Welcome to StudentLoanInsights! In this article, we’ll explore strategies and actionable tips on how to pay off $300k in student loans in just 5 years. Learn about budgeting, refinancing options, and more to take control of your financial future.

Strategic Planning: Mapping Your Path to Paying Off $300k in Student Loans in 5 Years

When faced with the daunting task of paying off $300k in student loans in just five years, meticulous planning and strategic execution are imperative. Here is a roadmap to help you achieve this goal:

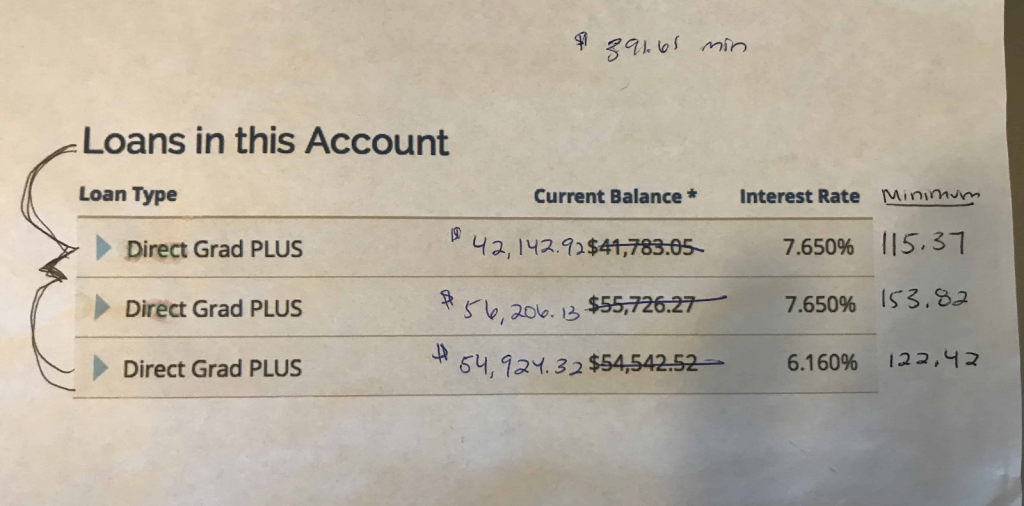

1. Assess Your Financial Situation: Begin by taking a comprehensive look at your current financial status. Calculate your total loan balance, interest rates, monthly payments, and any other debts or financial obligations. Understanding your starting point is crucial for drafting an effective repayment plan.

2. Create a Budget and Stick to It: Living on a strict budget is essential when trying to pay off a substantial amount of debt quickly. Identify areas where you can cut back on expenses. The money saved here should be redirected toward your loan payments. Every dollar counts when you’re working towards such an ambitious goal.

3. Increase Your Income: Explore opportunities to boost your income. This might involve taking on side gigs, freelancing, or seeking promotions and raises in your current job. Add any extra earnings directly to your loan payments to accelerate the payoff process.

4. Utilize Windfalls Wisely: Tax refunds, bonuses, or monetary gifts should be utilized strategically. Instead of indulging in luxury purchases, apply these windfalls to your loan balance. Lump-sum payments can significantly reduce your principal balance and, consequently, the interest you’ll pay over time.

5. Refinance or Consolidate Loans: Investigate refinancing options to secure a lower interest rate, which can save you thousands of dollars over the life of the loan. Make sure to weigh the pros and cons carefully, as refinancing federal loans into private loans means losing out on benefits like income-driven repayment plans and forgiveness programs.

6. Adopt the Snowball or Avalanche Method: Choose a repayment strategy that aligns with your financial habits. The Snowball Method involves paying off the smallest loans first, providing psychological wins and motivation to continue. The Avalanche Method focuses on paying off loans with the highest interest rates first, saving money on interest over time. Select the method that keeps you motivated and maximizes your savings.

7. Automate Payments: Set up automatic payments to ensure consistency and avoid late fees. Many lenders offer a discount on your interest rate for enrolling in autopay, which can further enhance your repayment efficiency.

8. Monitor Progress and Adjust: Regularly review your repayment progress and adjust your strategies as needed. Track how much you’ve paid down, any interest saved, and reassess your budget periodically. Staying adaptable and responsive to changes in your financial situation will keep you on track.

9. Seek Support and Resources: Join communities and forums for individuals facing similar challenges. These platforms can offer encouragement, innovative ideas, and advice. Additionally, consider consulting a financial advisor for personalized guidance tailored to your unique circumstances.

10. Stay Motivated: Paying off $300k in student loans within five years can seem overwhelming, but staying focused on your long-term goals is essential. Celebrate small milestones along the way to maintain motivation and remind yourself why you embarked on this journey.

By implementing these strategies and remaining disciplined, you can successfully repay $300k in student loans within five years, achieving financial freedom and peace of mind.

Developing a Strategic Repayment Plan

To successfully pay off $300k in student loans in five years, it is crucial to develop a strategic repayment plan. Begin by understanding the specifics of your loans: the total amount owed, interest rates, and repayment terms. Utilize tools like loan calculators to estimate monthly payments needed to meet your goal.

Next, consider the snowball or avalanche methods. The snowball method involves paying off smaller loans first to build momentum, while the avalanche method focuses on paying off loans with the highest interest rates first to minimize overall interest paid. Select the method that aligns best with your financial situation and psychological preferences.

Finally, explore consolidation or refinancing options. Consolidation can simplify multiple loans into a single monthly payment, though it may extend the repayment period. Refinancing, on the other hand, might offer a lower interest rate, reducing the total cost. Be sure to weigh the benefits and potential drawbacks of each option to create a robust repayment plan.

Maximizing Income and Reducing Expenses

A key component in achieving your goal is to maximize your income while minimizing expenses. To increase your income, consider side hustles, freelance work, or overtime opportunities. Every additional dollar earned can be directed towards your student loans, speeding up repayment.

Additionally, look for ways to reduce your living expenses. This may involve moving to a more affordable location, cutting down on discretionary spending, or negotiating bills and services for better rates. Creating and sticking to a strict budget will help you allocate as much money as possible toward loan repayment.

Another strategy is to take advantage of any employer student loan repayment assistance programs if available. These programs can significantly reduce your debt burden, making it easier to pay off your loans within the desired timeframe.

Utilizing Tax Benefits and Loan Forgiveness Programs

There are several tax benefits and loan forgiveness programs that can aid in managing and reducing student loan debt. For example, the Student Loan Interest Deduction allows you to deduct up to $2,500 of interest paid on qualified student loans from your taxable income, potentially lowering your tax liability.

Explore federal and state forgiveness programs, particularly if you work in public service, education, or healthcare. Programs like Public Service Loan Forgiveness (PSLF) forgive the remaining balance on Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Additionally, some states offer their own loan forgiveness or repayment assistance programs based on your profession or residency. Research and apply to all applicable programs to take full advantage of potential debt relief opportunities.

Frequently Asked Questions

What strategies can I use to pay off $300k in student loans within 5 years?

To pay off $300k in student loans within 5 years, consider these strategies:

1. Create a stringent budget to allocate maximum funds towards loan repayment.

2. Increase your income through side jobs or freelance work.

3. Make bi-weekly payments instead of monthly to reduce interest accumulation.

4. Refinance your loans for a lower interest rate.

5. Apply windfalls like bonuses or tax refunds directly to your loan balance.

These approaches require dedication and financial discipline but can significantly accelerate your loan repayment.

Are there any loan forgiveness programs available that might help reduce my $300k student loan debt?

Yes, there are several loan forgiveness programs available that can help reduce your $300k student loan debt. Some of the most notable include the Public Service Loan Forgiveness (PSLF), which forgives the remaining balance after 10 years of qualifying payments for those in public service jobs, and Income-Driven Repayment (IDR) plans, which can forgive the remaining balance after 20-25 years of qualifying payments based on your income and family size. Additionally, certain professions like teachers, nurses, and military personnel may qualify for specific loan forgiveness or repayment assistance programs.

How can refinancing my student loans assist in paying off $300k in student loans more quickly?

Refinancing your student loans can help you pay off $300k more quickly by securing a lower interest rate, which can reduce your monthly payments or allow you to pay more towards the principal. Additionally, refinancing can offer better loan terms and the opportunity to consolidate multiple loans into one, simplifying repayment and potentially shortening your loan term.

In conclusion, paying off $300k in student loans in five years is undoubtedly a daunting task, but it is achievable with the right strategies and dedication. By implementing a robust repayment plan, prioritizing high-interest loans, exploring refinancing options, and leveraging any additional sources of income, you can significantly accelerate your debt payoff journey. Remember, financial discipline and consistent budgeting play crucial roles in this process. Utilize the comprehensive resources available to you, stay focused on your goals, and don’t hesitate to seek professional financial advice if needed. With determination and a well-structured plan, you can overcome this substantial financial challenge and secure a debt-free future.