Understanding student grants and scholarships is essential for minimizing educational debt. This guide breaks down the key differences, application processes, and strategies to maximize your financial aid opportunities.

Decoding Student Grants and Scholarships: A Crucial Component of Financial Aid

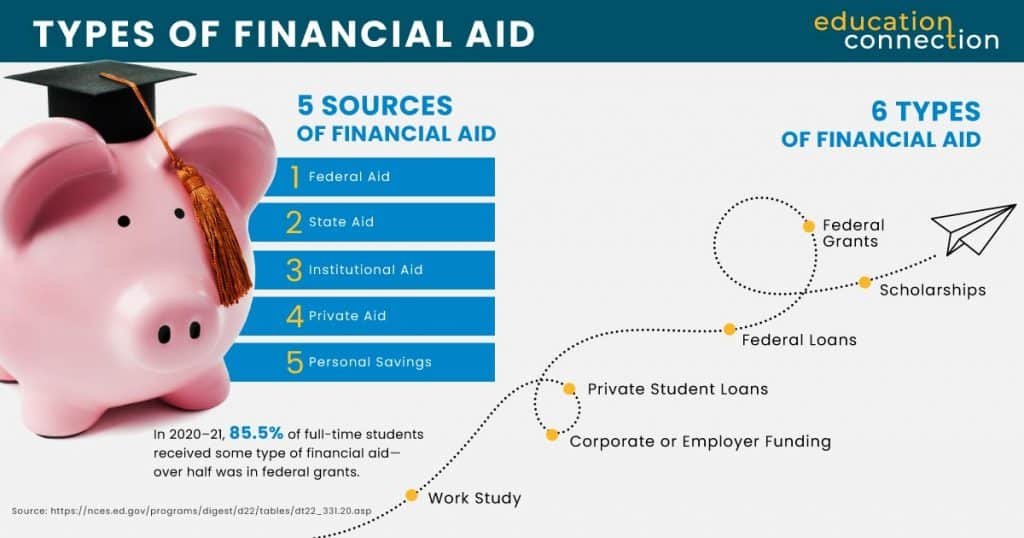

Understanding the landscape of financial aid for students requires a clear comprehension of not just student loans but also grants and scholarships. These financial resources are crucial components that can significantly reduce or even eliminate the need for loans.

Grants are typically need-based awards provided by the government, educational institutions, or private organizations. They do not require repayment, making them an invaluable resource for students who qualify. The most common source of grants in the United States is the federal government, with the Pell Grant being one of the most well-known examples.

Scholarships, on the other hand, are merit-based or need-based awards that also do not require repayment. They can be offered by a wide range of entities including colleges, private organizations, and non-profits. Scholarships often have very specific criteria such as academic achievement, extracurricular involvement, or demographic factors.

Both grants and scholarships are critical in minimizing student debt. By securing these types of financial aid, students can potentially reduce the amount they need to borrow through student loans. This financial strategy can alleviate long-term debt burdens and enhance financial stability post-graduation.

When planning for higher education expenses, it’s essential for students to thoroughly explore available grants and scholarships. These funds can offer a significant financial buffer against the high costs associated with college tuition, fees, and other related expenses. Therefore, alongside researching student loans, understanding and applying for grants and scholarships should be a top priority for any prospective or current student.

The Difference Between Grants, Scholarships, and Loans

Understanding the differences between grants, scholarships, and loans is crucial for students seeking financial aid. Grants are typically need-based awards that do not need to be repaid. They are often provided by the federal or state government, colleges, or nonprofits, and are designed to help students with demonstrated financial need.

Scholarships, on the other hand, are generally merit-based. These can be awarded based on academic achievement, athletic skill, artistic talent, or other criteria. Scholarships also do not require repayment and can come from a variety of sources, including educational institutions, private organizations, and community groups.

Student loans, unlike grants and scholarships, must be repaid with interest. They can be obtained from federal or private lenders, and they often have different terms, interest rates, and repayment plans. Understanding these distinctions helps students better navigate their financial aid options and make informed decisions.

How To Find and Apply for Grants and Scholarships

Finding and applying for grants and scholarships requires research, organization, and persistence. Start with the Free Application for Federal Student Aid (FAFSA), which determines eligibility for federal grants like the Pell Grant. Additionally, many states and colleges use FAFSA information to award their own grants and scholarships.

Students should also explore scholarship search engines like Fastweb, Scholarship.com, and the College Board Scholarship Search. These platforms allow you to create profiles and match you with scholarships based on your personal information and qualifications.

When applying, always read the eligibility requirements and follow the application instructions closely. Pay attention to deadlines and gather necessary documents early. Crafting a strong personal statement and securing letters of recommendation can significantly enhance your application.

Maximizing Your Financial Aid Package

To maximize your financial aid package, start by filling out the FAFSA as soon as possible—ideally on October 1st, when it opens. Submitting early increases your chances of receiving state and institutional grants, which may have limited funds.

Next, apply for multiple scholarships. There is no limit to how many you can receive, so cast a wide net. Look for both large national scholarships and smaller local ones; the latter often have less competition.

Maintain a strong academic record and stay involved in extracurricular activities. Continuous improvement in these areas can make you eligible for more scholarships over time. Also, consider reaching out to your school’s financial aid office for advice and additional opportunities they might offer.

Lastly, if your financial situation changes significantly after filing your FAFSA, notify your school’s financial aid office. They might be able to adjust your aid package to better reflect your current needs.

Frequently Asked Questions

What are the key differences between student grants and scholarships?

The key differences between student grants and scholarships are: grants are typically need-based, meaning they are given based on the student’s financial situation, while scholarships are usually merit-based, awarded for academic achievement, talents, or other criteria. Both provide funding that does not need to be repaid, but the eligibility requirements and sources of funding often differ.

How can I find and apply for student grants and scholarships?

To find and apply for student grants and scholarships, start by visiting your school’s financial aid office for resources and guidance. Use online platforms like Fastweb, Scholarships.com, and the FAFSA website to search for opportunities. Ensure that you pay attention to eligibility requirements and deadlines when applying. Utilizing these resources will help you access free financial aid options, reducing your student loan debt.

Are student grants and scholarships taxable income?

In the context of providing comprehensive insights and resources on student loans, it’s important to note that student grants and scholarships are generally not taxable income if they are used for qualified education expenses such as tuition, fees, and required books or supplies. However, amounts used for non-qualified expenses like room and board, travel, or optional equipment are typically considered taxable. It’s advisable to consult IRS guidelines or a tax professional for detailed information regarding specific circumstances.

In conclusion, gaining a thorough understanding of student grants and scholarships is essential for anyone navigating the complex world of higher education financing. While student loans often serve as a primary source of funding, grants and scholarships provide invaluable opportunities to reduce the financial burden of college costs. By exploring these options and utilizing available resources, students can make well-informed decisions that minimize debt and maximize educational opportunities. As you continue your journey, remember that equipping yourself with the right knowledge and tools will pave the way for a more secure and financially manageable future.