In this studentloaninsights article, we explore the severity of student debt in the United States and how it affects millions of people. Discover the shocking statistics and possible solutions being considered.

The Alarming State of Student Debt in America: Facts, Figures, and Realities

The Alarming State of Student Debt in America: Facts, Figures, and Realities

The state of student debt in the United States is indeed alarming. As of 2023, the total student loan debt in the country has surpassed $1.7 trillion. This staggering figure represents a significant financial burden on millions of Americans.

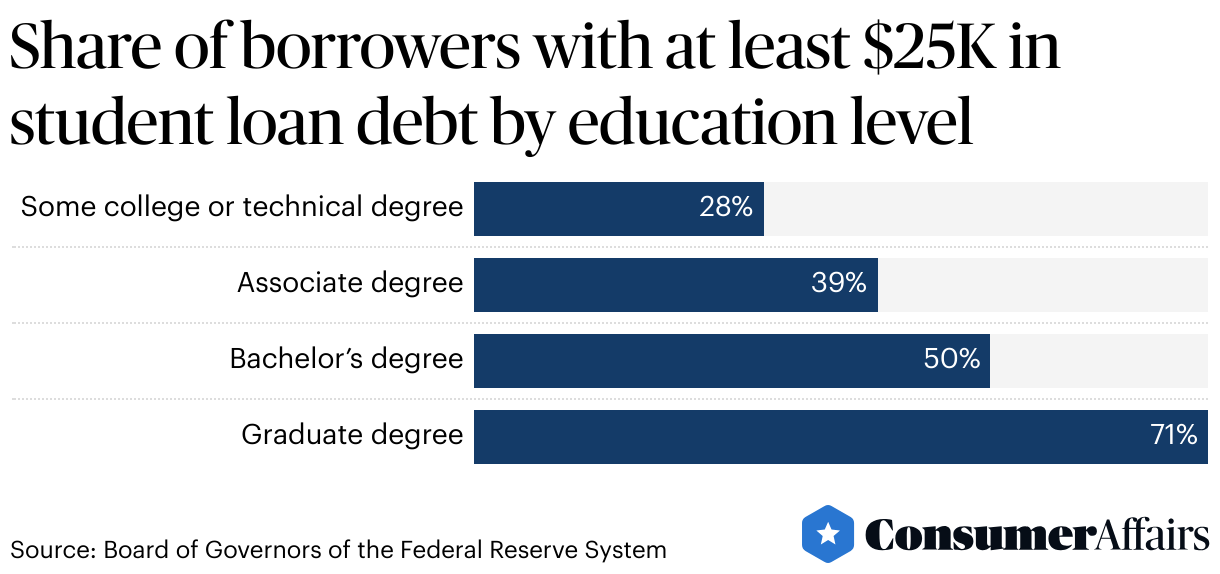

One of the most concerning aspects is that nearly 44 million borrowers are affected by this debt. On average, each borrower owes approximately $37,000, but this number can vary widely depending on the type of degree and the institution attended.

The impact of this debt is multifaceted. For young adults, it often means delaying key life milestones such as buying a home, starting a family, or even beginning a career in their field of study. In fact, about 60% of millennials with student debt have put off major life decisions because of their financial constraints.

Furthermore, default rates remain a critical issue. Approximately 11% of borrowers are in default, meaning they have failed to make payments for at least 270 days. The repercussions of defaulting on student loans can be severe, including wage garnishment, a negative impact on credit scores, and even withholding of tax refunds.

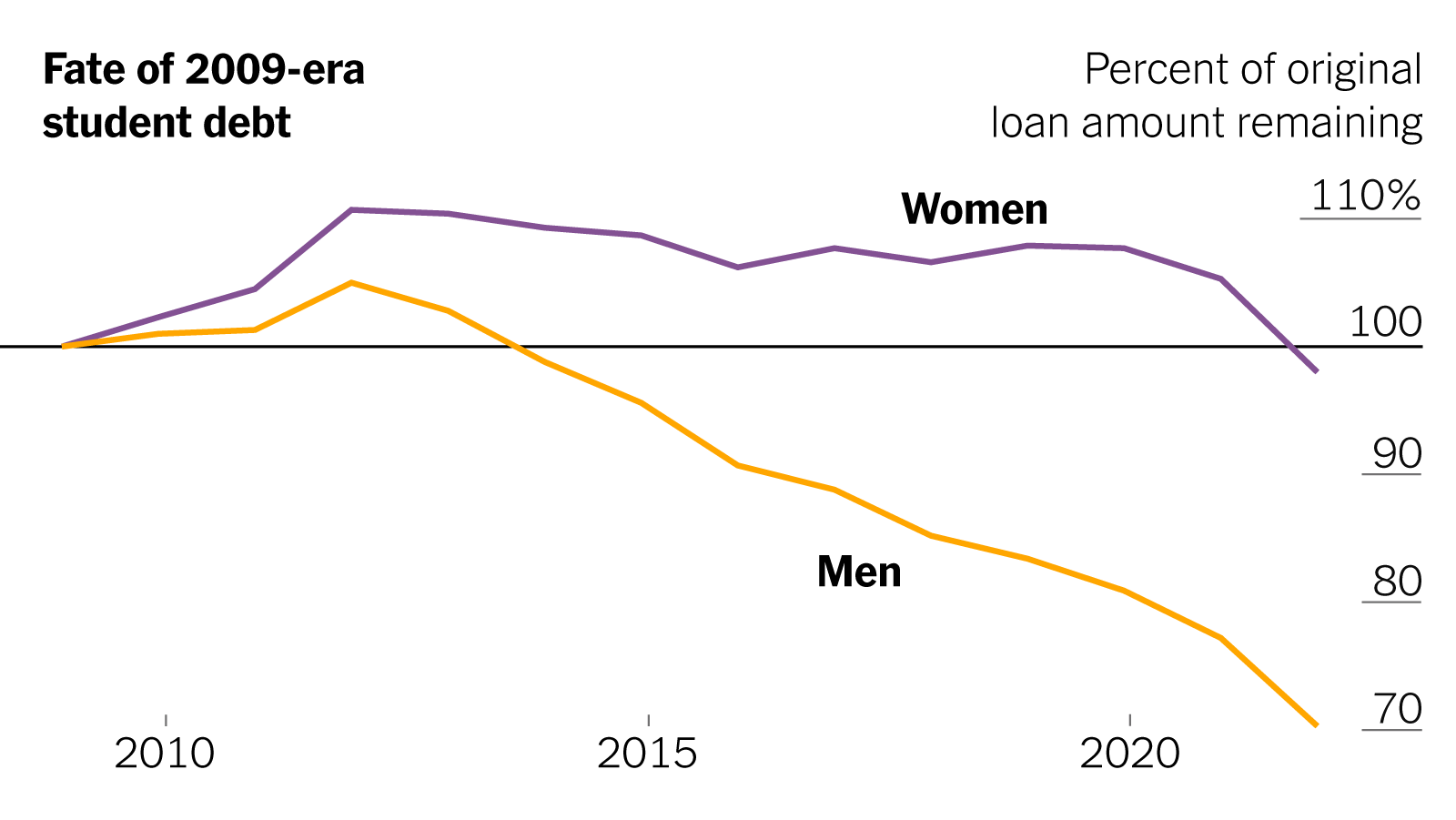

Another troubling trend is the disparity in debt burdens among different demographics. For example, women and people of color are more likely to carry higher levels of student debt. This can exacerbate existing inequalities, making it harder for these groups to achieve financial stability and build wealth over time.

Additionally, Private student loans are another area of concern. Unlike federal loans, private loans often come with higher interest rates and fewer repayment options, making them more challenging to manage.

Overall, the situation calls for urgent action and reform. Understanding the scope of the problem and exploring various strategies for repayment, refinancing, and forgiveness can provide some relief and pave the way for more manageable solutions in the future.

The Current State of Student Loan Debt in America

As of 2023, the total student loan debt in America has surpassed a staggering $1.7 trillion. This massive amount is spread across approximately 45 million borrowers, making it a significant financial burden for a large portion of the population. The average borrower graduates with around $30,000 in student loans. However, for many, especially those pursuing advanced degrees or attending private institutions, this number can be much higher. The high levels of debt are not just a financial issue but also a socio-economic one, impacting life choices such as homeownership, starting a family, or even career decisions.

The Impact of Student Debt on Financial Stability and Life Choices

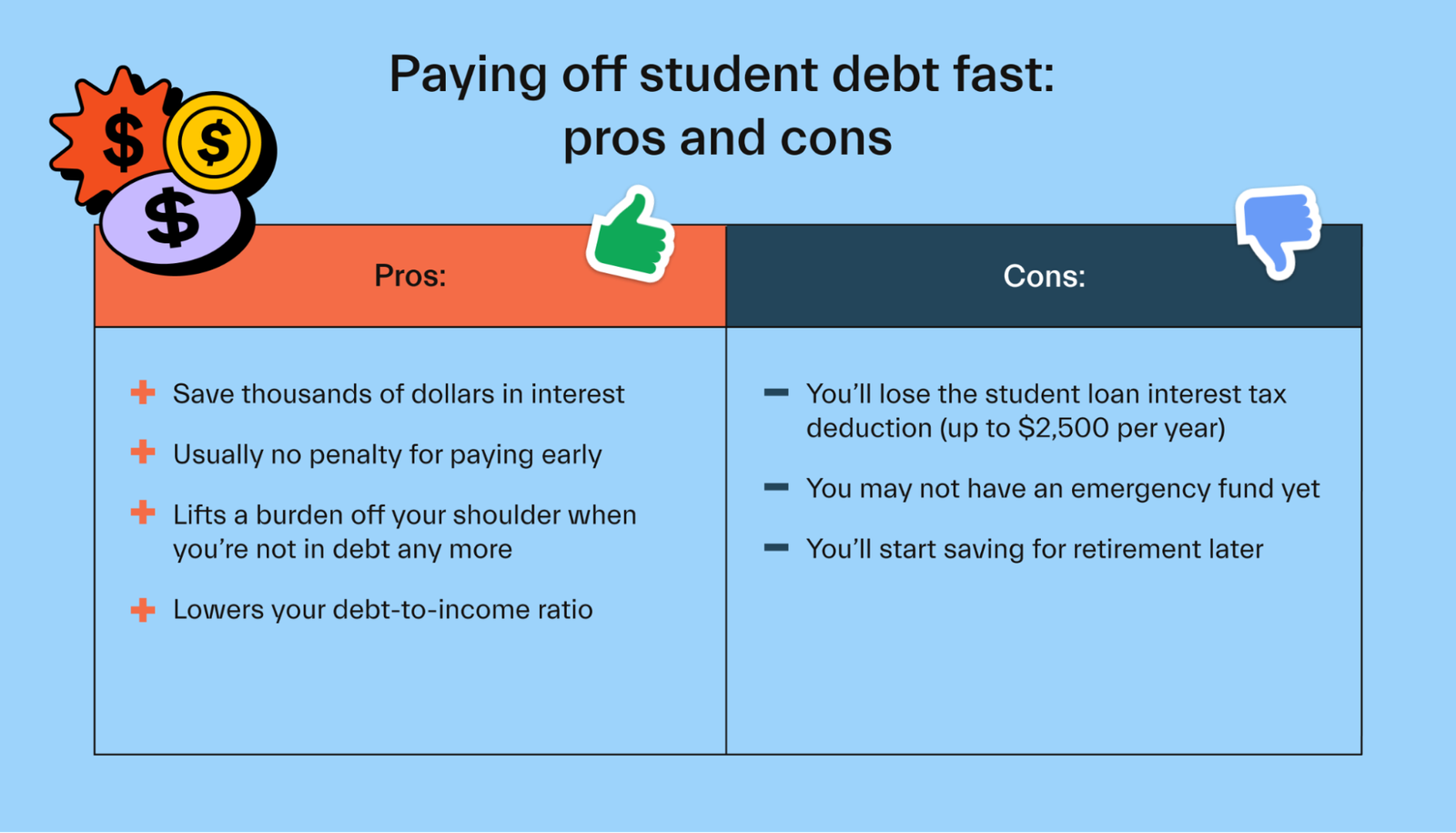

Student debt has far-reaching implications on an individual’s financial stability and life decisions. Graduates burdened with significant student loans often delay major life milestones like buying a home, getting married, or saving for retirement. According to recent studies, young adults with high student debt are more likely to have lower credit scores and less savings, which affects their ability to make substantial purchases or investments. Moreover, the pressure to repay student loans can limit career choices, forcing many to opt for higher-paying jobs over their passion-driven careers or entrepreneurial ventures.

Resources and Strategies to Manage and Reduce Student Debt

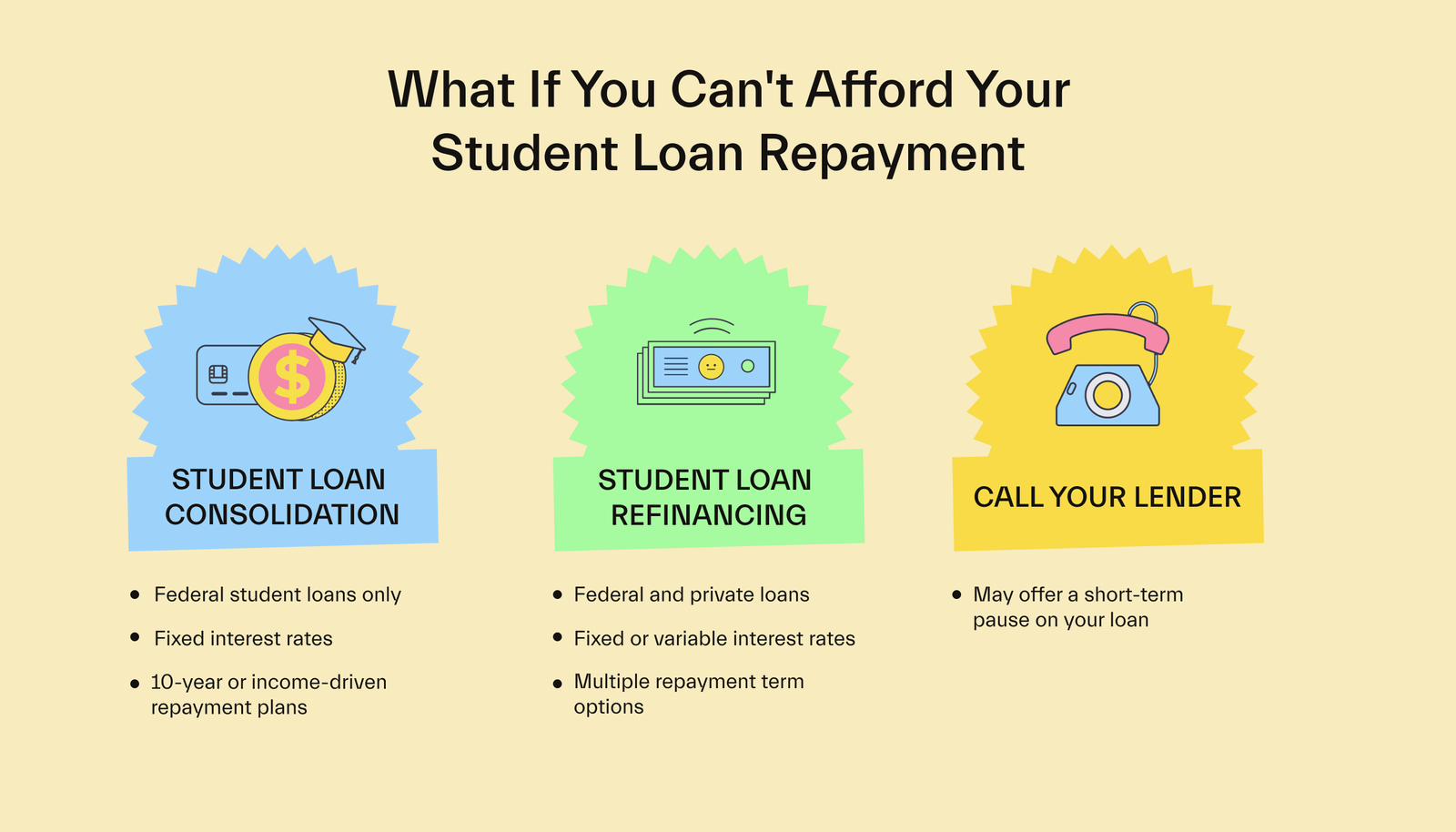

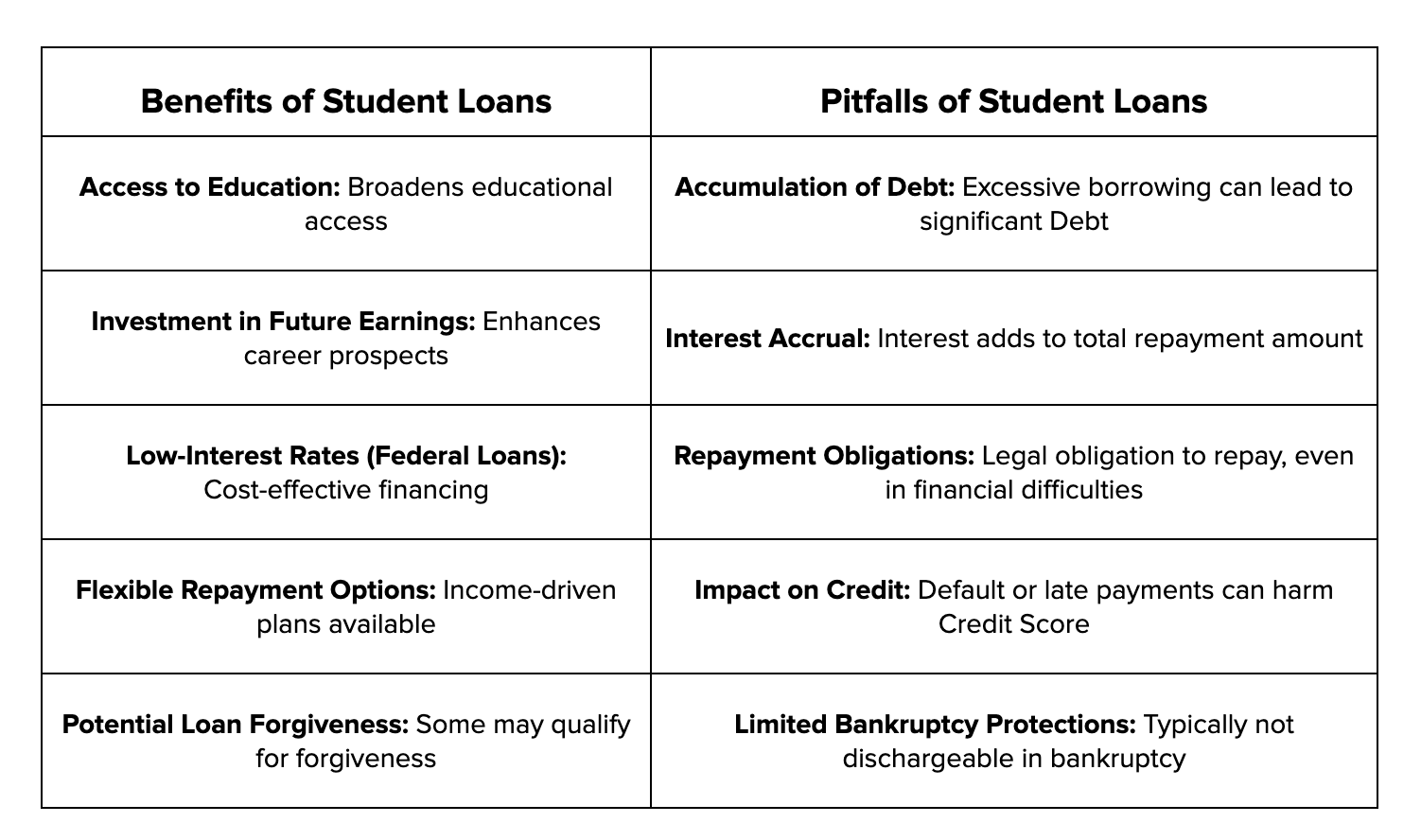

Managing and reducing student debt can seem daunting, but there are several strategies and resources available that can help. For instance, Income-Driven Repayment (IDR) plans can adjust monthly payments based on income and family size, making them more manageable. Additionally, loan forgiveness programs, like the Public Service Loan Forgiveness (PSLF) program, offer relief for those working in qualifying public service and non-profit positions. Refinancing student loans at a lower interest rate can also reduce the overall cost over time. It’s crucial to stay informed and utilize available resources, such as financial counseling services or online platforms specializing in student loan management, to navigate the repayment process effectively.

Frequently Asked Questions

What is the current total amount of student debt in America?

As of 2023, the total amount of student debt in America has surpassed $1.7 trillion. This figure highlights the critical need for students to understand their loan options and repayment plans.

How does student debt affect the financial stability of American graduates?

Student debt significantly impacts the financial stability of American graduates by limiting their capacity to save, invest, and spend. This burden can delay key life milestones such as buying a home, starting a family, or saving for retirement. High monthly payments and accumulating interest exacerbate financial stress, making it challenging to achieve long-term financial goals.

What are the long-term economic impacts of growing student debt in the United States?

The long-term economic impacts of growing student debt in the United States include a reduction in consumer spending, delayed homeownership, and hindered retirement savings. This burden can also constrict economic mobility and exacerbate wealth inequality. These factors combined can lead to a slower overall economic growth and an increased strain on social safety nets.

In conclusion, student debt in America has reached crisis levels, impacting millions of individuals across various socio-economic backgrounds. The exorbitant cost of higher education coupled with the complexities of loan repayment systems has made it increasingly difficult for graduates to achieve financial stability.

Understanding the intricate landscape of student loans and having access to comprehensive resources and guidance are crucial steps toward navigating this challenging terrain. By becoming informed about their options, borrowers can make more strategic decisions that could alleviate the financial burdens associated with pursuing higher education. As policymakers and educational institutions also play a role, a collective effort is essential to address and mitigate the student debt crisis in America, ensuring a more financially secure future for all students.