Discover how many owe OVER $100k in student loans and explore the implications of carrying such a substantial debt load. Stay informed with our comprehensive insights and resources on this critical issue.

The Rising Tide: Analyzing the Surge in Borrowers with Over $100k in Student Loans

The title “The Rising Tide: Analyzing the Surge in Borrowers with Over $100k in Student Loans” touches on a critical issue facing today’s higher education system. This piece delves into the root causes and implications of this trend.

Over the past decade, the number of borrowers with student loans exceeding $100,000 has significantly increased. According to recent data, about 2.5 million Americans now owe this staggering amount or more. There are several factors contributing to this surge:

1. Increasing Tuition Costs: One of the primary reasons for the rising loan balances is the continuously climbing cost of college tuition. Both public and private institutions have seen significant hikes in fees, pushing students to borrow more to cover their educational expenses.

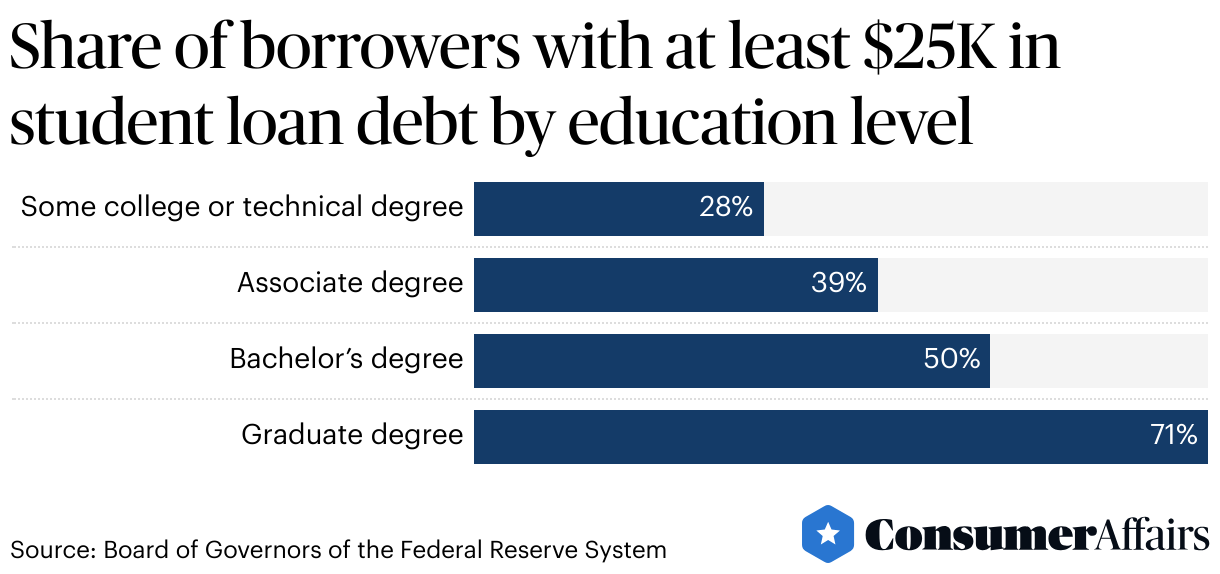

2. Graduate and Professional Degrees: A significant portion of borrowers with over $100k in debt are pursuing advanced degrees. Programs such as medicine, law, and business often come with hefty price tags, resulting in substantial borrowing to finance these degrees.

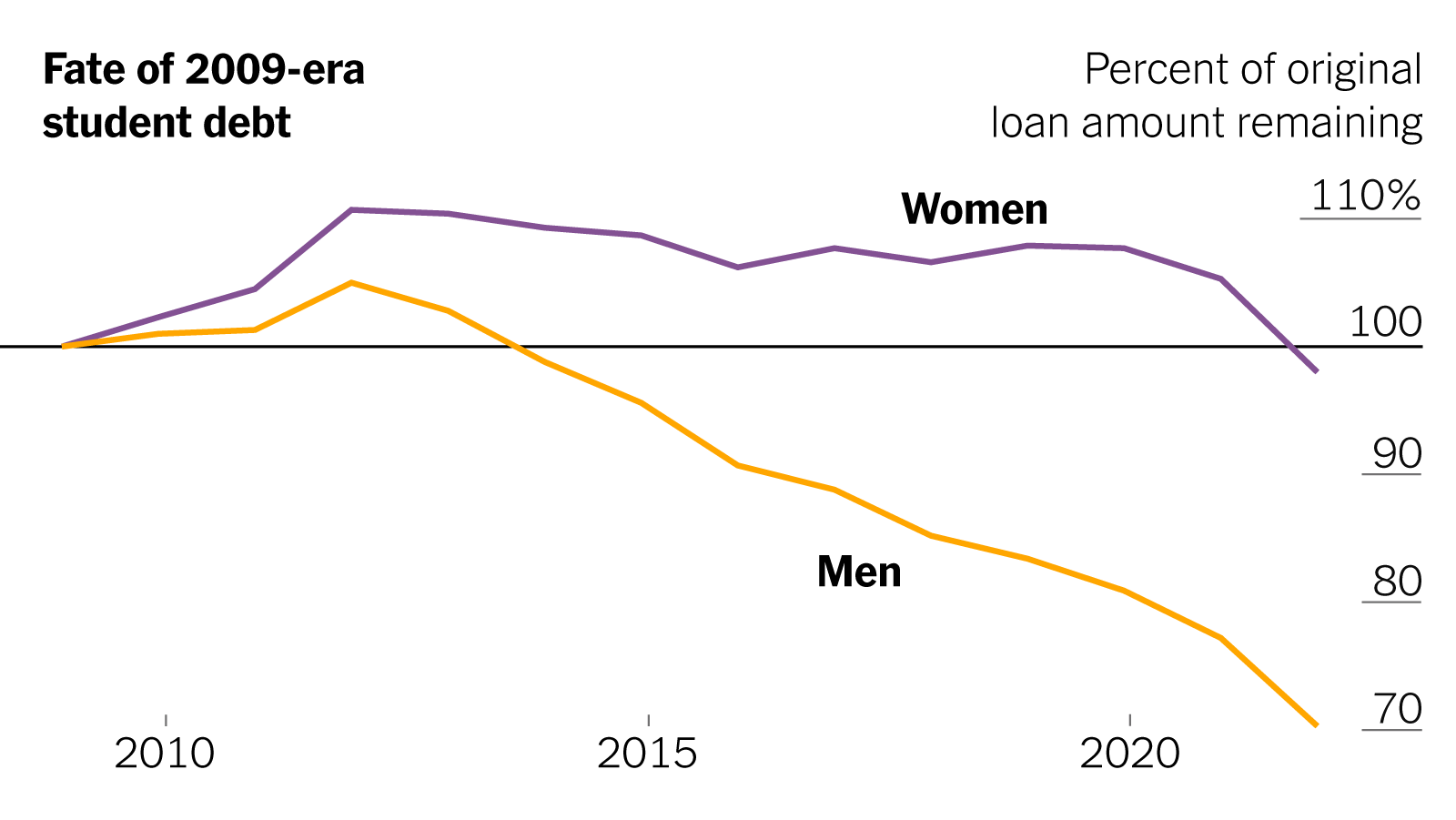

3. Interest Accumulation: For many borrowers, especially those in income-driven repayment plans, the interest can accumulate rapidly, causing their loan balances to grow over time. This interest accumulation often leads to a ballooning of the total debt, making it difficult for borrowers to see a substantial reduction in their principal balance.

4. Economic Pressures: The current economic landscape also plays a role. With stagnating wages and a competitive job market, many graduates find it challenging to repay their loans quickly. The economic pressures exacerbate the repayment process, causing some borrowers to struggle with their large balances for extended periods.

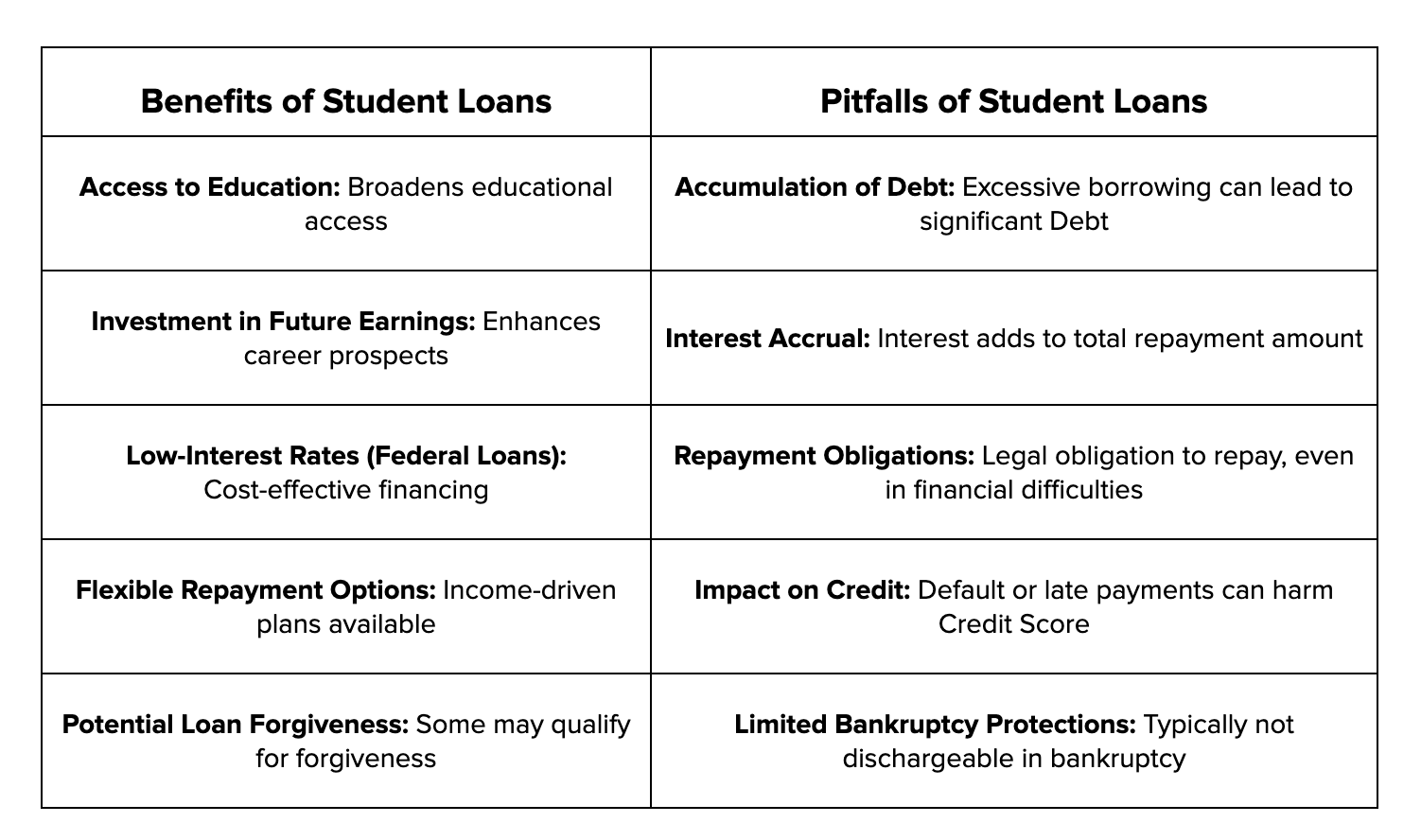

Understanding the surge in borrowers with over $100k in student loans requires a multi-faceted approach. Offering financial literacy resources, more affordable educational pathways, and effective loan repayment strategies is vital to address this issue comprehensively. For those grappling with high loan balances, seeking professional financial advice and exploring federal repayment options can provide much-needed relief.

Impact on Borrowers’ Financial Health: how many owe over $100k in student loans

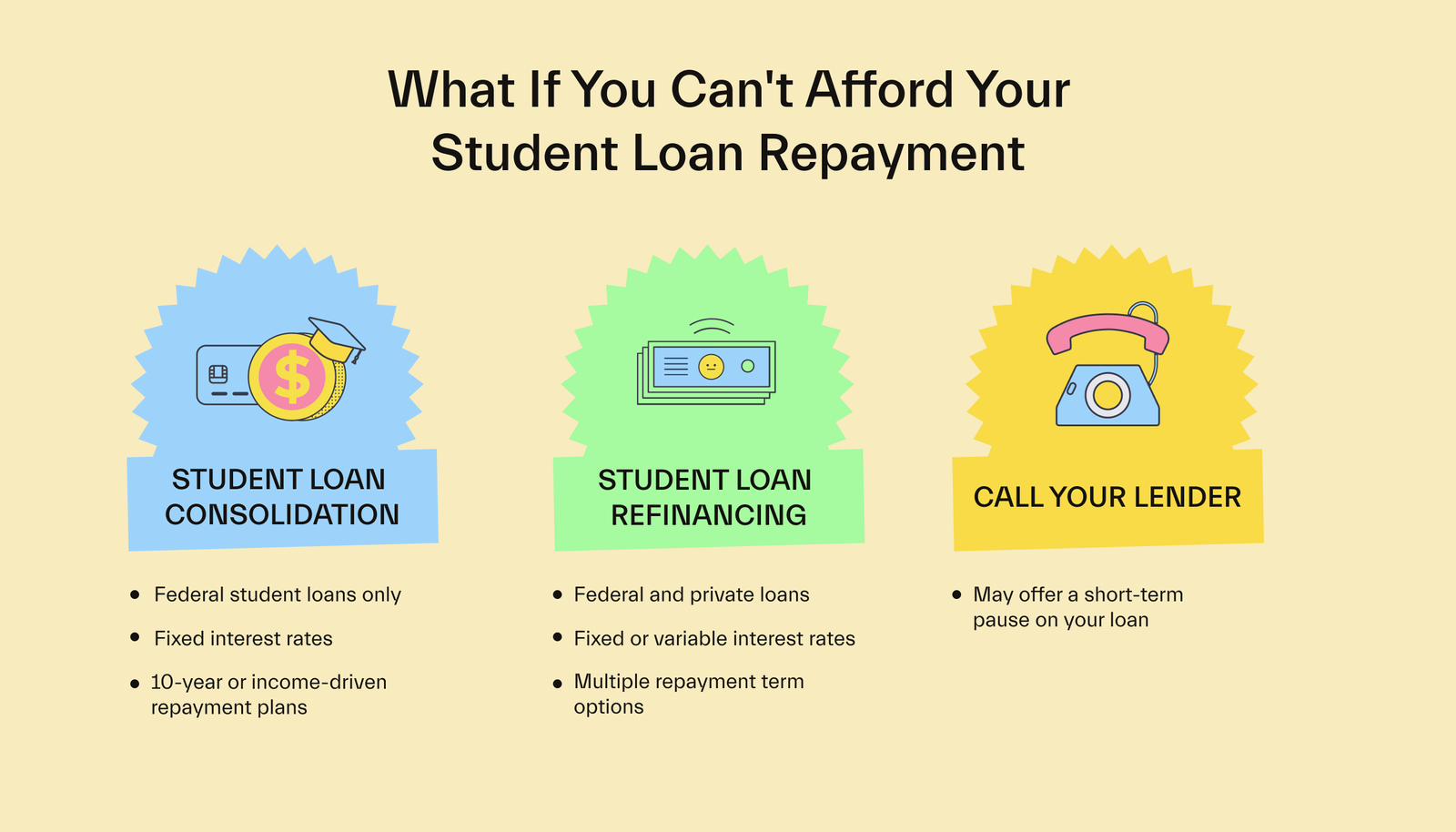

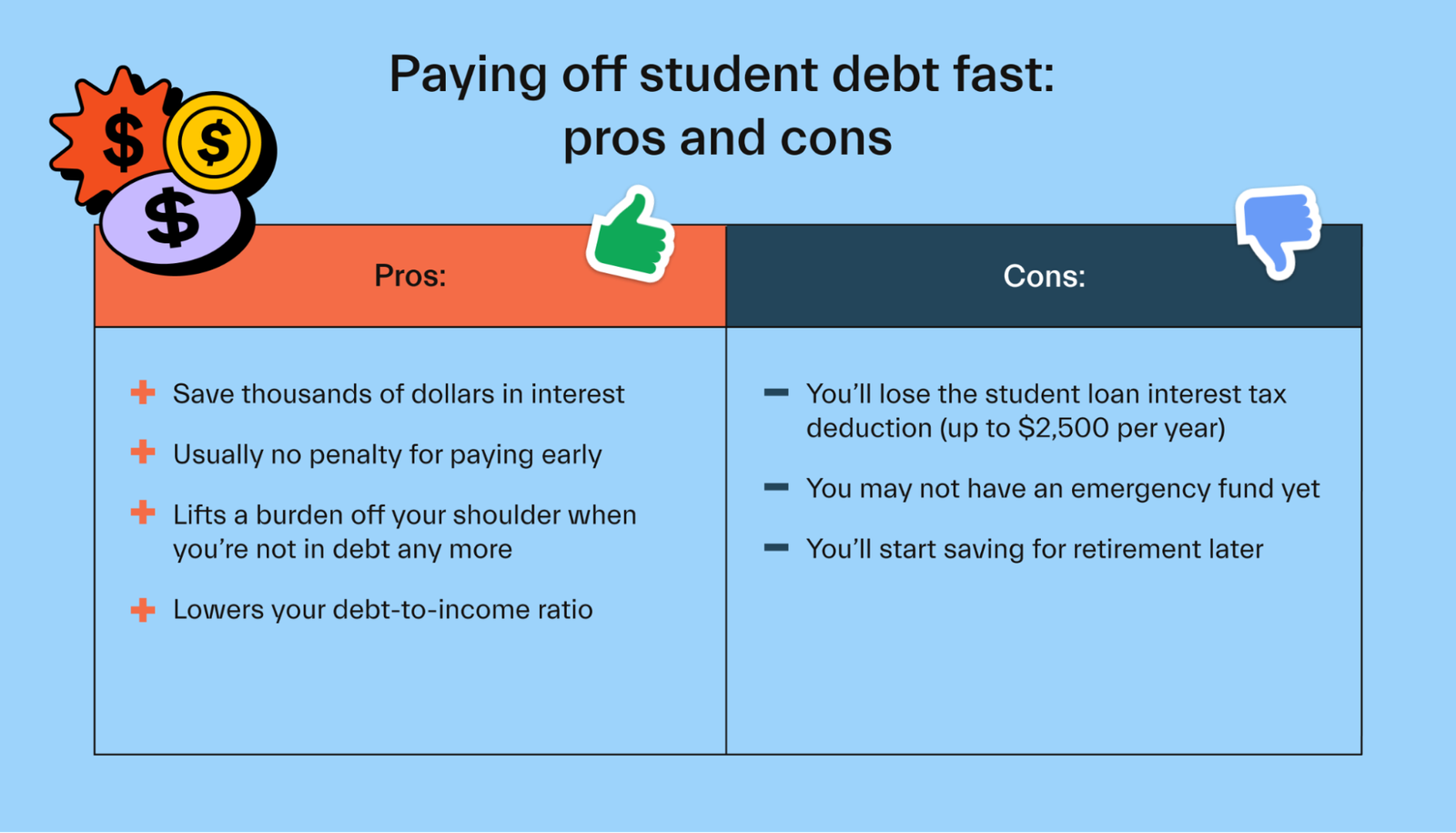

The weight of owing $100,000 or more in student loans significantly impacts a borrower’s financial health. Servicing such a substantial debt often leaves little room for other financial priorities. Many borrowers find themselves delaying major life events such as buying a home, starting a family, or investing in retirement accounts due to the heavy repayment burden. Monthly payments can be so high that they consume a large portion of disposable income, leading to additional stress and, in some cases, mental health issues. It is crucial for borrowers in this category to explore various repayment plans, refinancing options, or even loan forgiveness programs that might provide some relief.

Demographic Breakdown of High Student Loan Debt

A deeper look into the demographics reveals some interesting patterns among those who owe $100,000 or more. Graduate and professional degree holders constitute a significant portion of this group. Fields like medicine, law, and business often require extensive, costly schooling, resulting in higher loan balances. Additionally, data indicates that a disproportionate number of women and minorities carry larger student loan debts. For example, studies show that African-American students are more likely to take out larger loans and face higher rates of default. Understanding these demographics helps tailor resources and support systems to the needs of specific groups struggling under the weight of high student loan debt.

Available Resources and Strategies for Managing High Student Loan Debt

For borrowers grappling with $100,000 or more in student loan debt, numerous resources and strategies can mitigate the financial strain. Income-Driven Repayment (IDR) plans adjust monthly payments based on income and family size, making it easier to manage high loan balances. Public Service Loan Forgiveness (PSLF) is another option, particularly for those working in qualifying public service jobs. Refinancing student loans can also reduce interest rates, potentially lowering monthly payments and the total amount repaid over time. Moreover, financial counseling and educational resources can provide personalized advice and strategies tailored to individual circumstances, helping borrowers navigate their repayment journey more effectively.

Frequently Asked Questions

How many individuals currently have student loan debt exceeding $100,000?

Currently, around 2.6 million individuals have student loan debt exceeding $100,000.

What percentage of the total student loan borrowers owe more than $100,000?

Approximately 7% of the total student loan borrowers owe more than $100,000.

How does the number of borrowers with over $100,000 in student loans compare to those with lesser amounts?

The number of borrowers with over $100,000 in student loans is significantly smaller than those with lesser amounts. However, this group has a disproportionate impact due to the higher financial strain and potential for default.

In conclusion, understanding the landscape of student debt is crucial for both students and policymakers. With a significant number of individuals owing $100k or more in student loans, it’s clear that the financial burden of higher education continues to escalate. This issue not only impacts personal finances but also has broader economic implications. Therefore, it is essential to provide comprehensive insights and resources on student loans to help borrowers navigate their repayment options and seek necessary support.

By staying informed and advocating for effective policies, we can work towards a more sustainable future for student loan borrowers. Remember, you are not alone in this journey, and there are tools and resources available to assist you. Let’s continue to educate and empower each other to make informed financial decisions.

How many total student loan borrowers owe more than $100 000

According to recent data, there are approximately 2.5 million student loan borrowers who owe more than $100,000 in student loans. This staggering number represents a significant portion of the total student loan borrower population in the United States.

Among those with six-figure student loan debt, about 300,000 borrowers owe more than $200,000. This subset of borrowers faces even greater challenges in managing their debt and achieving financial stability after graduation.

It is concerning to note that the number of borrowers owing over $100,000 in student loans has more than doubled in the past decade. This sharp increase highlights the growing burden of student loan debt on individuals and the economy as a whole.

Higher education costs continue to rise, contributing to the escalation of student loan debt among borrowers. As tuition fees increase and financial aid options remain limited, more students are forced to take out larger loans to finance their education, leading to higher debt levels upon graduation.