Welcome to studentloaninsights! In our latest article, we explore why Gen Z is struggling financially. Discover the underlying causes and how student loans play a crucial role in these challenges. Stay informed and empowered with our insights and resources.

Understanding the Financial Challenges Faced by Gen Z: The Role of Student Loans

The financial landscape for Gen Z is uniquely challenging, particularly due to the burden of student loans. One of the significant elements in understanding these challenges is recognizing the increased cost of higher education. Gen Z is experiencing tuition rates that have soared dramatically compared to previous generations, compelling many to rely heavily on student loans.

Moreover, the job market plays a crucial role in this dilemma. The transition from education to employment can be rocky, with many new graduates finding themselves in positions that do not offer sufficient income to manage their substantial debt. This financial precariousness is compounded by an economy still recovering from global disruptions, making it essential for Gen Z to have a robust strategy for managing student loans.

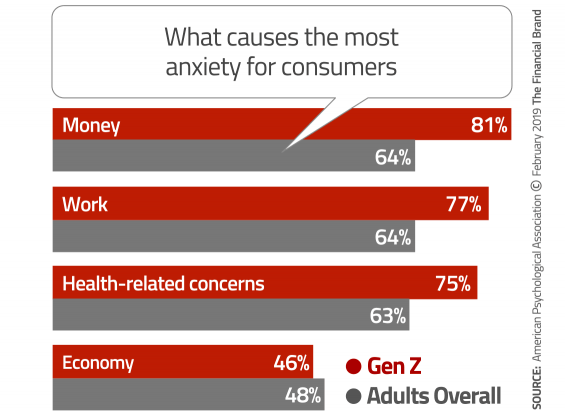

Another aspect to consider is the psychological impact of carrying heavy debt loads. The stress associated with significant student loan balances cannot be understated, influencing not just financial decisions but overall well-being and career choices. Understanding these pressures is crucial for providing effective support and resources.

To address these challenges, comprehensive insights and resources are vital. These include guidance on loan repayment options, strategies for minimizing borrowing through scholarships and grants, and practical advice on budgeting and financial planning. By equipping Gen Z with the right tools and information, we can help alleviate some of the burdens associated with student loans and support them in achieving financial stability.

The Rising Cost of Higher Education

The cost of obtaining a college degree has increased dramatically over the past few decades. This escalation in tuition fees, coupled with additional expenses such as housing, textbooks, and other supplies, has created a significant financial burden for Generation Z. According to the College Board, the average tuition and fees for the 2021-2022 academic year were $10,740 at public four-year in-state institutions and $38,070 at private non-profit four-year institutions. The steep rise in educational costs forces many students to rely heavily on student loans, often resulting in substantial debt upon graduation. Managing these loans while starting their careers can be overwhelming and impede their financial stability.

Limited Financial Literacy

Despite being one of the most educated generations, Gen Z often lacks comprehensive financial literacy. The complexities of managing student loan repayment options, interest rates, and budgeting can be daunting. Many students are not taught financial management skills in school, leaving them unprepared to handle their finances effectively. The gap in financial literacy contributes to difficulties in managing student loans strategically, potentially leading to missed payments, mounting interest, and long-term financial stress. Enhancing financial education and providing resources such as workshops, online courses, and counseling can empower Gen Z to make informed decisions about their loans and overall financial health.

Job Market Challenges

Entering the workforce during an unpredictable economic climate presents significant challenges for Gen Z graduates. Factors such as the COVID-19 pandemic have resulted in a volatile job market, making it harder for new graduates to secure stable, well-paying jobs immediately after completing their education. In many cases, the pressure of repaying student loans begins soon after graduation, regardless of whether they have secured a reliable income source. Additionally, the necessity to take on multiple part-time or low-wage jobs to meet financial obligations can delay career advancement and further strain their finances. Addressing these challenges requires robust support systems, including career counseling, job placement services, and flexible loan repayment options tailored to their unique financial situations.

Frequently Asked Questions

How has the rising cost of education impacted Gen Z’s financial stability?

The rising cost of education has significantly impacted Gen Z’s financial stability, with many relying heavily on student loans to fund their education. This has resulted in elevated levels of student debt, delaying major life milestones such as buying a home and saving for retirement. Additionally, the burden of repayment often leads to increased financial stress and limited disposable income.

In what ways are student loans contributing to the financial struggles of Gen Z?

Student loans are significantly impacting the financial struggles of Gen Z by leading to high levels of debt early in their careers, which can limit their ability to save for future goals such as buying a home or investing. The burden of monthly loan repayments often consumes a considerable portion of their income, making it challenging to cover essential living expenses and emergencies. Additionally, the stress associated with loan repayment obligations can affect their mental well-being and career choices, sometimes forcing them into higher-paying jobs that may not align with their passions.

What resources are available to help Gen Z manage the burden of student loans effectively?

Gen Z can manage student loans effectively by utilizing several resources: government websites like Federal Student Aid for up-to-date information on repayment plans, loan servicer portals for personalized account management, mobile apps like Mint or YNAB for budgeting, and non-profit organizations such as The Institute of Student Loan Advisors for free, expert advice. Additionally, many universities offer financial literacy programs to help students make informed decisions about their loans.

In conclusion, it is evident that Gen Z is grappling with significant financial challenges. These include the rising costs of higher education, a competitive job market, and economic uncertainties exacerbated by the recent global pandemic. However, by understanding the root causes of these financial difficulties, we can better equip this generation with the tools they need to succeed.

Access to comprehensive insights and resources on student loans is crucial in helping Gen Z navigate their educational expenses without falling into unmanageable debt. Additionally, financial literacy programs and support systems can play a pivotal role in empowering young adults to make informed decisions about their finances.

Ultimately, while the financial landscape may appear daunting, there are numerous resources and strategies available to help Gen Z achieve financial stability. By taking proactive steps today, tomorrow’s leaders can pave the way for a more secure financial future.