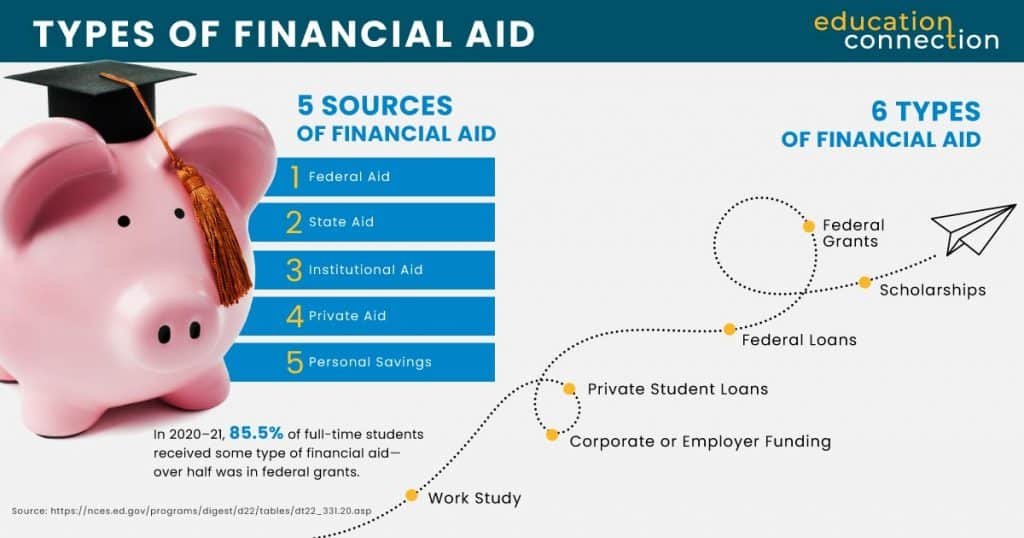

Are you worried about how to fund your college education? Have you heard about federal student aid but aren’t sure how to apply for it? Look no further! We have the answers you need. But before we dive in, let’s start with a question: Did you know that the Free Application for Federal Student Aid (FAFSA) is not just for federal aid? It’s also used by states and colleges to determine eligibility for their financial aid programs.

Now, let’s get down to business. To apply for federal student aid, you must complete the FAFSA on time. The federal deadlines for submitting the FAFSA for the upcoming school years are June 30, 2025, for the school year 2024-25, and June 30, 2024, for the school year 2023-24. It’s important to mark these dates on your calendar and plan ahead.

To start the application process, you’ll need to create a FAFSA account and get a Federal Student Aid (FSA) ID. This ID will serve as your electronic signature and grant you access to your FAFSA information. Once you have your account and ID, you can fill out the FAFSA application online.

Key Takeaways:

- The FAFSA is not only for federal aid, but it’s also used by states and colleges to award financial aid packages.

- Mark the federal deadlines on your calendar to ensure timely submission of the FAFSA.

- Create a FAFSA account and get an FSA ID to start the application process.

- Fill out the FAFSA application online once you have your account and ID.

Now that you have a clear understanding of the importance of FAFSA in securing college funding, it’s time to explore the eligibility requirements for federal student aid. Stay tuned for the next section!

Eligibility for Federal Student Aid

To be considered for federal student aid, you must meet certain eligibility requirements. These requirements ensure that aid is distributed fairly and to those who need it most. Here are the basic eligibility requirements:

- Federal Student Aid Eligibility: You must be a U.S. citizen or eligible noncitizen. This means that international students, undocumented immigrants, and certain categories of noncitizens may not be eligible for federal student aid.

- Basic Eligibility Requirements: You need to have a valid Social Security number. This is necessary for identification and to verify your eligibility. Additionally, you must be enrolled or accepted for enrollment in an eligible degree or certificate program at an accredited institution.

- Financial Need: To determine your eligibility, you must demonstrate financial need. This is determined by your Expected Family Contribution (EFC), which is calculated from the information you provide on the Free Application for Federal Student Aid (FAFSA). Your EFC assesses your family’s ability to contribute to your education expenses.

- Maintaining Satisfactory Academic Progress: To remain eligible for federal student aid, you must maintain satisfactory academic progress. This usually involves meeting minimum GPA requirements and successfully completing a certain number of credits each semester.

- Not Being in Default: Lastly, you must not be in default on a federal student loan. If you have defaulted on a previous federal student loan, you may not be eligible for further aid until you have resolved the default.

Meeting these eligibility requirements is crucial to be considered for federal student aid. It’s important to carefully review and understand these requirements before applying for aid.

Steps to Complete the FAFSA

Completing the Free Application for Federal Student Aid (FAFSA) is a crucial step in securing financial aid for college. To ensure a smooth application process, it’s important to gather all the required information beforehand. This includes:

- Your Social Security number

- Federal income tax returns and W-2 forms

- Records of untaxed income

- Information about your assets

- Certain demographic information

Gathering these documents and details in advance will save you time and prevent unnecessary delays. Once you have all the necessary information, you can begin the FAFSA application online. If you’re unable to provide exact tax information at the time of application, you can estimate your income and correct it later when your tax returns are ready. Accuracy is important, so make sure to review the information you enter before submitting the application.

After completing the FAFSA, you will receive a Student Aid Report (SAR) that summarizes the information you provided. This report is an important document, so be sure to review it carefully and make any necessary corrections by the specified deadline. The SAR will also include your Expected Family Contribution (EFC), which is used by colleges to determine your eligibility for financial aid.

Completing the FAFSA may seem daunting, but with the right preparation and attention to detail, you can navigate the process successfully. Remember, the FAFSA is a gateway to federal, state, and college financial aid opportunities, so it’s essential to fill it out accurately and on time.

Checking Your FAFSA Application Status

After submitting your FAFSA, it’s important to regularly check the status of your application to ensure it has been processed correctly and to stay updated on any updates or requests for additional information. Here are the steps to check your FAFSA application status:

- Login to your FAFSA account: To access your application status, log in to your FAFSA account using your FSA ID. If you don’t have an account, you can create one on the FAFSA website. Your FSA ID serves as your electronic signature and allows you to access your application and other important information related to your financial aid.

- View your application status: Once logged in, navigate to the “My FAFSA” page or a similar section where you can view the status of your application. You should find information about whether your FAFSA has been processed, if any additional documents are required, or if there are any updates or changes to your financial aid package.

- Contact the Federal Student Aid Information Center: If you’re unable to access your application status online or have any questions or concerns, you can reach out to the Federal Student Aid Information Center. Their contact information can be found on the FAFSA website. They can provide further assistance and answer any queries you may have.

In addition to checking your application status, it’s crucial to thoroughly review your Student Aid Report (SAR) once it becomes available. The SAR is a summary report that provides an overview of the information you entered on your FAFSA. It includes your Expected Family Contribution (EFC), which is used to determine your eligibility for federal student aid. Make sure to carefully review the SAR and check for any errors, omissions, or discrepancies.

If you notice any mistakes or need to make corrections to your FAFSA, it’s essential to address them promptly. Failure to correct errors or provide missing information can result in significant delays in processing your application and potentially impact the amount of financial aid you’re eligible to receive. The SAR will provide instructions on how to make corrections, either online or by submitting the necessary documentation.

Checking your FAFSA application status and ensuring the accuracy of your information are critical steps to ensure the proper processing of your financial aid application. By staying informed and proactive, you can navigate the sometimes complex process of financial aid with confidence.

Applying for federal student aid through the FAFSA is a vital step towards securing funding for college. By meeting the deadlines, ensuring eligibility, completing all the necessary steps, and staying informed about your application status, you increase your chances of receiving financial aid. The FAFSA serves as a gateway to federal, state, and college financial aid programs, making it crucial to apply on time and accurately.

Remember to review your Student Aid Report (SAR), make corrections if needed, and stay in touch with the financial aid office of your chosen institution. Taking these steps will help you unlock college funding and pave the way for a successful education.

1 thought on “How to Apply for Federal Student Aid (FAFSA)”