Navigating student loans can be challenging, but understanding your options can help you secure better rates and more manageable terms. Whether you’re applying for federal or private student loans, knowing how to make the right decisions can save you money and stress in the long run.

Types of Federal Student Loans: Finding the Best Option for You

Federal student loans are often the most favorable option for students. They come with lower interest rates and more flexible repayment options compared to private loans. Here are the main types:

- Direct Subsidized Loans: For students with financial need. The government pays the interest while you’re in school.

- Direct Unsubsidized Loans: Available to undergraduates and graduate students, but interest accrues from the moment the loan is disbursed.

- PLUS Loans: For graduate students and parents of undergrads, offering higher borrowing limits but at higher interest rates.

- Direct Consolidation Loans: These allow you to combine multiple federal loans into one.

Compare Private Student Loan Rates: Are They Right for You?

While federal student loans are generally the first option, private student loans can be useful if you’ve hit your federal borrowing limit. However, interest rates vary:

- Variable APR: Can range from 4.98% to 16.69%, depending on your credit score and lender.

- Fixed APR: Typically between 4.29% and 17.96%, offering stable, predictable payments.

Federal vs. Private Student Loans: Key Differences

Understanding the difference between federal and private student loans is critical. Federal loans usually have better protections, such as deferment, forbearance, and income-driven repayment plans. Private loans, on the other hand, are credit-based and often come with fewer borrower protections.

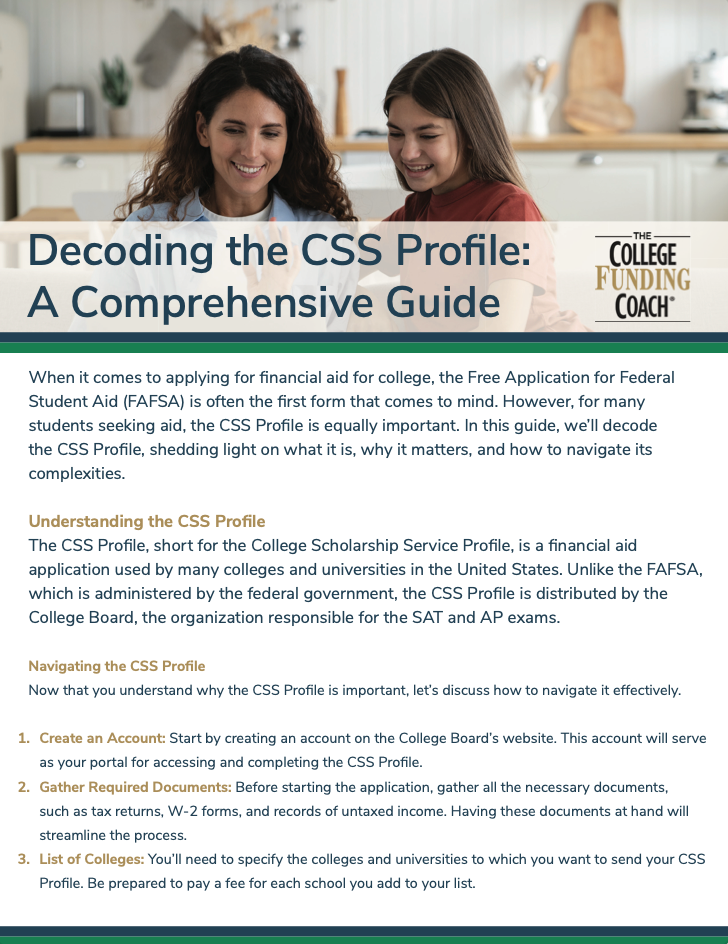

How to Apply for Federal Student Loans

To apply for federal student loans, you need to submit the Free Application for Federal Student Aid (FAFSA). This form determines your eligibility for federal financial aid, including loans, grants, and work-study programs. Once approved, your school’s financial aid office will guide you through the next steps.

Reasons for Taking Out Federal Student Loans

- Deferred Repayment: You won’t have to make payments until after you graduate.

- Lower Interest Rates: Federal loans typically have lower rates than private loans.

- Flexible Repayment Plans: Income-driven repayment plans and forgiveness programs are available for federal loans.

Building Credit with Student Loans

Managing your student loans responsibly can help you build a good credit history. Here’s how:

- Make On-Time Payments: Ensuring timely payments will improve your credit score.

- Avoid Default: Defaulting on loans will severely impact your credit.

- Use a Mix of Credit: Having student loans and other forms of credit can boost your score.

Graduate Student Loans and Law School Loans

Pursuing a graduate degree or law degree can be expensive, but specific loans can help cover costs:

- Graduate Student Loans: Private loans designed to cover tuition and additional fees.

- Law School Loans: Some private lenders offer loans tailored for law students, including financing for bar exam preparation.

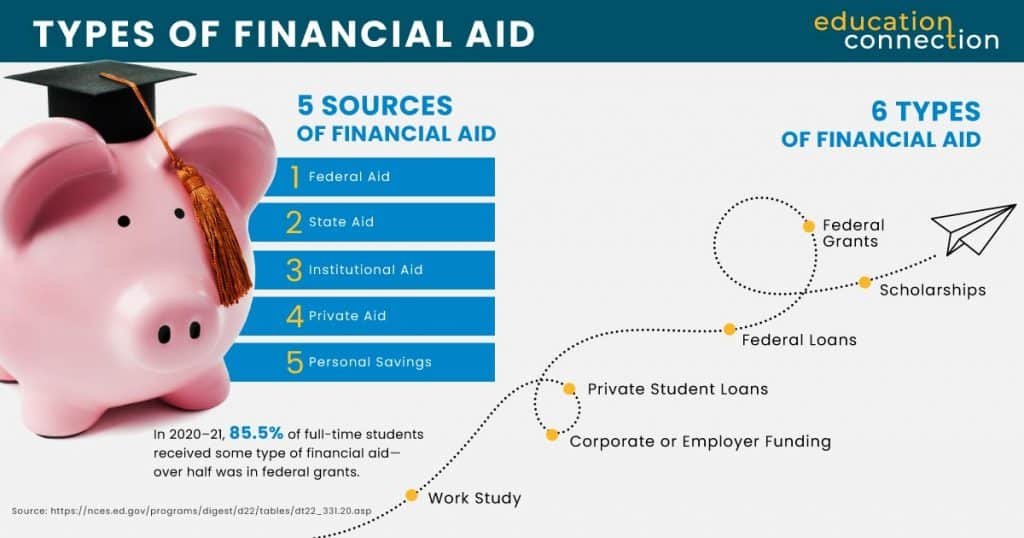

Alternatives to Student Loans

Before taking on student loans, explore other options:

- Scholarships: Merit-based awards that don’t need to be repaid.

- Grants: Need-based aid from federal, state, or institutional sources.

- Work-Study Programs: Earn money for school by working part-time.

- Employer Tuition Assistance: Some companies help pay for college.

- Community College: Starting at a community college can reduce tuition costs before transferring to a four-year school.

Ethical Considerations for Student Loans

Borrowing responsibly is essential. Here are some tips:

- Borrow Only What You Need: Avoid taking on unnecessary debt.

- Understand Loan Terms: Make sure you know the interest rates, repayment terms, and potential penalties.

- Plan for Repayment: Have a strategy in place for paying off your loans after graduation.

Beware of Student Loan Scams

Student loan scams prey on borrowers, often promising instant loan forgiveness or lower payments in exchange for fees or personal information. Always verify offers with trusted sources like the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB).

Current Trends in Student Loans

The student loan landscape is always evolving. Some trends to watch include:

- Rising Tuition Costs: The cost of higher education continues to increase.

- Increased Online Education: More affordable online programs may gain popularity.

- Expanded Loan Forgiveness Programs: Future policies may extend relief to more borrowers.

How Much Student Loan Debt is Too Much?

For many students, taking out $30,000 or even $200,000 in student loans can seem daunting. However, what’s considered “too much” depends on your future earning potential and the degree you pursue. Plan wisely and assess how your future income will accommodate your loan repayments.

Borrow Smart and Plan Ahead

Student loans are a powerful tool, but they require careful planning and management. Whether you opt for federal student loans or seek out private loans, always borrow responsibly and stay informed. With the right approach, you can minimize debt and set yourself up for a successful financial future.