The student loan repayment process is set to restart soon after a pause due to the COVID-19 pandemic. Graduates need to proactively plan and budget their finances to ensure a smooth repayment process. It is important to understand the restart of student loans and find out the total amount owed before creating a repayment plan. Budgeting and saving strategies can help graduates manage their loan repayments effectively.

Student loan repayment can be a complex and overwhelming process, especially for recent graduates. Understanding the steps involved and having a clear plan in place can make this journey much smoother. Whether you have federal or private loans, managing and repaying them should be a priority to maintain financial stability.

In this guide, we will cover important aspects of the student loan repayment process, offering useful tips and strategies to help you stay on top of your loan payments and successfully navigate this financial journey. From understanding the restart of student loans to creating a budget and exploring strategies for saving money during repayment, we will equip you with the knowledge and tools you need to manage your student loans effectively.

Key Takeaways from Student Loan Repayment: Understanding the repayment process for student loans is essential :

- Understanding the restart of student loans is crucial for timely repayment.

- Finding out the total amount owed is the first step in creating a repayment plan.

- Budgeting and saving strategies can help you manage your loan repayments effectively.

- Exploring different types of student loans and eligibility criteria is important before applying.

- Utilizing available resources and programs can accelerate the repayment process.

Understand the Restart of Student Loans

The student loan moratorium provided relief to most federal student loan borrowers, but the ability to extend the pause has ended. Over 40 million borrowers will soon see payment due dates restart. Federal student loans typically have a grace period before repayment begins, but this period will come to an end soon. It is important to be aware of the restart date and prepare for the financial responsibility. Interest will resume on September 1, 2023, and payments will restart in October 2023.

As the student loan moratorium comes to an end, it’s crucial to understand what this means for federal student loans. With over 40 million borrowers soon facing the restart of payment due dates, it’s essential to be prepared for the upcoming financial responsibility.

One important aspect to consider is the grace period typically provided by federal student loans. This grace period allows borrowers some time before they are required to begin repaying their loans. However, this grace period will soon come to an end, and borrowers will need to start making regular payments once again.

Interest on federal student loans will also resume on September 1, 2023. This means that borrowers will need to account for the accruing interest when planning their repayment strategy. Understanding how interest accrual affects the overall loan amount can help borrowers better manage their loan repayment journey.

The restart of student loans is scheduled for October 2023 when borrowers will need to resume making monthly payments. It’s important to mark this date on your calendar and be prepared to allocate funds towards your loan repayment.

Being informed about the restart of student loans and the associated payment due dates is crucial to stay on top of your financial obligations. By understanding these key dates, you can plan your budget effectively and allocate the necessary funds to ensure a smooth repayment process.

Finding Out How Much You Owe

Before you can create a repayment plan for your student loans, it’s important to have a clear understanding of the total amount owed. This includes the outstanding balance, interest rates, and contact information of your loan servicer.

You can access a comprehensive summary of your federal loans through the National Student Loan Data System (NSLDS) website. This online tool provides a centralized database of federal loan information, making it easy to keep track of your loans and stay organized. The NSLDS website also allows you to view your loan history, including any current or past loans, as well as details such as loan types and repayment statuses.

Private loan holders should refer to their respective loan providers for similar information. Different providers may have different platforms or systems for accessing loan details. It’s important to familiarize yourself with your loan servicer’s website or contact their customer service for assistance.

Tip: Remember to gather all relevant information and make note of your loan servicer’s contact details. This will come in handy when you need to reach out for any questions or concerns regarding your loans.

Understanding the total amount owed is the first step toward managing your student loan debt effectively. By staying informed about your loan details, you can make informed decisions about your repayment plan and take control of your financial future.

Loan Summary Example

| Loan Type | Outstanding Balance | Interest Rate |

|---|---|---|

| Federal Direct Subsidized Loan | $12,000 | 4.5% |

| Federal Direct Unsubsidized Loan | $8,500 | 5.0% |

| Federal Perkins Loan | $3,000 | 3.75% |

In the above example, the borrower has three federal loans with different outstanding balances and interest rates. This breakdown helps to provide a clear overview of the loan situation, making it easier to create a repayment plan based on individual loan characteristics.

Budgeting Monthly Loan Repayment Totals

Creating a realistic budget is crucial when it comes to managing your loan repayments effectively. By carefully evaluating your monthly income and deducting essential expenses, you can determine the amount you can comfortably allocate towards repaying your loans. This will provide you with a clear understanding of your loan repayment budget, helping you stay on track and avoid financial stress.

When budgeting for your loan repayments, it’s important to prioritize high-interest loans. These loans tend to accrue more interest over time, making them more expensive in the long run. By allocating more funds towards these loans, you can minimize the overall interest paid and expedite your repayment process.

Additionally, consider exploring income-driven repayment plans if you’re struggling to meet your repayment obligations. These plans adjust your monthly payments based on your income and family size, making them more manageable. They can help alleviate the financial burden and prevent defaulting on your loans. Be sure to research and compare different income-driven repayment plans to find the best fit for your financial situation.

It’s important to be mindful of your spending habits during the repayment process. Avoid unnecessary expenses and lifestyle inflation, which can hinder your ability to meet your loan obligations. By maintaining a focus on your loan repayment budget, you can avoid unnecessary debt and save money in the long run.

Consider implementing money-saving strategies to further support your loan repayment efforts. For example, you can automate your loan payments to ensure they are made on time and avoid any late fees. Some employers also offer student loan repayment assistance programs, which can significantly reduce the financial burden. Additionally, you may want to explore refinancing options or loan consolidation to potentially secure lower interest rates and simplify your repayment process.

Remember to make the most of any windfalls or unexpected income to make extra loan payments. Utilizing tax refunds, bonuses, or other financial windfalls wisely can help you reduce the principal amount, resulting in faster overall loan repayment.

By budgeting your loan repayments effectively, prioritizing high-interest loans, considering income-driven repayment plans, and making strategic financial decisions, you can navigate the loan repayment process with confidence and achieve financial stability.

Example Budget Template

| Income | Amount |

|---|---|

| Monthly Salary | $3,500 |

| Side Gig | $500 |

| Total Income | $4,000 |

| Expenses | Amount |

|---|---|

| Rent/ Mortgage | $1,200 |

| Utilities | $200 |

| Food | $400 |

| Transportation | $200 |

| Loan Payments | $800 |

| Savings | $300 |

| Total Expenses | $3,100 |

Based on the given income and expenses, you would have a surplus of $900 each month, which you can allocate towards additional loan payments or savings.

Strategies for Saving Money During Loan Repayment

When it comes to repaying your student loans, finding strategies to save money can make a significant difference. By implementing smart financial practices, you can accelerate the repayment process and potentially reduce the overall cost of your loans. Here are some effective strategies to help you save:

Automate Payments

Automating your loan payments can help you avoid late fees and ensure that payments are made on time. Setting up automatic payments through your loan servicer or bank not only saves you the hassle of remembering to make manual payments but can also qualify you for interest rate reductions. Be sure to check with your loan servicer about any available incentives for automated payments.

Utilize Employer Repayment Programs

Some employers offer student loan repayment programs as part of their benefits package. Take advantage of these programs, as they can provide significant financial relief. Check with your employer to see if they offer any repayment assistance, and if they do, consider directing the funds toward paying down your loans. This will help you save money and make progress on your repayment journey.

Consider Refinancing and Consolidation

If you have multiple loans with different interest rates, refinancing and consolidation can simplify your repayments and potentially secure lower interest rates. Refinancing involves replacing your existing loans with a new loan that offers more favorable terms. Consolidation, on the other hand, combines multiple loans into a single loan with a fixed interest rate. Explore these options with reputable lenders to see if they can help you save money and streamline your repayment process.

Utilize Windfalls Wisely

Windfalls such as tax refunds, work bonuses, or unexpected monetary gifts provide an excellent opportunity to make extra payments on your student loans. Rather than splurging on non-essential expenses, consider utilizing these windfalls wisely by putting them towards your loan payments. By reducing the principal amount, you can save on interest charges and shorten the overall repayment period.

By implementing these strategies, you can save money and make progress on your student loan repayment journey. Remember, every dollar saved brings you one step closer to financial freedom and debt-free living.

| Strategy | Description |

|---|---|

| Automate Payments | Set up automatic payments to avoid late fees and qualify for interest rate reductions. |

| Utilize Employer Repayment Programs | Take advantage of employer-provided student loan repayment assistance. |

| Consider Refinancing and Consolidation | Explore options to combine loans and secure lower interest rates. |

| Utilize Windfalls Wisely | Put unexpected monetary windfalls towards extra loan payments. |

Understanding Different Types of Student Loans

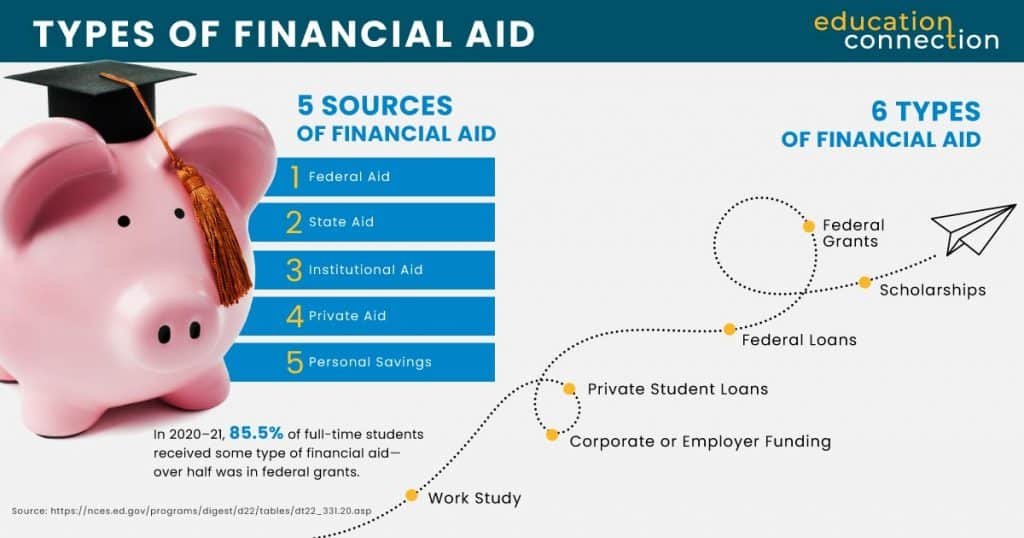

When it comes to financing your education, there are two main types of student loans: federal and private. Each comes with its own unique application process, terms, and benefits. Understanding the differences between these loan types can help you make informed decisions about funding your education.

The Federal Student Loans

Federal student loans are funded by the government and offer several advantages. To apply for federal loans, you will need to complete the Free Application for Federal Student Aid (FAFSA) form. This application determines your eligibility for federal loans, grants, work-study programs, and other forms of financial aid.

Federal loans come with low fixed interest rates, meaning they won’t change over time. This provides stability and predictability when it comes to your monthly loan payments. Additionally, federal loans offer flexible repayment options, such as income-driven repayment plans, which adjust your monthly payments based on your income and family size.

Another benefit of federal loans is the potential for loan forgiveness or deferment options. Depending on your profession or circumstances, you may be eligible for loan forgiveness after a certain number of years of qualifying payments or deferment if you experience financial hardship.

Private Student Loans

Private student loans, on the other hand, are offered by financial institutions like banks and credit unions. The application process for private loans differs from federal loans. While federal loans evaluate your eligibility based on financial need, private loans typically require a credit check and may ask for a co-signer, especially if you have a limited credit history.

Private loans often have higher interest rates compared to federal loans. The rates are determined by your creditworthiness and can vary from one lender to another. Additionally, private loans may have fewer benefits and repayment options compared to federal loans.

It’s important to carefully consider your options and compare the terms and benefits of federal and private loans. Evaluate factors such as interest rates, repayment plans, and potential forgiveness or deferment options to ensure you make the best choice for your situation.

Eligibility and Applying for Student Loans

Before applying for student loans, it’s vital to understand the eligibility requirements and the application process. These factors differ depending on whether you’re considering federal or private loans. Let’s explore the key aspects you need to know.

1. Federal Student Loan Eligibility

If you’re considering federal student loans, the first step is to determine your eligibility. To qualify, you must meet these basic requirements:

- Be a U.S. citizen, permanent resident, or eligible non-citizen

- Have a valid Social Security number

- Enroll or be accepted as a student in an eligible degree or certificate program

- Maintain satisfactory academic progress

- Not be in default or owe a refund on any federal student aid

Additionally, federal student loans require completion of the Free Application for Federal Student Aid (FAFSA) form. The FAFSA determines your eligibility for various types of financial aid, including grants and work-study programs.

2. Private Student Loan Eligibility

If you’re considering private student loans, the eligibility requirements vary depending on the lender. Private loans often take into account your credit history, income, and other factors. Some lenders may require a co-signer, especially if you have limited credit history or income.

It’s important to research and compare different private loan options to find the best fit for your financial situation.

3. Exploring Financial Aid

While student loans are a common option for financing education, it’s crucial to explore other forms of financial aid. Grants and scholarships, for example, do not require repayment and can significantly reduce your financial burden.

Research local, national, and institutional scholarship opportunities, and apply for as many as possible. This can help supplement your funds and potentially reduce the amount of student loans needed.

4. Applying for Student Loans

After determining your eligibility and exploring financial aid options, it’s time to apply for student loans. The application process varies depending on the type of loan:

- Federal loans: Complete the FAFSA form online and submit it to the U.S. Department of Education. Once your eligibility is determined, you will receive a financial aid offer from your school.

- Private loans: Research different lenders and their application processes. Visit their websites, fill out the necessary forms, and provide any required documentation, such as proof of enrollment or income.

It’s essential to follow the instructions carefully and provide accurate information to avoid delays or potential loan denial.

Note: Completing the FAFSA form is a crucial step for federal loans. Even if you think you may not qualify for need-based aid, it’s still recommended to submit the FAFSA, as it could qualify you for other financial assistance.

By understanding eligibility requirements, exploring financial aid options, and following the correct application procedures, you can navigate the process of applying for student loans with confidence.

Next, we will discuss strategies for managing student loan repayments and saving money during the repayment process.

Navigating the student loan repayment process can be challenging, but with proper planning and budgeting, you can manage your loan repayments effectively. Understanding the restart of student loans, finding out the total amount owed, and creating a repayment budget are key steps in taking control of your student loan debt.

To save money and accelerate the repayment process, consider strategies such as automating payments and utilizing employer repayment programs. These options can help you stay on track and make progress towards paying off your student loans faster.

It’s important to explore different types of student loans and understand eligibility requirements before applying. By doing so, you can make informed decisions and choose the loan options that best suit your needs. Remember to utilize available resources like student loan help and student loan resources to guide you through the repayment journey. With determination and careful management, you can successfully navigate your student loan debt and pave the way to a brighter financial future.