Welcome to studentloaninsights! In this article, we explore: Is Gen Z in debt? Uncover the financial challenges faced by today’s youth and understand the impact of student loans on their lives

Understanding Gen Z Student Loan Debt: Trends and Realities

Understanding Gen Z Student Loan Debt: Trends and Realities in the context of providing comprehensive insights and resources on student loans involves examining both the current landscape of student debt and the unique challenges faced by this generation. For Gen Z, who are currently aged between 11 and 26, the prospect of higher education often comes with significant financial considerations.

The cost of college tuition has been steadily rising, leading to an increased reliance on student loans. According to a report by the Federal Reserve, outstanding student loan debt in the United States has reached over $1.7 trillion, a substantial portion of which is held by younger individuals. As Gen Z enters college, they encounter these high costs head-on, often requiring them to take out loans to finance their education.

The trends indicate that Gen Z is more financially cautious compared to previous generations. They are more likely to attend community colleges or in-state universities to minimize costs and often work part-time jobs to offset expenses. However, despite these efforts, the burden of student loan debt remains a significant issue.

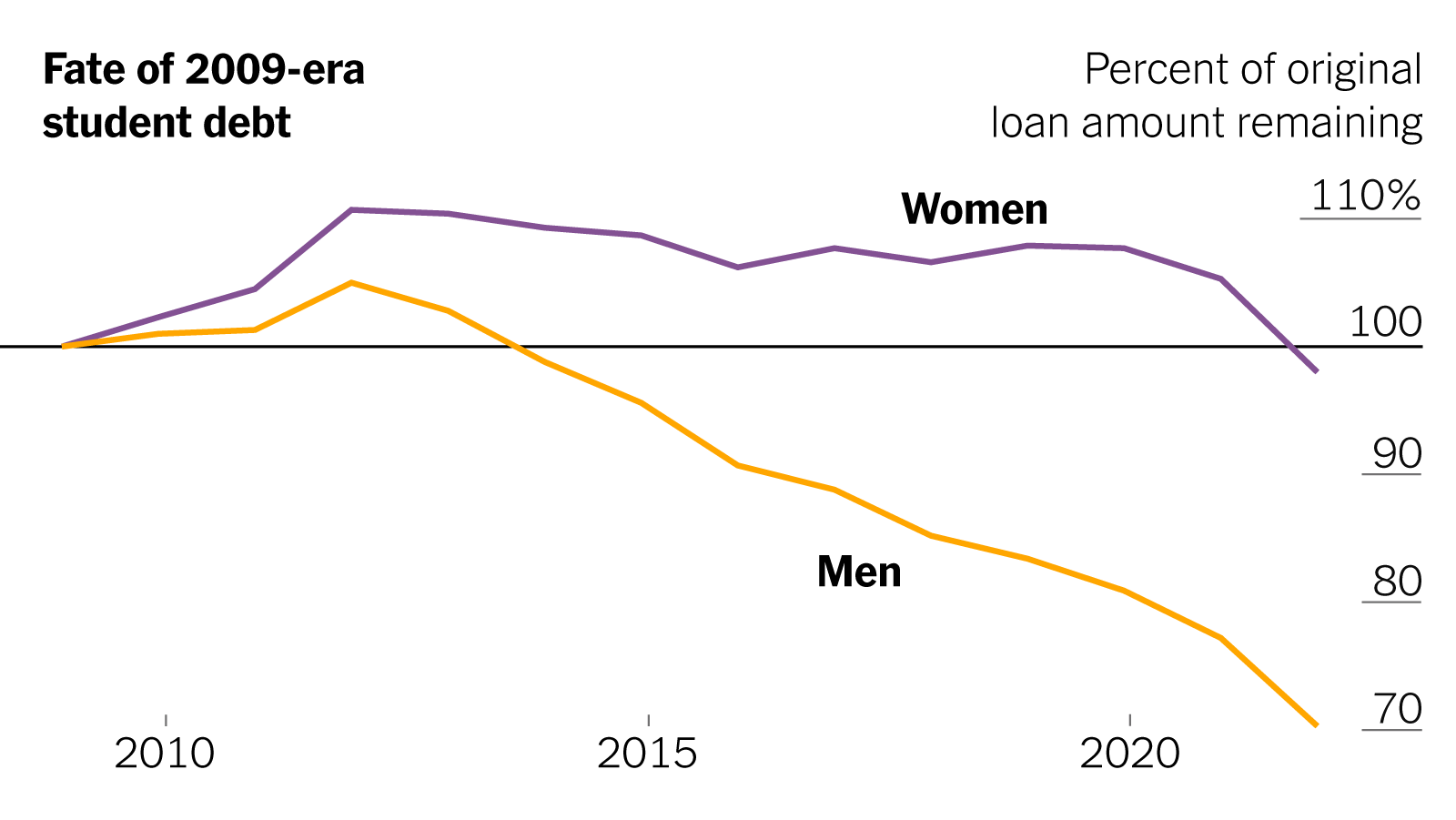

One of the key realities for Gen Z is the impact of student loan debt on their financial futures. High levels of debt can delay major life milestones such as buying a home, starting a family, or saving for retirement. Additionally, the stress associated with debt repayment can affect mental health and overall well-being.

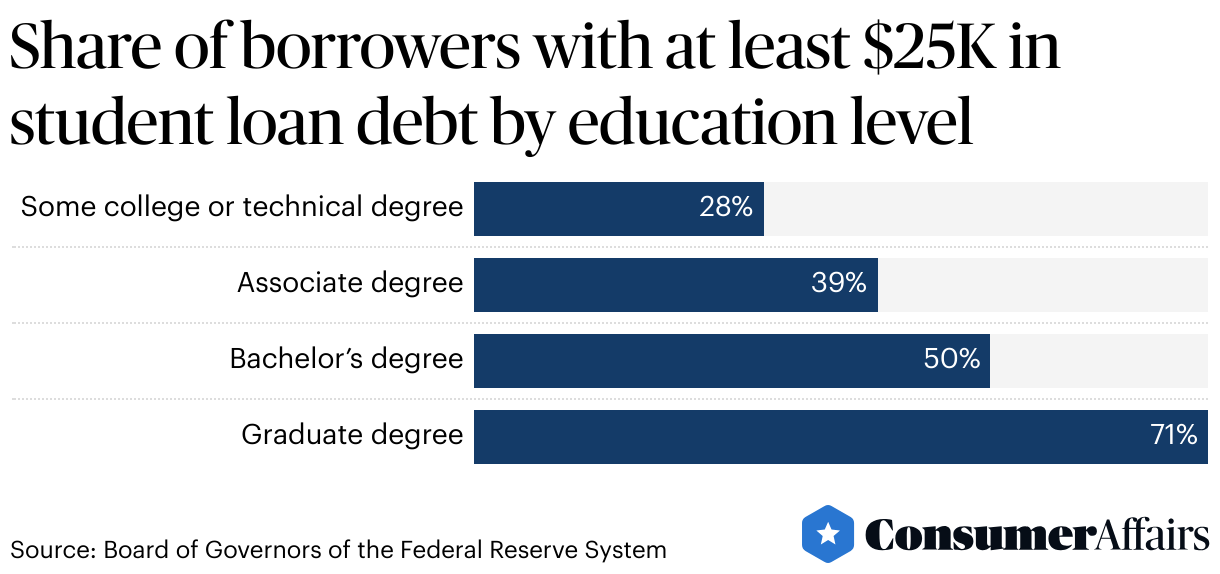

Moreover, there are disparities within Gen Z regarding student loan debt. Minority students and those from lower-income backgrounds tend to borrow more and face greater challenges in repayment, exacerbating existing inequalities.

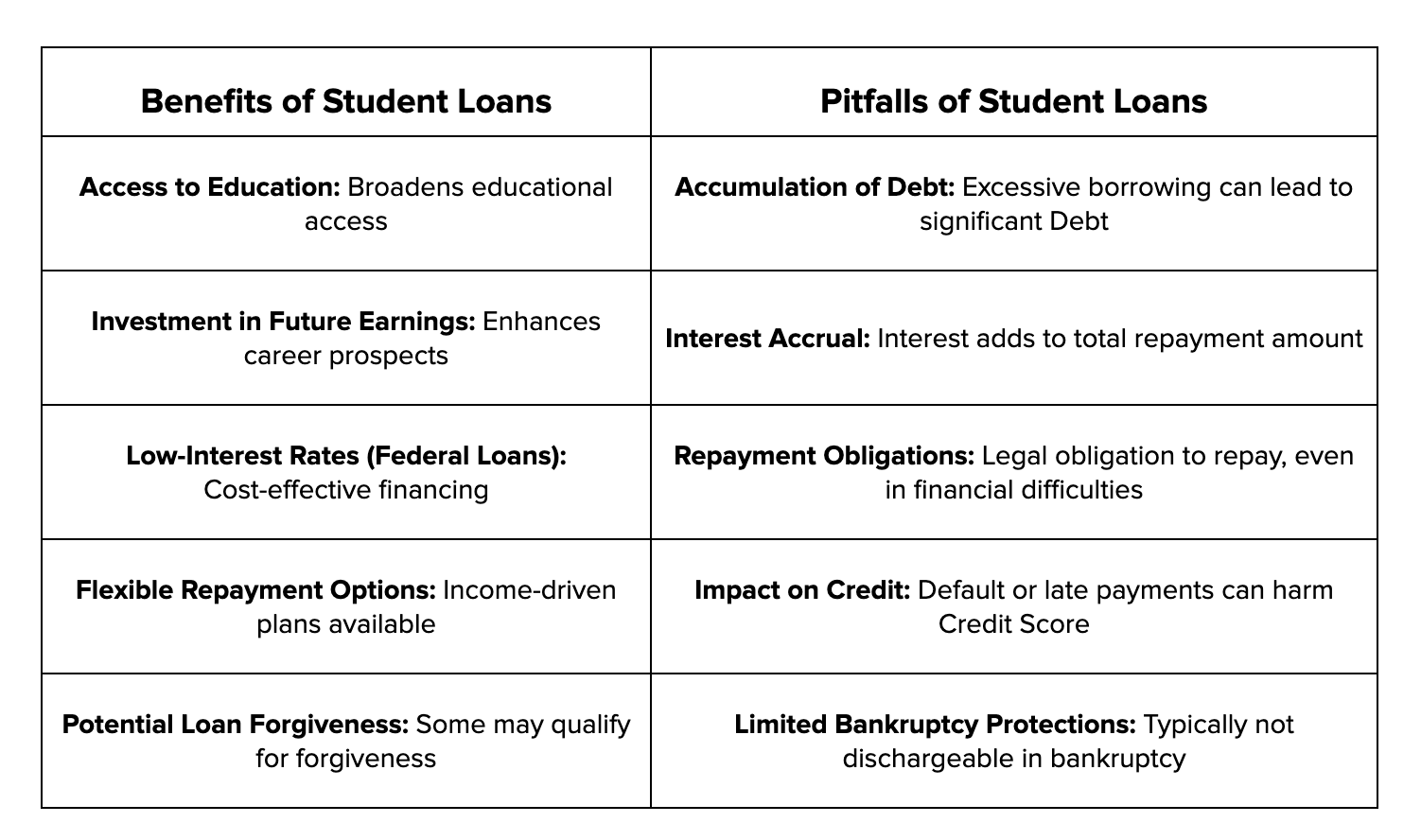

In terms of resources, it’s crucial for Gen Z to have access to comprehensive financial education and guidance on managing student loans. This includes understanding different types of loans, interest rates, repayment plans, and options for forgiveness or deferment. Access to this information can help them make informed decisions and better navigate the complexities of financing higher education.

Overall, comprehending the trends and realities of Gen Z’s student loan debt requires a multifaceted approach that addresses the financial, educational, and social dimensions of this pressing issue.

The Increasing Student Loan Burden on Gen Z

The members of Generation Z, those born roughly between 1997 and 2012, are encountering substantial financial challenges as they pursue higher education. The average student loan debt for recent graduates continues to rise, placing a significant burden on young adults entering the workforce. Many Gen Z students are also taking out larger loans compared to earlier generations, driven by the increasing cost of tuition and associated expenses.

Several factors contribute to this trend: higher tuition fees, the necessity for additional financial aid to cover living expenses, and sometimes insufficient knowledge about borrowing and repayment strategies. As these students graduate, they face the dual pressures of starting their careers while managing substantial debt, impacting their financial stability and ability to make major life decisions like purchasing a home or investing in further education.

The Impact of Debt on Gen Z’s Financial Future

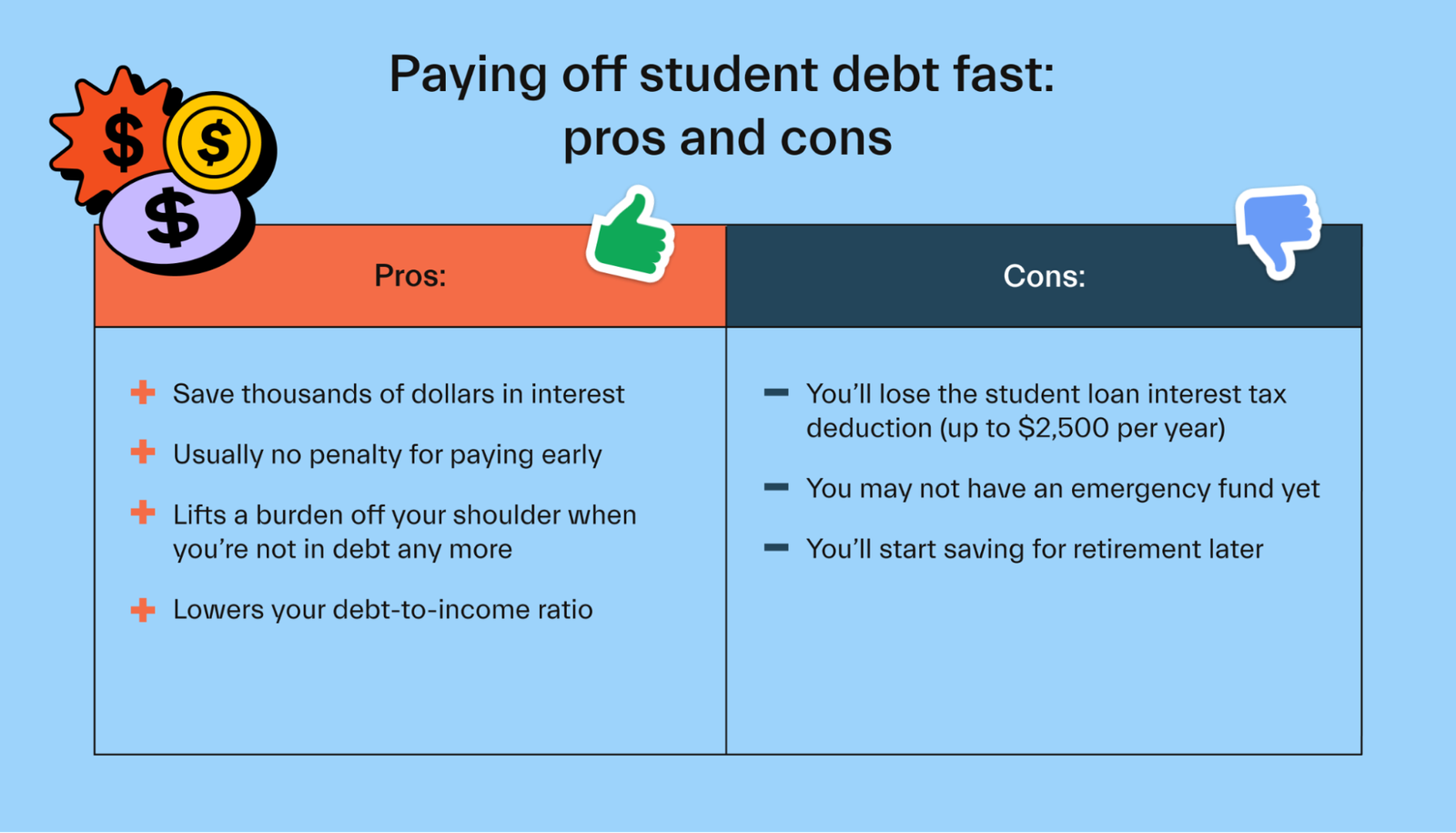

The extent of student loan debt is not just an immediate concern but carries long-term implications for Gen Z’s financial health. This generation’s debt load affects their credit scores, savings, and ability to invest in assets that typically build wealth over time. High student loan payments can limit disposable income and hinder the ability to save for emergencies, retirement, or other financial goals.

Moreover, the psychological impact of carrying significant debt can lead to stress and anxiety, which further affects their overall quality of life. As financial challenges mount, Gen Z may adopt more cautious financial behaviors, including delaying significant investments and spending, which could have ripple effects on the broader economy.

Resources and Strategies for Managing Student Loans

To help Gen Z navigate their student loans effectively, several resources and strategies can be employed. Firstly, understanding the different types of loans—federal versus private—and their respective terms is crucial. Federal loans often offer more flexible repayment options and potentially forgivable programs based on employment in specific sectors.

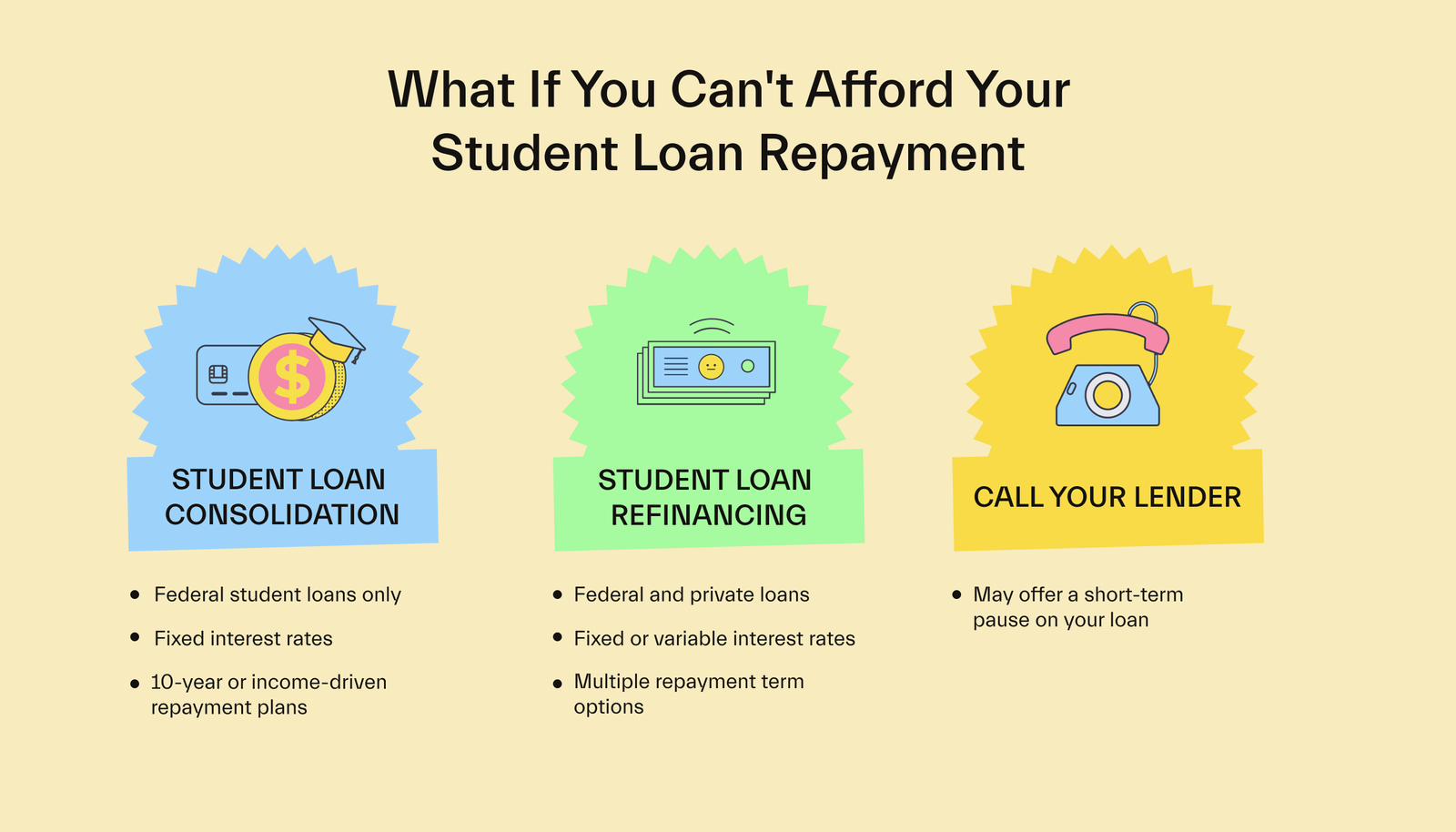

Secondly, financial literacy education plays a critical role in empowering Gen Z to make informed decisions about borrowing and repayment. Personalized counseling services and online tools can assist in creating realistic repayment plans. Additionally, exploring options like income-driven repayment plans, loan consolidation, and refinancing can offer relief by lowering monthly payments and interest rates.

Finally, seeking scholarships, grants, and work-study opportunities before opting for loans can reduce the overall amount borrowed. Promoting awareness of these alternatives is essential in minimizing debt and fostering a financially secure future for Gen Z.

Gen z student debt

Gen Z student loan debt has become a significant financial burden for many young adults in today’s society. With the rising costs of higher education, Gen Z students are increasingly turning to student loans to fund their college education. As a result, many are graduating with substantial debt that can take years, if not decades, to pay off.

The impact of student loan debt on Gen Z goes beyond just financial strain. It can also affect their mental health and overall well-being. The stress of managing debt, combined with the pressure to find a job and start a career, can take a toll on Gen Z students’ mental health, leading to anxiety and depression.

One concerning trend is the high default rate among Gen Z borrowers. Due to various factors such as high debt levels, lack of job opportunities, and economic instability, many Gen Z individuals are struggling to make their student loan payments on time. This can have long-term consequences on their credit score and financial stability.

As the issue of student loan debt continues to grow, it is essential for policymakers and educational institutions to address this problem. Finding solutions to make higher education more affordable and providing more financial education to Gen Z students can help alleviate the burden of student loan debt and set them up for a more secure financial future.

Frequently Asked Questions

How much student loan debt does Gen Z currently have?

Gen Z currently holds approximately $140 billion in student loan debt. As this generation continues to enter higher education, understanding the implications of borrowing and seeking out resources for managing debt is crucial for financial stability.

What are the primary factors contributing to Gen Z’s student loan debt?

Rising tuition costs, limited access to scholarships and grants, and increased reliance on borrowing are primary factors contributing to Gen Z’s student loan debt. Additionally, the pressure to attend prestigious institutions and a lack of comprehensive financial literacy education exacerbate the issue.

Are there any specific student loan forgiveness programs available for Gen Z borrowers?

Yes, Gen Z borrowers can benefit from several student loan forgiveness programs. Notable options include the Public Service Loan Forgiveness (PSLF) program, which forgives loans for those working in qualifying public service jobs after 10 years of payments, and the Teacher Loan Forgiveness program, which offers up to $17,500 in forgiveness for teachers in low-income schools. Additionally, income-driven repayment plans may offer forgiveness after 20-25 years of qualifying payments.

In conclusion, the question “Is Gen Z in debt?” reveals a complex reality for this generation, particularly when examining the impacts of student loans. While Gen Z has shown prudence and caution by seeking more affordable educational avenues and diverse career paths, the burden of student loans continues to be a significant challenge. Access to comprehensive insights and resources is crucial for helping them navigate these financial waters effectively. By staying informed and utilizing available resources, Gen Z can better manage their debt, paving the way for a more financially secure future. As we continue to address this issue, our goal should be to provide ongoing support and educational tools that empower every student to make informed financial decisions.