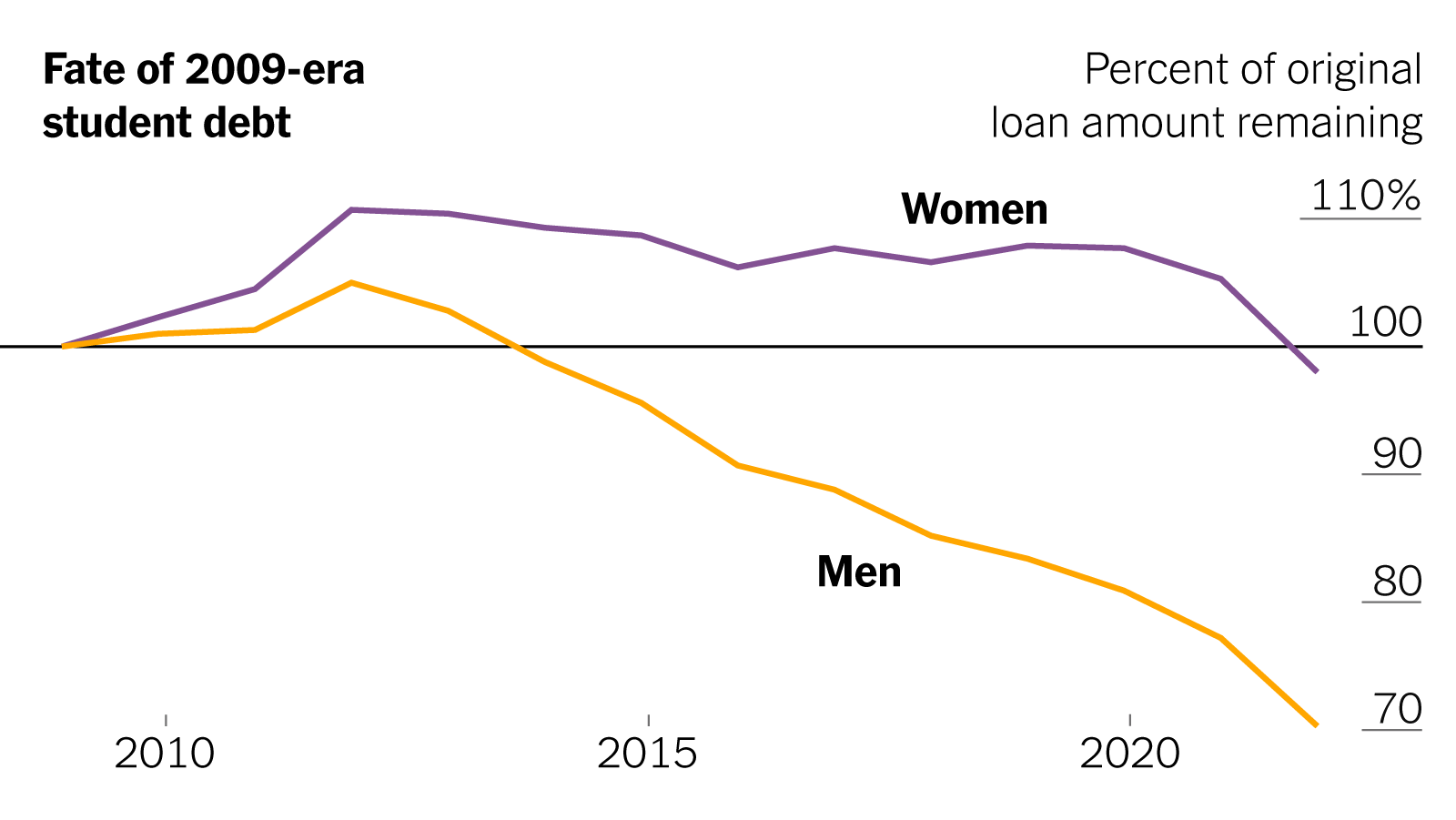

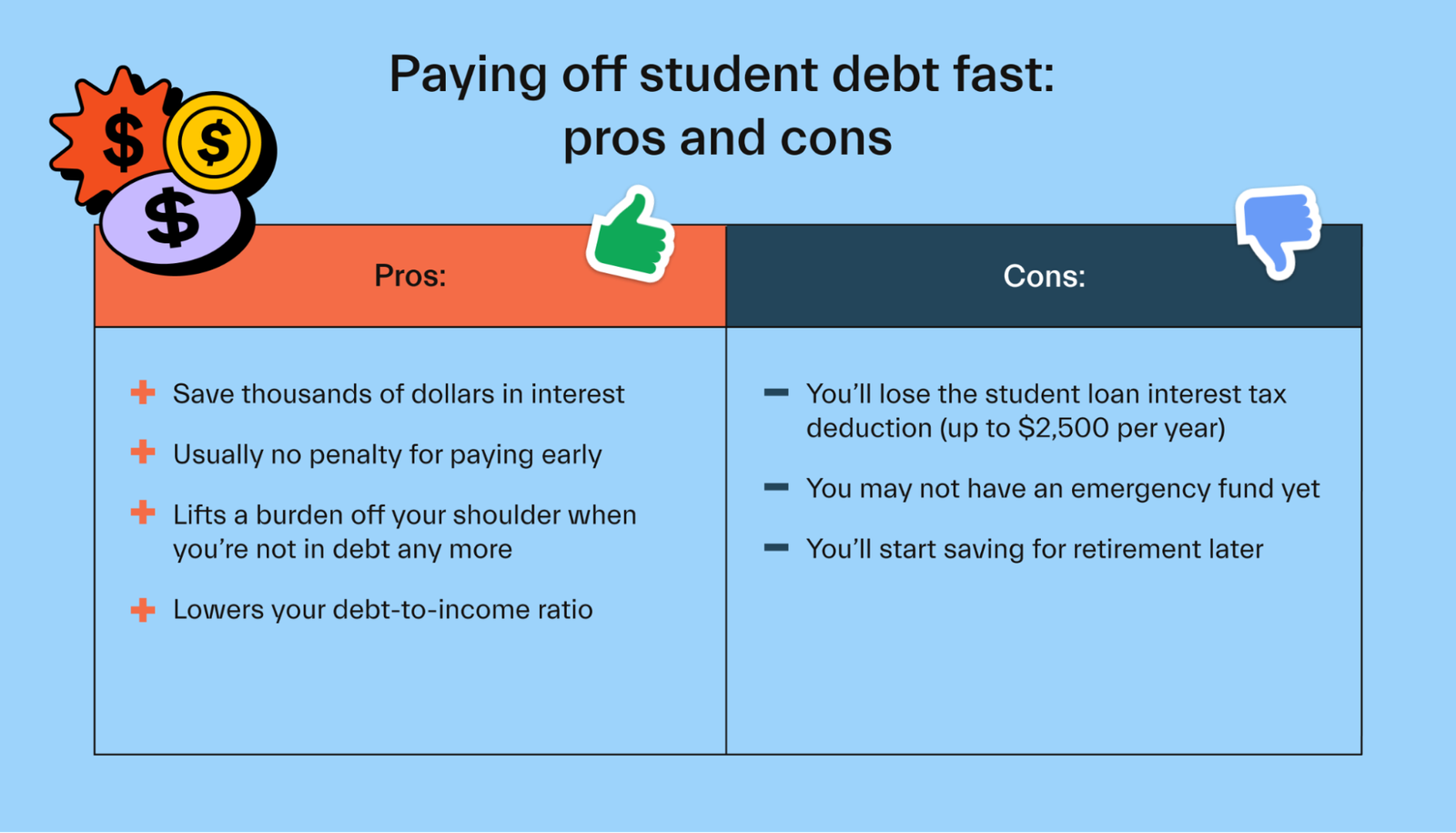

Despite the advantages, student loans have significant drawbacks that must be carefully considered. One of the most concerning aspects is the potential for substantial long-term debt. Graduates often find themselves burdened with debt that can take decades to repay, which might affect their ability to purchase homes, start families, or save for retirement.

Furthermore, the interest that accrues over time can significantly increase the total amount repaid. It’s important to note that unlike other types of debt, student loans are generally not dischargeable in bankruptcy, meaning that you’re stuck with them until they’re fully paid off. Additionally, defaulting on student loans can lead to severe financial consequences, including damaged credit scores and wage garnishment.

Alternative Funding Options

Before committing to student loans, it’s wise to explore alternative funding options that may help reduce the need for borrowing. Scholarships and grants are among the best alternatives as they do not require repayment and are often based on academic merit or financial need. These can substantially lower the amount you need to borrow.

Another option is participating in work-study programs, where students can work part-time jobs to help pay for their education, gaining valuable work experience in the process. Some employers also offer tuition assistance programs, which can cover a portion of your educational expenses. Crowdfunding and community-based funding might also be viable options depending on your situation. The key is to exhaust all possible avenues before resorting to student loans, thus minimizing your future debt burden.

Frequently Asked Questions

What are the potential long-term financial impacts of taking on student loans?

Taking on student loans can have several long-term financial impacts. Borrowers may experience a delay in achieving financial milestones such as buying a home, saving for retirement, or starting a family due to the burden of loan repayments. Additionally, high levels of debt can affect one’s credit score, impact borrowing capacity, and increase financial stress, potentially influencing career choices. Careful planning and understanding repayment options are crucial to minimize these impacts.

How do interest rates on student loans affect the total amount repaid over time?

Interest rates on student loans significantly affect the total amount repaid over time. Higher interest rates increase the overall cost of the loan, leading to higher monthly payments and a larger total repayment sum. Conversely, lower interest rates reduce these costs. Therefore, understanding and comparing interest rates is crucial for minimizing student loan debt.

Are there alternative funding options to student loans for covering educational expenses?

Yes, there are alternative funding options to student loans for covering educational expenses. Some of the key alternatives include scholarships and grants, which do not need to be repaid; work-study programs, offering part-time employment opportunities; and savings plans like 529 plans. Additionally, employer tuition assistance programs and crowdfunding can also provide financial support.

In conclusion, whether student loans are a good idea largely depends on individual circumstances. The decision to take out a loan for educational purposes should be weighed carefully against future earning potential, the chosen field of study, and the ability to manage debt responsibly. Student loans can provide invaluable opportunities for education and career advancement, but they also come with long-term financial commitments that must not be underestimated. Therefore, it is crucial to utilize available resources, seek comprehensive insights, and potentially consult financial advisors to make an informed choice. Ultimately, when approached with careful planning and consideration, student loans can serve as a powerful tool to unlock educational and professional growth.