Discover various financial aid options for students in our latest blog post. Learn how to navigate grants, scholarships, and loans to make your educational journey more affordable and stress-free.

Financial Aid Options for Students: Scholarships, Grants, and Loans

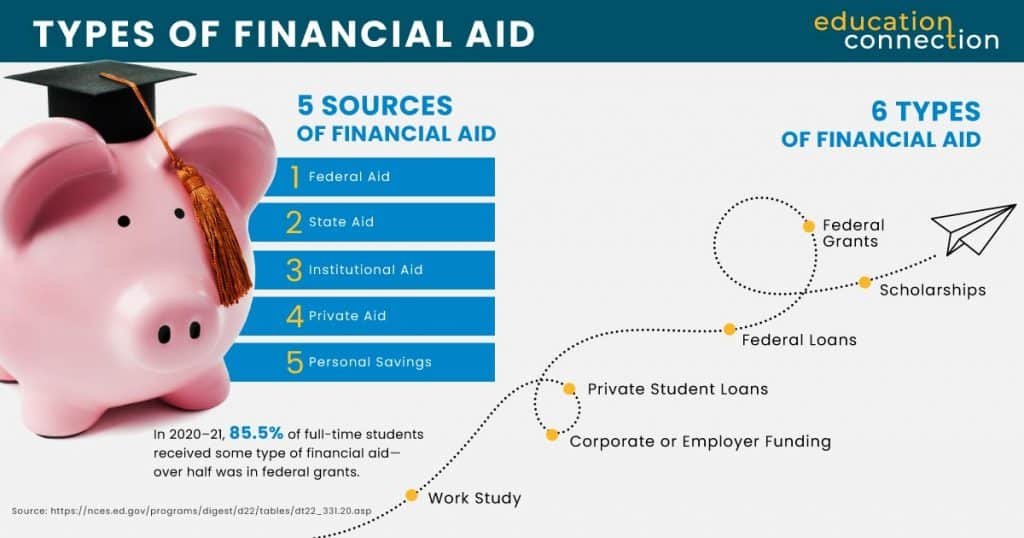

In the realm of higher education, exploring different avenues of financial aid is crucial for students aiming to manage their educational expenses. Scholarships, grants, and student loans are the primary forms of financial assistance available.

Scholarships are awarded based on academic merit, leadership qualities, or other criteria set by the organization offering them. These funds do not need to be repaid, making them highly desirable for students looking to minimize debt.

Grants, much like scholarships, provide funds that do not require repayment. They are often need-based and can come from federal, state, or institutional sources. The Pell Grant, for example, is a common federal grant awarded to undergraduate students demonstrating significant financial need.

Student loans, on the other hand, constitute borrowed money that must be repaid with interest. Federal student loans are typically more favorable than private loans due to lower interest rates and more flexible repayment options. Within federal loans, there are subsidized loans where the government pays the interest while the student is in school, and unsubsidized loans where interest accrues immediately upon disbursement.

Understanding the differences between these forms of financial aid and how they can be leveraged is essential for students. Combining scholarships and grants with student loans can create a well-rounded financial aid package that meets educational needs while minimizing debt.

Scholarships and Grants: Free Money for Students

Scholarships and grants are forms of financial aid that do not need to be repaid, making them extremely advantageous for students. Scholarships are typically merit-based, awarded based on criteria such as academic achievement, athletic ability, or extracurricular involvement. There are also scholarships available for specific fields of study, underrepresented groups, and various other categories.

Grants, on the other hand, are usually need-based and often provided by the federal or state government, institutions, or private organizations. The most well-known grant program in the United States is the Federal Pell Grant, which is awarded to undergraduate students who demonstrate significant financial need. To maximize your chances of receiving a scholarship or grant, apply early and diligently search for opportunities through multiple channels, including university websites, local community organizations, and scholarship databases like Fastweb and Scholarships.com.

Federal Student Loans: The Backbone of Financial Aid

Federal student loans are a cornerstone of financial aid for many students. These loans are funded by the U.S. Department of Education and come with benefits that generally make them preferable to private loans. Federal student loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans.

Direct Subsidized Loans are for undergraduate students with demonstrated financial need, and the government pays the interest while you’re in school and during grace periods. Direct Unsubsidized Loans are available to both undergraduate and graduate students without the need-based requirement, but you are responsible for all the interest. PLUS Loans are available to graduate students and parents of dependent undergraduates, but they require a credit check.

The benefits of federal student loans include lower fixed interest rates, flexible repayment plans, and eligibility for loan forgiveness programs. It’s crucial to fill out the Free Application for Federal Student Aid (FAFSA) to determine your eligibility and for access to these loans. Be mindful of borrowing only what you need to mitigate future debt.

Private Student Loans: A Valuable Supplement to Federal Aid

While federal student loans should be your first choice due to their favorable terms, private student loans can serve as a valuable supplement if you’ve exhausted other options. Private student loans are offered by banks, credit unions, and other lenders, and they can help cover the gap between your financial aid package and your educational costs.

However, private loans typically come with higher interest rates and less flexible repayment terms compared to federal loans. To secure the best rates and terms, students (or their co-signers) need to have good credit histories and may benefit from comparing offers from multiple lenders. Some well-known private student loan providers include Sallie Mae, College Ave, and Discover Student Loans.

Before opting for a private loan, evaluate all other forms of financial aid, including scholarships, grants, work-study programs, and federal loans. Consulting with a financial aid advisor can provide personalized guidance and ensure that you’re making the best decision for your financial situation.

Student aid 2024

As we look ahead to student aid in 2024, it is crucial to stay informed about the latest updates and changes in financial aid programs. Students can expect to see continued support from federal and state governments, as well as institutions, to help make higher education more accessible.

Student aid in 2024 will likely focus on addressing the growing concerns around student debt and affordability. Efforts may include increased funding for need-based grants, scholarships, and work-study programs to lessen the financial burden on students and their families.

Furthermore, student aid in 2024 may introduce innovative solutions to promote financial literacy among students. This could involve providing resources and tools to help students better understand their financial options, make informed decisions, and manage their finances responsibly.

Overall, student aid in 2024 is expected to adapt to the evolving needs of students and the higher education landscape. By staying informed and proactive, students can take advantage of the various financial aid options available to support their academic journey and achieve their educational goals.

Student aid 2024

Student Aid 2024 is a program designed to provide financial support to students pursuing higher education. This initiative aims to make college more accessible and affordable for individuals from all walks of life.

Through Student Aid 2024, students can apply for grants, scholarships, and loans to help cover the costs of tuition, books, and living expenses. This financial assistance can alleviate the burden of student debt and allow individuals to focus on their academic pursuits.

One of the key features of Student Aid 2024 is its emphasis on inclusivity. The program is committed to supporting students from diverse backgrounds, including those from underrepresented communities and low-income households.

By participating in Student Aid 2024, students can access resources and support services to help them navigate the complex world of financial aid. Whether it’s filling out forms, understanding loan options, or seeking guidance on budgeting, this program is there to assist every step of the way.

Overall, Student Aid 2024 represents a significant investment in the future of education. By providing students with the financial resources they need to succeed, this program is helping to build a more equitable and prosperous society for all.

Frequently Asked Questions

What types of financial aid options are available for students?

Students have several financial aid options available, including federal student loans, private student loans, scholarships, grants, and work-study programs. Federal student loans often have lower interest rates and more flexible repayment options compared to private loans. Scholarships and grants are forms of aid that don’t need to be repaid, making them highly desirable. Work-study programs provide part-time employment opportunities to help students earn money while attending school.

How can students apply for scholarships and grants?

Students can apply for scholarships and grants by researching opportunities through their school’s financial aid office, online scholarship databases, and community organizations. It’s essential to complete the FAFSA (Free Application for Federal Student Aid) to determine eligibility for federal grants. Additionally, students should prepare strong personal statements, gather recommendation letters, and keep track of application deadlines to increase their chances of success.

What are the eligibility requirements for federal student loans?

To be eligible for federal student loans, you must meet several criteria. You need to be a U.S. citizen or an eligible non-citizen, have a valid Social Security number, and be enrolled in an eligible degree or certificate program at least half-time. Additionally, you must demonstrate financial need (for some loans), maintain satisfactory academic progress, and register with the Selective Service if required. Finally, you must complete the Free Application for Federal Student Aid (FAFSA).

In conclusion, navigating the myriad of financial aid options for students can seem daunting, but with the right guidance and resources, it becomes a manageable task. From federal student loans and grants to scholarships and work-study programs, there are numerous avenues available to help alleviate the financial burden of higher education. It’s crucial for students to thoroughly research and understand their options, ensuring they make informed decisions that will benefit their educational and financial futures. Our mission remains to provide comprehensive insights and resources on student loans, empowering students to pursue their academic goals with confidence and clarity.