Discover the latest updates on the current status of student loan forgiveness. Will it be approved? Stay informed about the potential changes impacting your financial future.

Understanding the Current Status of Student Loan Forgiveness

The topic of student loan forgiveness has been a significant focus in recent years, capturing the attention of millions of borrowers. Understanding the current status of student loan forgiveness is crucial for any borrower navigating the complex landscape of student debt.

Key Programs in Student Loan Forgiveness

As of now, several forgiveness programs are available for specific types of borrowers. One of the most prominent is the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. It’s vital for borrowers to ensure they meet all criteria to benefit from this program fully and understand the current status of student loan forgiveness.

Another key program is the Teacher Loan Forgiveness Program, which provides forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans and Subsidized and Unsubsidized Federal Stafford Loans for teachers who work in low-income schools or educational service agencies for five consecutive years. This program targets educators, recognizing their critical role in society.

Legislative Discussions and Proposals

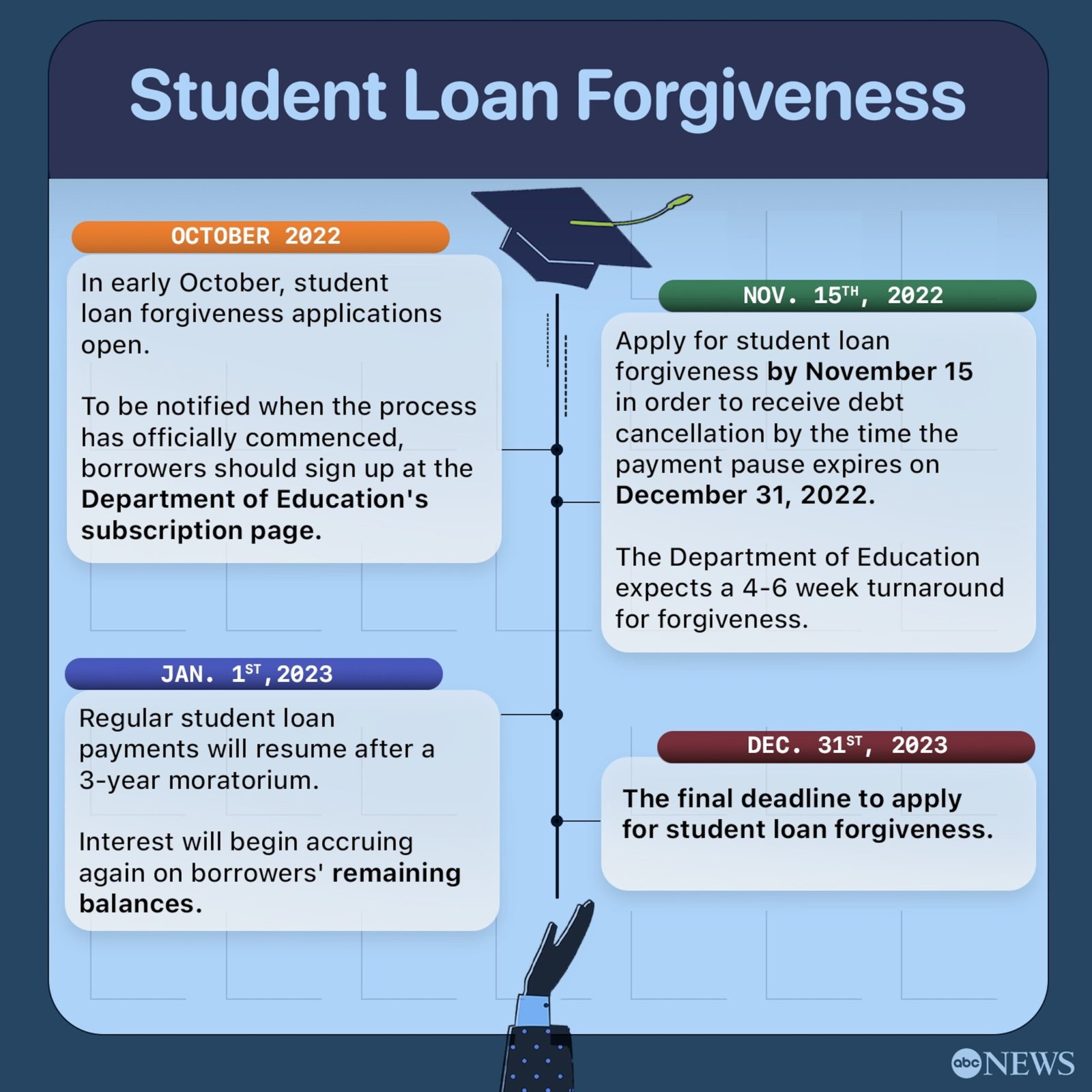

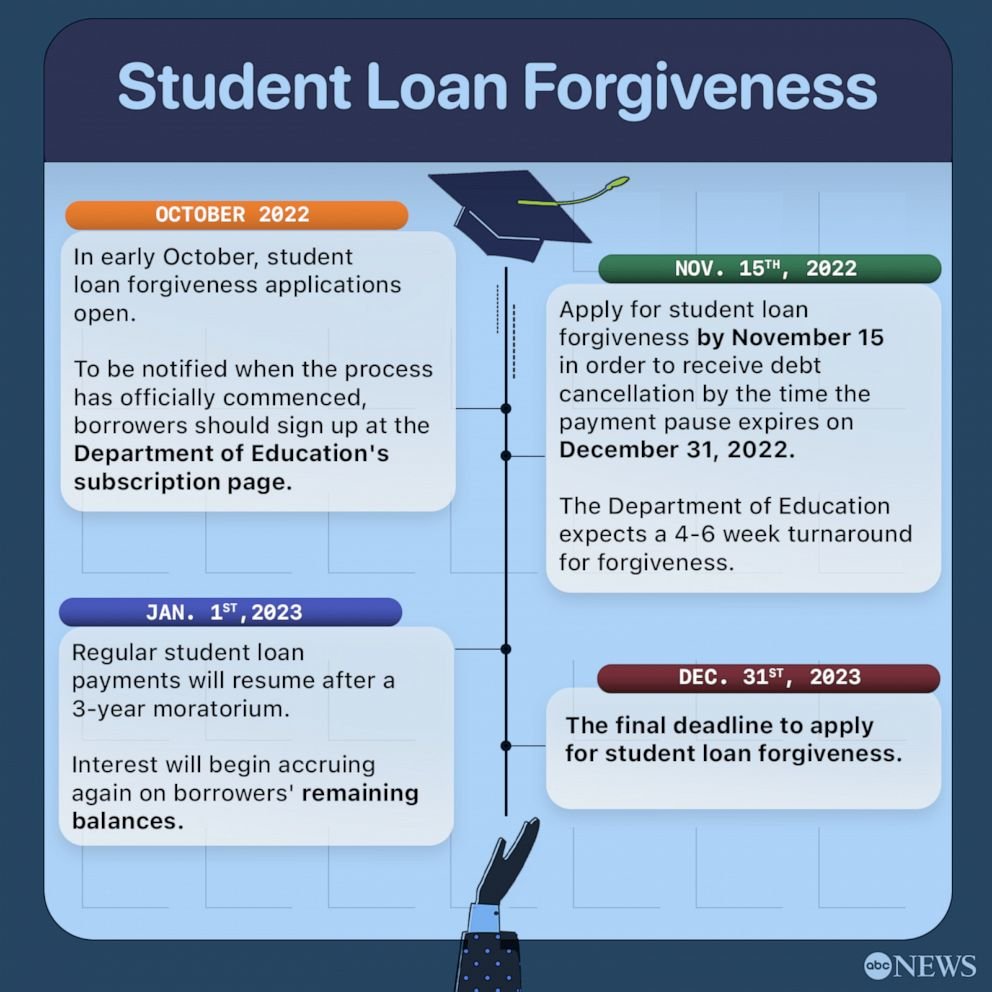

On the legislative front, there have been numerous discussions and proposals aimed at broadening the scope of student loan forgiveness. The Biden administration has proposed forgiving $10,000 in federal student loan debt per borrower. While this proposal has not yet become law, it underscores the ongoing efforts to address the current status of student loan forgiveness at a national level.

State and Private Forgiveness Programs

In addition to these federal programs, some states and private organizations offer their own forgiveness programs. These often target specific professions or incentivize work in underserved areas. Borrowers should explore all available options, including state-specific programs that might apply to their situation.

Future Prospects of Student Loan Forgiveness

Looking ahead, the future of student loan forgiveness is uncertain but promising. Legislative changes at the federal level could potentially expand relief options. Staying informed about policy changes and new developments is essential for borrowers who wish to take advantage of forgiveness programs.

Moreover, advocacy and borrower education play pivotal roles in shaping the future of student loan forgiveness. By voicing their concerns and staying engaged with advocacy groups, borrowers can contribute to a more favorable lending environment.

Proactive Debt Management

Navigating the complexities of student loans and forgiveness programs requires diligence and proactive management. Regularly consulting with financial advisors and staying updated on legislative changes can help borrowers make informed decisions about their debt management strategies.

The Current Landscape of Student Loan Forgiveness Programs

The landscape of student loan forgiveness programs is complex and ever-evolving. Various programs exist at both the federal and state levels, targeting different groups of borrowers. Among the most notable is the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Additionally, Teacher Loan Forgiveness and Perkins Loan Cancellation also provide avenues for debt relief. Understanding these programs and their respective eligibility criteria is crucial for borrowers seeking forgiveness. While there have been several proposals and actions by the federal government indicating steps toward broader student loan forgiveness, such initiatives often face legislative and financial hurdles.

Economic and Political Factors Influencing Approval

The approval of student loan forgiveness is influenced by a multitude of economic and political factors. Politically, the issue of student loan forgiveness is highly polarizing, with strong opinions on both sides of the aisle. Proponents argue that forgiving student loans would stimulate economic growth by allowing graduates to spend more freely and invest in major life events like buying homes or starting businesses.

Opponents, however, contend that such a move could be economically irresponsible, adding significant sums to the national debt. Moreover, the economic impact of the COVID-19 pandemic has further complicated the landscape.

The temporary suspension of federal student loan payments and interest through various administrative actions has highlighted the need for long-term solutions. Ultimately, any path forward requires navigating these intricate socio-political dynamics.

What Borrowers Should Do While Awaiting a Decision

While awaiting a final decision on broad-based student loan forgiveness, borrowers should take proactive steps to manage their debt effectively. First and foremost, it is advisable to stay informed about any updates regarding potential changes in student loan policies by regularly checking official sources like the Federal Student Aid website. Enrolling in an income-driven repayment (IDR) plan can also be beneficial, as these plans offer the potential for reduced monthly payments based on income and family size. Borrowers currently eligible for existing forgiveness programs should ensure they meet all requirements to avoid missing out on relief.

Keeping meticulous records of qualifying payments and employment certifications is crucial for programs such as PSLF. Lastly, consulting with a certified financial advisor or a student loan counselor can provide personalized guidance tailored to individual circumstances.

These secondary subtitles and their detailed explanations offer a comprehensive look into the intricacies of student loan forgiveness, helping borrowers navigate through uncertain times.

Frequently Asked Questions

What are the current legislative proposals for student loan forgiveness?

As of 2023, some of the current legislative proposals for student loan forgiveness include President Biden’s Student Debt Relief Plan, which aims to forgive up to $10,000 in federal student loans for eligible borrowers, and the Public Service Loan Forgiveness (PSLF) program reform, which seeks to simplify and expand benefits for public service workers. Additionally, there are various other bills in Congress proposing broader cancellation measures, though their passage remains uncertain.

How would the potential approval of student loan forgiveness impact repayment plans?

The potential approval of student loan forgiveness would have a significant impact on repayment plans by reducing or eliminating the outstanding balances for eligible borrowers. This could lead to lower monthly payments, alterations in current repayment schedules, and potentially make income-driven repayment plans less necessary for some individuals. Additionally, it could offer financial relief and improve overall economic stability for many borrowers.

What are the eligibility criteria for proposed student loan forgiveness programs?

The eligibility criteria for proposed student loan forgiveness programs generally include income thresholds, meaning borrowers must earn below a certain amount to qualify. Additionally, some programs may require borrowers to be in specific employment fields such as public service or teaching. Other criteria might include the type of loan (e.g., federal vs. private) and the borrower’s payment history, such as making a certain number of qualifying payments under an income-driven repayment plan.

The current status of student loan forgiveness remains uncertain, with numerous factors at play influencing its potential approval. As legislative proposals and policy discussions continue to evolve, it’s crucial for borrowers to stay informed and engaged. Whether you’re hoping for immediate relief or preparing for long-term repayment strategies, understanding the intricacies of these developments is essential. By leveraging the right resources and staying up-to-date on the latest news, you can position yourself to make the best financial decisions for your educational investment. Remember, being proactive and knowledgeable about your student loans will always serve you well in navigating this complex landscape.