In this article on studentloaninsights, we delve into the long-term consequences of not paying student loans for 10 years. Understand the impact on your credit score, potential legal actions, and the options available to manage or resolve your debt.

Long-Term Consequences of Defaulting on Student Loans

Defaulting on student loans can have severe long-term consequences, which become even more significant when examined over a decade. One of the primary repercussions is the impact on your credit score. A default can severely damage your credit, making it challenging to obtain new credit, such as credit cards, car loans, or mortgages. This damaged credit score can also lead to higher interest rates if you are approved for any new credit.

Another major consequence is the possibility of wage garnishment. After defaulting, lenders might take legal action to recover the owed amount, leading to the court ordering a portion of your wages to be automatically deducted to repay the debt. This can reduce your disposable income and make it difficult to meet other financial obligations.

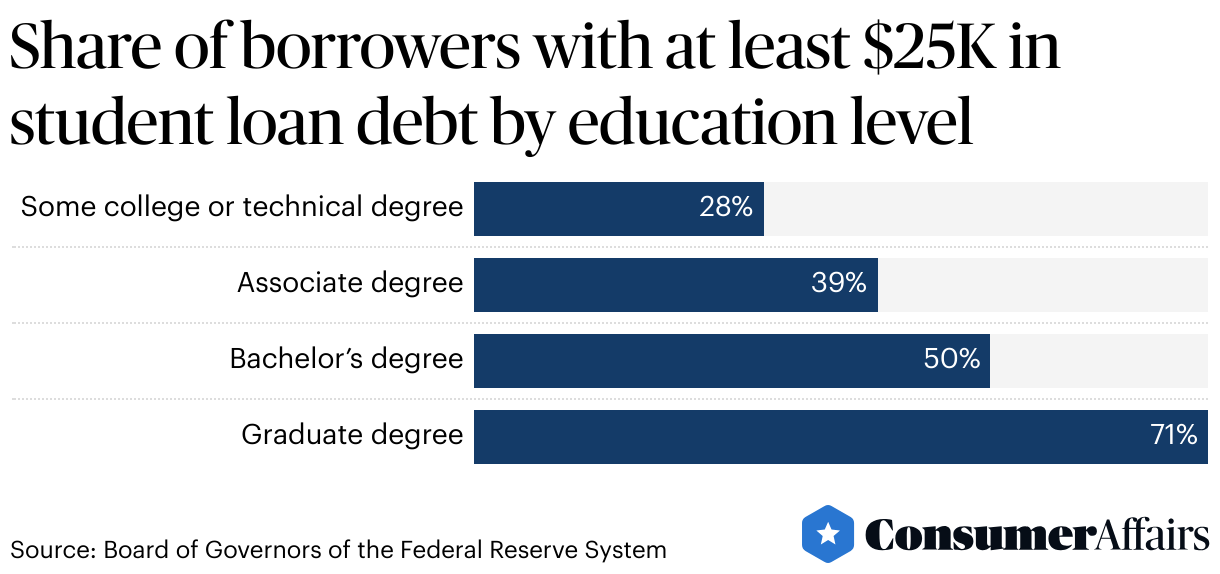

Additionally, defaulting on student loans can result in the loss of eligibility for federal student aid, which can be crucial if you decide to return to school or pursue further education. The defaulted loan status can also impact your ability to rent an apartment, as many landlords perform credit checks and may view a default as a red flag.

Furthermore, financial hardships continue as collection fees and additional interest accumulate on the defaulted loan, making the total debt much larger over time. This financial strain can persist even if you eventually manage to rehabilitate the loan or reach a settlement agreement.

The psychological toll should not be underestimated. Living under the stress of a default can affect your mental health, causing anxiety and depression due to the continuous financial pressure and uncertainty about the future.

Potential Consequences of Not Paying Your Student Loans for 10 Years

If you haven’t paid your student loans in 10 years, the consequences can be severe. For federal student loans, after about 270 days of non-payment, your loan goes into default. This can lead to garnishment of your wages, withholding of your tax refunds, and a significant negative impact on your credit score. Private loans may have different default timelines, but the outcomes are similar, often resulting in legal action. In addition, collection agencies might pursue you aggressively, adding further stress and financial strain.

Options for Handling Defaulted Student Loans

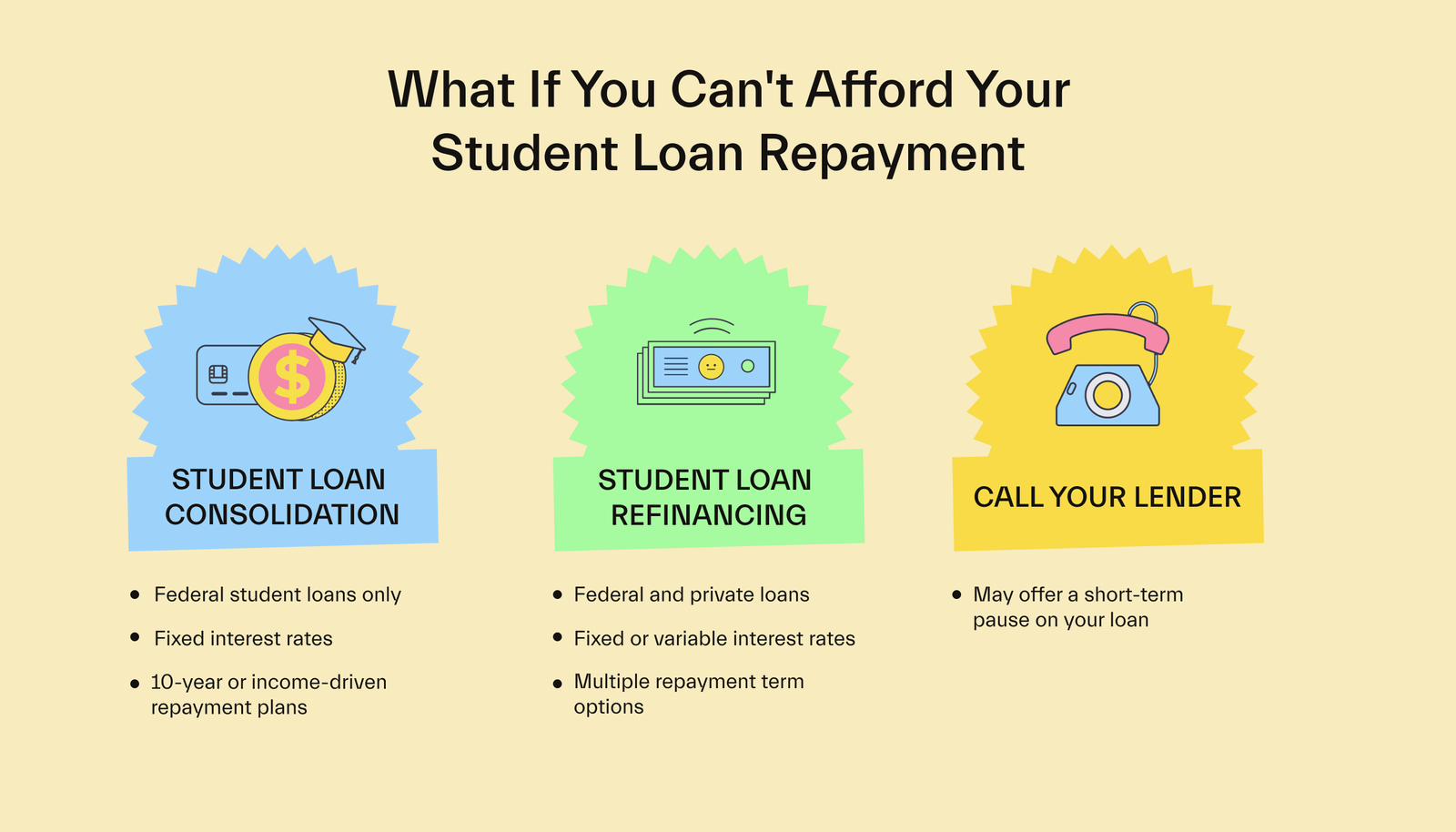

Even if you’re in default, there are still options to manage your situation. For federal loans, you might be eligible for loan rehabilitation, which can remove the default status from your credit report upon completion of an agreed payment plan. Alternatively, loan consolidation can combine your loans into one, potentially with more manageable repayment terms. For private loans, options may vary, but contacting your lender to negotiate a new payment plan or settlement is crucial. Some lenders may agree to a lump-sum payment that’s less than your total owed amount.

Long-Term Financial Planning Post-Default

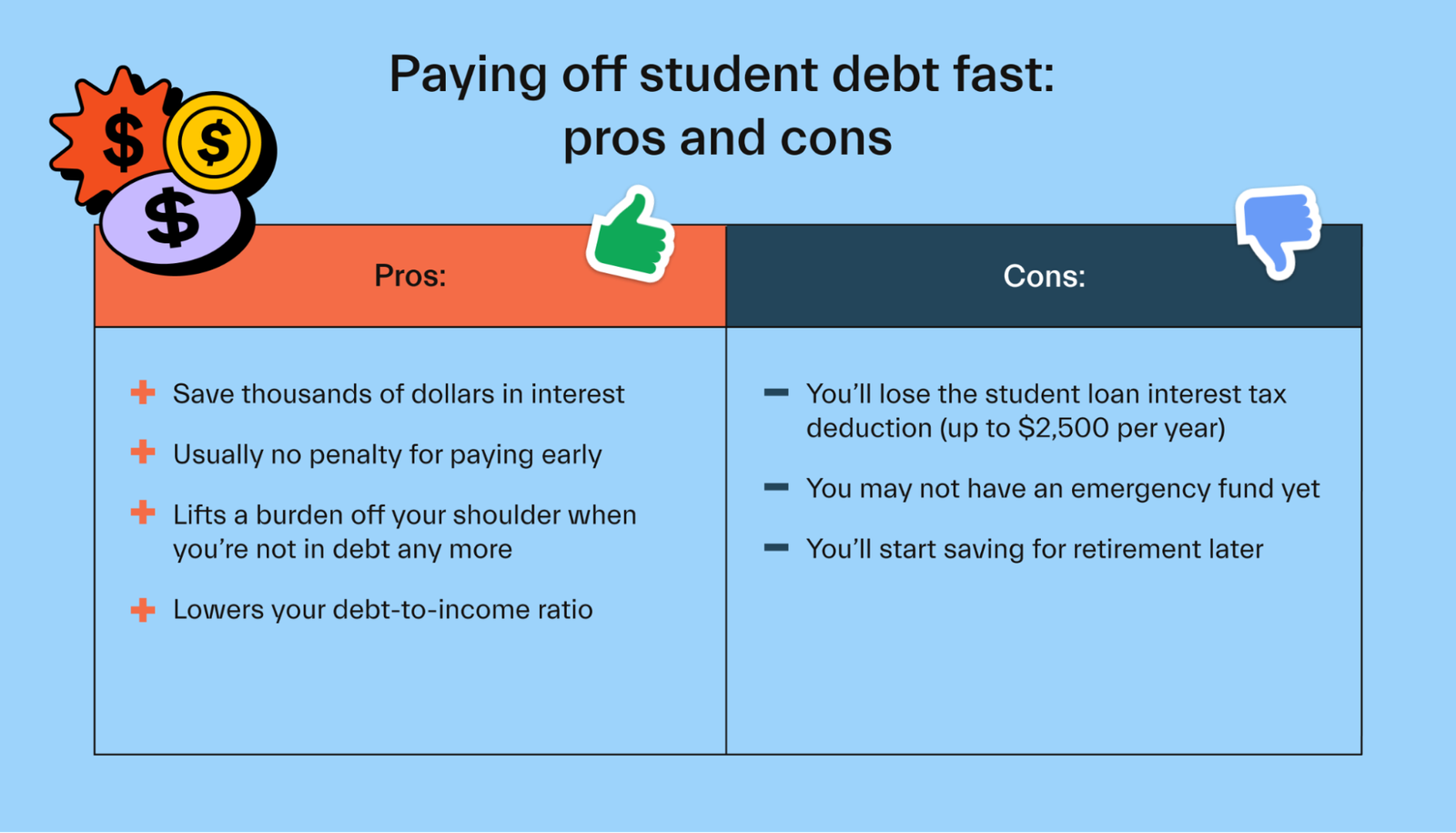

Navigating life after a student loan default requires strategic long-term financial planning. First, rebuilding your credit score should be a priority. This can include paying off any remaining debts, maintaining consistent payments on any other credit accounts, and correcting any errors on your credit report. Additionally, budgeting effectively and possibly working with a financial advisor can help you regain financial stability. If possible, consider setting up an emergency fund to prevent future financial crises.

Frequently Asked Questions

What are the potential legal consequences of not paying student loans for 10 years?

If you do not pay your student loans for 10 years, the potential legal consequences can be severe. Your credit score will significantly drop, making it difficult to obtain new credit or even rent an apartment. Wage garnishment may occur, where a portion of your paycheck is taken to repay the debt. Your tax refunds and Social Security benefits could be seized. Additionally, you could face lawsuits, and if successful, creditors can put liens on your property. Ignoring student loans can lead to long-term financial instability and legal troubles.

How does unpaid student loan debt after 10 years affect my credit score and financial future?

Unpaid student loan debt after 10 years can significantly affect your credit score and financial future. Defaulting on loans leads to negative marks on your credit report, lowering your score and making it harder to secure loans or get favorable interest rates. Additionally, you may face wage garnishments, tax refund seizures, and difficulties in renting apartments or getting certain jobs. It’s crucial to explore repayment options and seek advice to mitigate these impacts.

Are there any forgiveness programs or relief options available after 10 years of non-payment?

Yes, under certain conditions, student loans may be forgiven after 10 years of non-payment through the Public Service Loan Forgiveness (PSLF) program. To qualify, you must make 120 qualifying payments while working full-time for a qualifying employer, such as a government or non-profit organization.

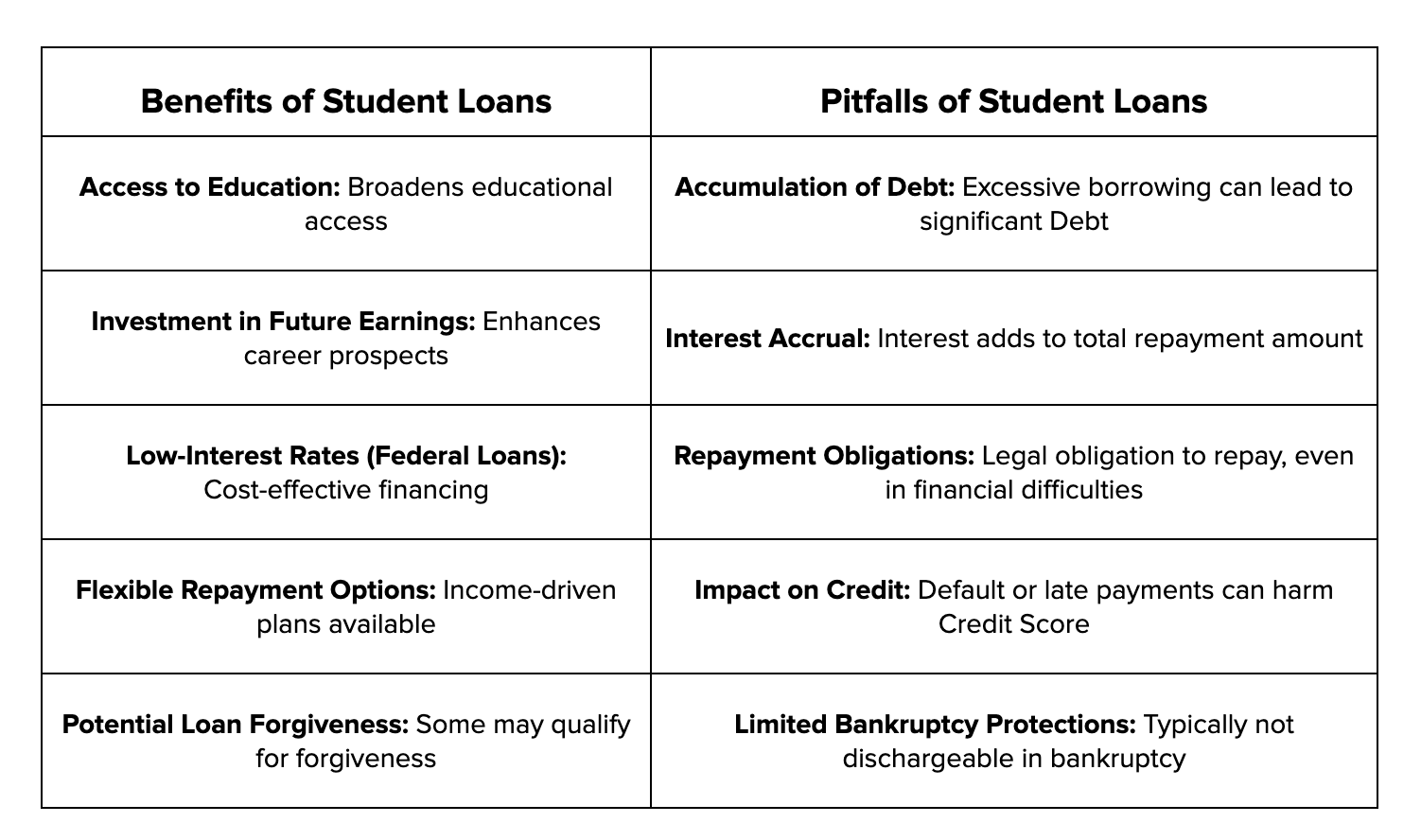

In conclusion, not paying your student loans for 10 years can have severe and lasting consequences. The absence of payments can lead to credit score damage, wage garnishments, tax refund intercepts, and a host of other financial and legal issues. It’s crucial to understand that federal loans and most private loans are not easily discharged through bankruptcy, leaving you with few options besides repayment or rehabilitation programs. To avoid these dire outcomes, it’s important to explore all available avenues, such as income-driven repayment plans, loan forgiveness programs, or even consulting a financial advisor for tailored advice. Remember, staying informed and proactive is key to managing your student loans effectively.