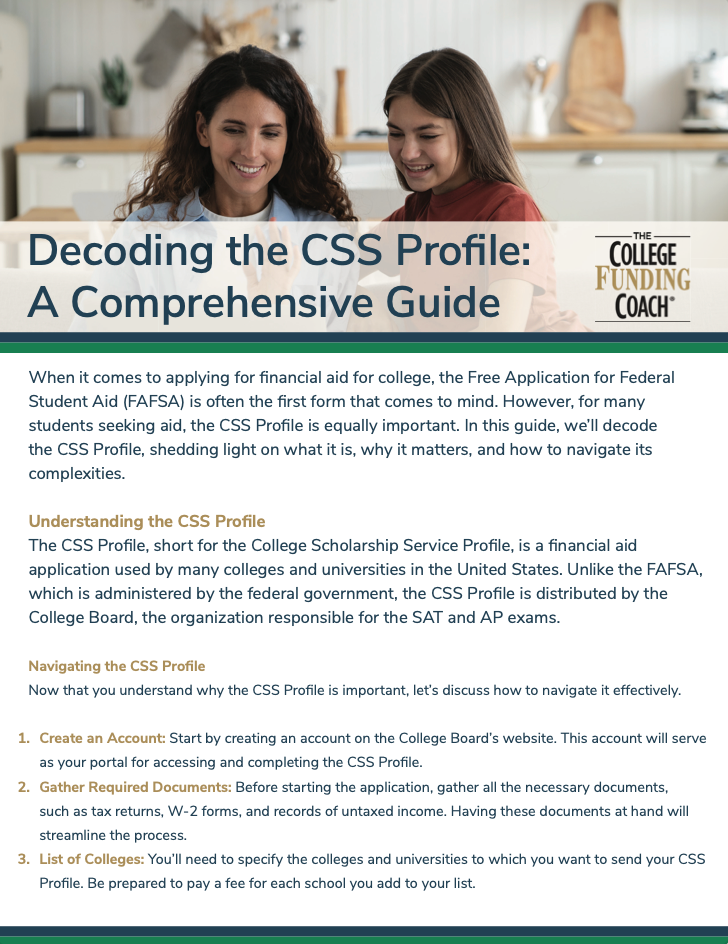

Did you know the Free Application for Federal Student Aid (FAFSA) form is key? It helps access financial aid. This form shows if you qualify for government, state, and college aid. It opens doors to grants, scholarships, and loans. But, learning about deadlines and how to apply is crucial. The official site for federal student aid offers help for an affordable education.

Key Takeaways

- The FAFSA is the gateway to accessing federal, state, and college-specific financial aid.

- Understanding FAFSA deadlines and requirements is crucial to securing aid.

- Completing the FAFSA is a free process, and students should not pay for assistance.

- Exploring federal grant programs and student loan options can help bridge financial gaps.

- In-state residency can impact the cost of education and eligibility for state aid.

Applying for Federal Student Aid

To apply for federal student aid, fill out the FAFSA before the deadlines. The deadline for the school year 2024-25 is June 30, 2025, and for 2023-24, it’s June 30, 2024. Remember, states also use the FAFSA for their aid, so know your state’s deadlines too.

FAFSA Deadlines

Submitting the FAFSA by its federal deadlines is key. It lets you access grants, loans, and work-study funds. States and colleges also look at the FAFSA for their aid, making it important to know all the deadlines.

Create a FAFSA Account and Login

To start, make an FSA ID to use on the FAFSA website. This ID is vital as your electronic signature. It lets you fill out and submit the FAFSA form online.

Fill Out the FAFSA

With your FSA ID ready, sign in to the FAFSA website and start the application. It’s completely free, and you shouldn’t pay for any help with federal student aid. The details you share on the FAFSA will check if you qualify for aid from the federal government, your state, and college.

Eligibility for Federal Student Aid

To get federal student aid, students need to meet some criteria. They should show they need financial help. They must also have a diploma from high school or its equal.

Furthermore, they should be studying a program that qualifies. It’s also key for them to do well in their classes. This shows they’re serious about their education.

Many people could qualify for aid. This includes U.S. nationals and certain immigrants. Also, students from some Native American groups born in Canada under the Jay Treaty could apply. FAFSA must get their tax info to process their application.

The whole process aims to help those truly in need. It’s about making sure that financial help gets to students eager to learn. By following these steps, students can get various government aids. This can greatly lessen the burden of student debt.

| Eligibility Requirement | Description |

|---|---|

| Demonstrate Financial Need | Eligibility is determined based on the information provided in the FAFSA application. |

| High School Diploma or Equivalent | Students must have a high school diploma, GED, or other recognized equivalent to qualify for federal student aid. |

| Enrolled in Eligible Program | Students must be enrolled in an eligible degree or certificate program at a participating college, career school, or trade school. |

| Satisfactory Academic Progress | Students must maintain satisfactory academic progress in their studies to continue receiving federal student aid. |

| Valid Social Security Number | Students must have a valid Social Security number to be eligible for federal student aid. |

Checking Your FAFSA Application Status

After you submit your federal student aid application with the FAFSA, keeping track is key. This helps ensure your info is right. That way, you’ll boost your chances of getting the student aid government and financial aid student aid you actually need.

Log In to Your Account

Check your FAFSA status easily by logging in at fafsa.gov. Here, you can see how your application is going. You’ll also know if the fin aid office needs more info from you.

Contact Federal Student Aid Information Center

Need help or have questions about your student aid status? Simply reach out to the Federal Student Aid Information Center. They’re there to guide you, making the student gov aid and government student aid process easier.

Review and Correct Information

Once your FAFSA is processed, you’ll get a SAR with your info. It’s crucial to check this report and fix any mistakes quickly. This step ensures the federal student debt info for your student aides is spot on.

By being on top of your FAFSA, you pave the way for a smooth entry into the federal student aid world.

Federal Student Aid: A Performance-Based Organization

Federal Student Aid (FSA) is part of the U.S. Department of Education. It helps students by providing over $120 billion in various aids each year. Nearly 13 million students benefit from their grants, work-study funds, and loans. FSA follows a detailed strategic plan and yearly reports to meet its goals.

Federal Student Aid’s Performance

FSA is judged on how well it achieves the goals set in its plan. For instance, it processes about 22 million financial aid applications each year. It also manages a large amount of student debt. In the 2010-2011 year, it gave out $144 billion in aid.

However, FSA faces challenges like high loan default and delinquency rates. Despite these issues, it keeps working hard to help its stakeholders efficiently.

How We Serve the Public

FSA supports students and those involved in financial aid. Its website, StudentAid.gov, has detailed information on aid programs and how to apply.

There’s also a hotline for answering aid questions. Financial aid administrators can find helpful resources at the Knowledge Center website. Both are part of FSA’s efforts to provide the best help possible.

Free Application for Federal Student Aid (FAFSA)

The FAFSA is a critical form for students seeking financial help for college. With it, you can apply for federal, state, and college aid. Applying is key to accessing support for your future education.

Applying Online at FAFSA on the Web

Thanks to the FAFSA on the Web, applying for aid is simpler. This user-friendly platform lets you fill out forms and submit data with ease. By doing so, your application processes quickly and meets the deadlines.

It is important to be sure your information is secure. With the online system, you can keep your details safe while also making the process smooth.

Federal Student Aid Information Center

If applying online is tricky or you have questions, the Federal Student Aid Information Center can help. They offer support and advice from people who understand how the system works. This help ensures you’re not alone in figuring out the aid process.

Resources for Financial Aid Professionals

Federal Student Aid offers many tools for financial aid pros. They help with their daily tasks. These tools include:

Knowledge Center Website

The Knowledge Center website has info for aid experts. It has guides and news about the federal student aid programs. It keeps you informed about the newest rules and tips.

Postsecondary Education Participants System (PEPS)

PEPS is a system for updating aid officers. It shares key info about institutions in the aid programs. Financial aid leaders use it to keep their programs running smoothly.

Ombudsman’s Office

The Ombudsman’s Office is for sorting out loan problems. It helps students and loan companies reach fair solutions. Aid experts can send students here for help with loans.

Experimental Sites Initiative

The Experimental Sites Initiative helps schools try new ways of giving out aid. It gives aid officers chances to test new ideas and learn from others. This way, they can find better ways to help students.

With these resources, financial aid workers can improve their services. They can make sure they’re following federal rules. This way, they help more students get the aid they need to follow their dreams.

federal student aid

Federal student aid helps students pay for college. It includes grants, loans, and work-study programs. To get this help, you must fill out the FAFSA® form online.

This aid makes college more affordable. It offers grants that don’t have to be paid back. There are also loans and jobs on campus to help pay for school. No matter what, filling out the FAFSA® opens the door to federal government student aid.

States and colleges also give out financial aid. By doing the FAFSA®, you automatically apply for this aid. It gives students more ways to get help for school.

Federal student aid is for all types of college programs. By knowing what you qualify for and exploring your options, you can use government aid to help pay for school.

Getting Started with the FAFSA

When applying for federal student aid, knowing the right deadlines is key. The FAFSA should be filled out by June 30, 2025, for the 2024-25 school year or by June 30, 2024, for the year after. It’s also worth noting that many states use the FAFSA for their aid too. So, students must check their state’s deadlines.

FAFSA Deadlines and Timelines

The federal deadline for the FAFSA is June 30th each year. But, doing it early can improve your aid chances. States may have earlier deadlines, so find out what’s required where you live. Getting your FAFSA in on time matters a lot. Aid money from the federal government, states, and schools runs out fast.

Information Needed for FAFSA

Before you get started on the FAFSA, gather your financial paperwork. Things like tax forms, bank statements, and investment records. Having all this ready will help you finish the FAFSA without a hitch. Don’t forget, creating an account on StudentAid.gov can help, and you might need your parents to chip in too.

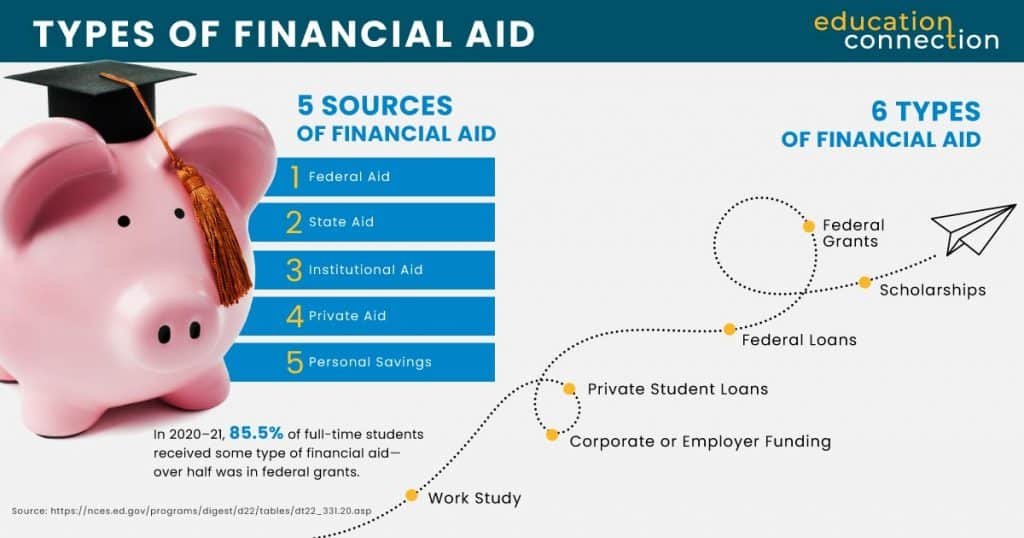

Types of Federal Student Aid

The main types of federal student aid include grants, loans, and work-study. These help students access and afford higher education. They are available to students all over the United States.

Grants

Federal grants do not need to be repaid. They are great for students with financial need. Pell Grants, FSEOG, and TEACH Grants are examples. For more on who qualifies and how much you can get, visit the federal student aid site.

Loans

The government also offers student loans. These include Subsidized, Unsubsidized, and PLUS Loans. Students must repay these loans. But, they have good terms and benefits like fixed rates. They also offer plans based on your income and can be forgiven under certain conditions.

The interest rates for these loans vary. They can be between 4.99% to 7.54%. This depends on the type of loan and if you’re a graduate or undergraduate student.

Work-Study Programs

The federal work-study program gives students part-time jobs to help with education costs. This can include tuition, fees, and buying books. How much you earn from work-study depends on your financial situation and your school’s funding.

Knowing about the aid the U.S. government offers can help students a lot. It’s not just grants and loans. There are also work-study opportunities. These resources are there to help students achieve their college dreams.

Repaying Student Loans

If you’ve borrowed from the Federal Student Loan program, you’re not alone. Many have. And there’s good news for dealing with the payback. You can combine your loans into one with loan consolidation. Or, choose plans where what you pay depends on your income. Some may even get their loans forgiven. These options aim to make paying back easier and stress-free.

Loan Consolidation

Imagine having one loan instead of many, all with the same interest rate. This is what loan consolidation does. It simplifies paying back and might lower what you owe each month. It’s a helpful choice for those who got federal aid to tidy up their student debt.

Income-Driven Repayment Plans

If your income is low, you might not need to pay as much each month. Income-driven plans figure out your payment based on what you earn and your family’s size. This makes it easier to keep up. Over time, the balance might even be forgiven, depending on how many years you’ve been paying.

Loan Forgiveness Programs

If you work for the government or a non-profit full-time, you could be eligible for the PSLF program. After making 120 payments, your remaining debt might be wiped clean. This is called forgiveness. PSLF could be a great option if you’re eligible and your goal is to give back through your work.

There are also special programs. For example, if you were misled by your school, you might qualify for the Borrower Defense to Repayment. If your school shut down while you were enrolled, the Closed School Discharge program could help. Teachers and those in the military might also find specific forgiveness paths. Exploring these options can make a big difference in your loan journey.

Student Aid Eligibility

To get student aid from the government, you first must qualify. For starters, you need to be a U.S. citizen or someone who fits the criteria. You should have a social security number that’s valid. Plus, you should be doing well in school. This is known as maintaining satisfactory academic progress.

When you fill out the FAFSA (Free Application for Federal Student Aid), they decide if you’re dependent. This decision can affect how much aid you get and even if you qualify.

Basic Eligibility Requirements

Students must show they need financial help. There are more things you need to do to qualify for aid too. You should be signed up or already in an approved study program. Having a high school diploma or equal education is a must. And, you have to promise to use the aid for school costs only.

Dependency Status

Whether you’re dependent or not makes a big difference. If you’re considered dependent, you put your parents’ financial information on the FAFSA. Independent students share their personal finances instead.

Special Circumstances

Sometimes, life doesn’t go as planned and you might need more help. If your family situation or finances are tough, you can ask for extra aid. This request is called a special circumstances appeal. It might cover things like a drop in your family’s earnings, high medical bills, or major life changes.

Federal Student Aid Resources

Federal Student Aid offers resources to guide students and families through financial aid. The main resource is the

StudentAid.gov

website. It explains various federal student aid, how to apply, and ways to pay it back.

The

Federal Student Aid Information Center

is ready to help by phone. And the

Financial Aid Toolkit

provides aid professionals with advice, publications, and materials for helping students receive aid.

Avoiding Student Aid Scams

Be on guard when anyone requests payment for student aid help. Getting federal student aid is free, even with forms like the Free Application for Federal Student Aid (FAFSA). You should be able to find help and info without spending money. Places like the Federal Student Aid Information Center and your school’s aid office can offer free support.

Watch out for scams that promise quick or full student loan forgiveness for a fee. Real student aid programs usually need years of payments or specific job types to forgive loans. Any offer that seems amazing is likely too good to be true.

Always confirm the credentials of those offering federal student aid or loan help. You can check for complaints against a company with the Better Business Bureau®. Also, key U.S. Department of Education contacts come from certain email addresses. Text messages come only from 227722 or 51592.

If you think you’ve fallen for a student aid scam, act fast. Contact anyone you’ve paid, like a federal loan servicer or your bank. Also, report it to the Federal Trade Commission. The U.S. Department of Education urges quick steps to keep your money and personal details safe.

Tax Benefits for Education

On top of federal aid, many tax benefits can help cut education costs. These can be a big help financially for students and their families.

American Opportunity Tax Credit

The AOTC offers up to $2,500 yearly for education costs. It can be used for tuition, fees, and materials. You can claim this credit for up to four years of college by filling out Form 8863.

Lifetime Learning Credit

The LLC gives a $2,000 yearly tax credit for certain students. It covers education costs like tuition and materials. You can use this credit for any post-secondary year, even for job training. But, it’s not for married people filing separately or dependents.

Student Loan Interest Deduction

The student loan interest deduction lets you take off up to $2,500 in interest. It lowers your taxable income. To get it, your loans must have paid for your education. Remember, the deduction has an income limit.

These tax benefits really can cut the cost of education. You need to understand the rules to get them on your taxes. Knowing what you qualify for can help save money.

Conclusion

Federal student aid helps make college affordable for many. Grants, loans, and work-study programs make up this aid. By filling out the FAFSA, you can learn about the help you might get. This means you have more ways to pay for school or job training.

Applying for FAFSA is free. It gives you a chance to get Pell Grants, loans, and work-study. Knowing about these options can reduce how much you owe in student loans.

The U.S. Department of Education’s Federal Student Aid office supports students like you. They offer help on their website and through a phone information service. These resources help you get the financial aid to further your education.