Whether you just graduated, are taking a break from school, or have already started repaying your student loans, it is important to have a plan in place to manage your student loan debt. This section provides tips and advice for recent graduates on how to keep their student loan debt under control.

One of the first steps in managing your student loan debt is to know the details of your loans. This includes keeping track of the lender, balance, and repayment status for each loan. Understanding the grace periods for your loans is crucial as well. Staying in touch with your lender and choosing the right repayment option are also important factors to consider.

Defaulting on your student loans can have long-term consequences, so it is crucial to take steps to avoid default. Additionally, this section provides advice on how to pay off your loans faster.

Managing student loan debt can be challenging, but with the right knowledge and strategies in place, it is possible to successfully repay your loans and achieve financial independence.

Key Takeaways on Managing Student Loan Debt:

- Know the details of your loans, including lenders, balances, and repayment status.

- Understand the grace periods for your loans.

- Stay in touch with your lender and keep them updated on any changes.

- Choose the right repayment option for your financial situation.

- Avoid defaulting on your student loans by making payments on time and exploring options for deferment or forbearance if needed.

Know Your Loans and Grace Periods

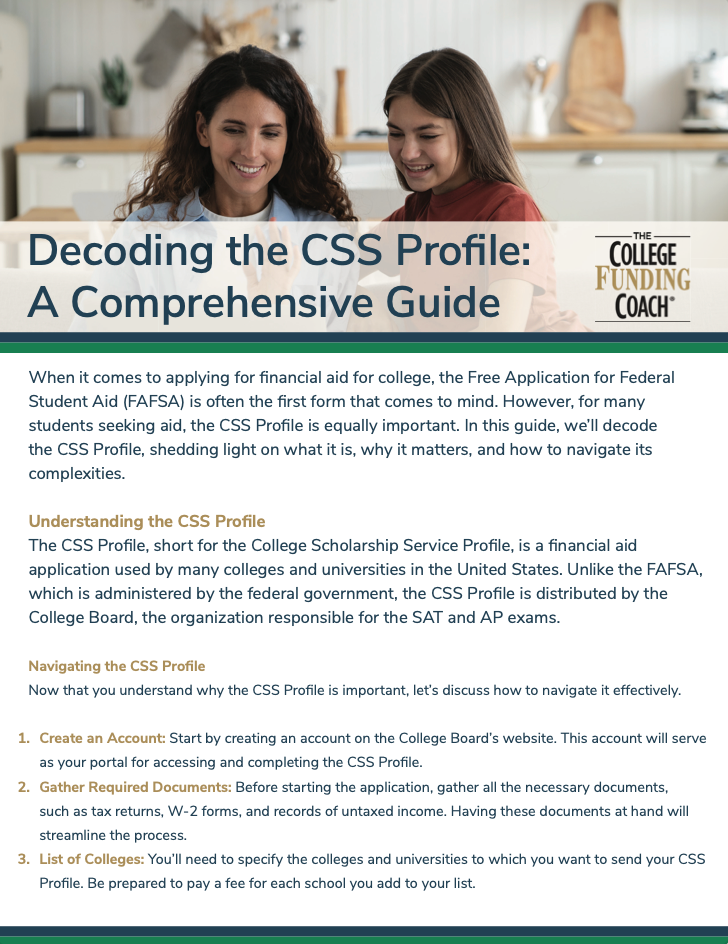

One of the first steps in managing your student loan debt is to have a clear understanding of your loans. It’s essential to know the details of each loan, including the lender, balance, and repayment status for each. To access information about your federal loans, log in to StudentLoans.gov. This platform allows you to view the loan amounts, lender(s), and repayment status of your federal loans. For private loans, it’s important to locate and review the original paperwork or billing statements to gather the necessary information. By having this knowledge, you can better organize and plan for loan repayment.

Additionally, familiarizing yourself with the grace periods associated with your loans is crucial. The grace period refers to the amount of time you have after graduating, leaving school, or dropping below half-time enrollment before you are required to start making payments. Federal student loans typically have a six-month grace period, allowing you some breathing room to secure employment and establish a financial plan. Private loan grace periods may vary, so it’s important to verify the terms with your lender.

During the grace period, it’s important not to miss your first payment. Set up reminders or automatic payments to ensure timely repayment. Failing to make your first payment can have consequences, including additional fees and a negative impact on your credit score. If you’re facing financial challenges during your grace period or at any point during repayment, it’s essential to explore the deferment or forbearance options available. These options allow you to temporarily suspend or reduce your loan payments if you meet certain eligibility criteria.

Understanding Your Loan Types

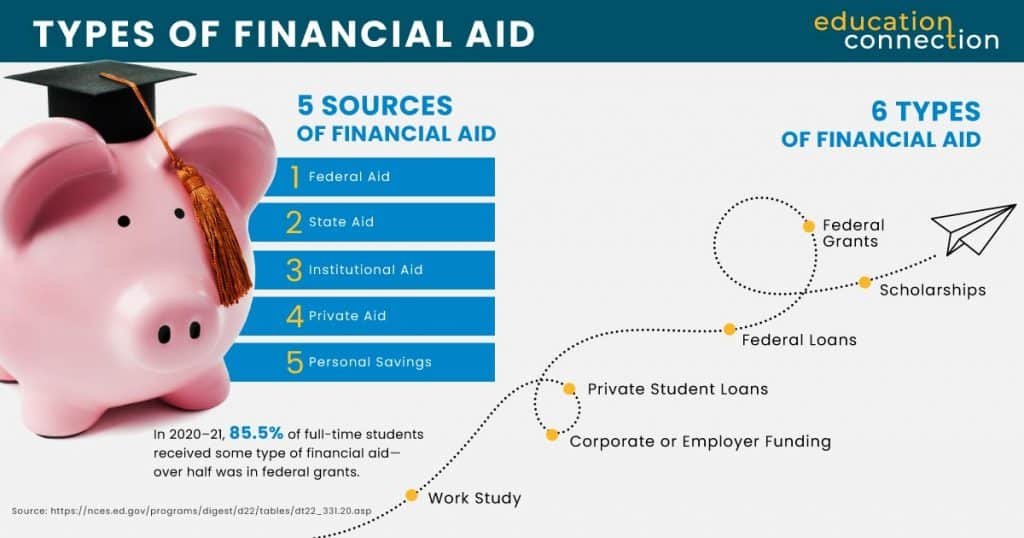

Student loans can come from a variety of sources, including the federal government, private banks, or credit unions. It’s important to distinguish between federal and private loans, as they may have different terms, repayment options, and benefits.

| Loan Type | Description |

|---|---|

| Federal Loans | Loans funded by the federal government with fixed interest rates and various repayment options. These loans may offer forgiveness, income-driven repayment plans, and deferment options. |

| Private Loans | Loans offered by private lenders, such as banks or credit unions. These loans may have variable interest rates and fewer repayment options compared to federal loans. Private loan terms vary, so it’s important to review the terms and conditions. |

Being aware of the type of loans you have will help you navigate the specific requirements and repayment options associated with each.

Stay in Touch with Your Lender and Choose the Right Repayment Option

When it comes to managing your student loan debt, staying in touch with your lender is essential. By maintaining open lines of communication, you can keep them updated on any changes to your contact information and address any concerns or issues that may arise during your loan repayment journey. By proactively reaching out to your lender, you can ensure that both parties are on the same page and working towards a mutually beneficial solution.

Ignoring bills or serious problems related to your student loan debt can have severe consequences, including default. Defaulting on your loans can lead to damaged credit, increased interest rates, and even wage garnishment. Therefore, it is crucial to stay engaged and informed throughout the repayment process.

Choosing the right repayment option is another important step in managing your student loan debt. For federal loans, the standard 10-year repayment plan is automatically applied if no other option is chosen. However, it’s essential to assess your financial situation and explore alternative repayment plans that may better suit your needs.

One such option is an income-driven repayment plan. These plans cap your monthly loan payments at a percentage of your income, making it more manageable to repay your loans while still meeting your other financial obligations. Additionally, income-driven repayment plans often offer loan forgiveness after a certain number of years of consistent repayment.

It’s important to note that private loans may have different repayment options. Therefore, reviewing the terms and conditions of your loans and contacting your lender for more information is crucial. By understanding the available repayment options, you can make an informed decision that aligns with your current financial circumstances and long-term goals.

Keeping in Touch with Your Lender

Communication is key when it comes to staying in touch with your lender. Here are a few tips to help you establish and maintain a relationship:

- Update your contact information promptly if you move or change your phone number or email address.

- Reach out to your lender if you experience financial hardship or anticipate difficulties in making your loan payments.

- Ask questions and seek clarification if you are unsure about any aspect of your loan repayment.

- Take advantage of online tools and resources provided by your lender to stay informed about your loan status and repayment progress.

- Make note of important dates, such as when your grace period ends or when your repayment plan will change.

Choosing the Right Repayment Option

When considering your repayment options, take the time to evaluate your financial situation and goals. Here are some factors to consider:

- Your current income and job prospects

- Your other financial obligations and expenses

- The interest rates on your loans

- Your eligibility for loan forgiveness or income-driven repayment plans

By carefully assessing these factors, you can select the repayment option that best suits your needs. Remember, the goal is to find a plan that allows you to manage your student loan debt while still making progress towards your financial future.

By staying in touch with your lender and choosing the right repayment option, you can take control of your student loan debt and pave the way towards a debt-free future.

Tips for Avoiding Default and Paying Off Your Loans

Defaulting on your student loans can have long-term consequences, so it is crucial to take steps to avoid default. By following these tips and strategies, you can stay on track with your student loan repayment and work towards financial stability.

1. Keep track of your loans

Knowing the details of your loans is essential for effective management. Keep a record of the lender, balance, and repayment status for each loan. This knowledge will help you stay organized and make informed decisions.

2. Make payments on time

Timely payments are crucial for avoiding default. Set reminders or automate your payments to ensure you never miss a due date. If you are facing financial hardship, explore options such as deferment or forbearance to temporarily pause or reduce your payments.

3. Prioritize loans with the highest interest rates

If you want to pay off your loans faster, focus on loans with higher interest rates first. By tackling these loans aggressively, you can reduce the overall interest you pay over the life of your loans.

4. Consider loan consolidation

Loan consolidation allows you to combine multiple student loans into a single loan with a new interest rate. This can simplify your repayment process and potentially lower your monthly payments. However, it’s important to carefully evaluate the terms and conditions of consolidation before making a decision.

5. Prepay if possible

If you have extra income or windfalls, consider making additional payments towards your student loans. By paying more than the minimum amount due, you can reduce the principal balance faster and save on interest over time.

6. Explore loan forgiveness and repayment assistance programs

Depending on your profession or income level, you may qualify for loan forgiveness or repayment assistance programs. These programs can provide relief by reducing or eliminating a portion of your student loan debt. Research available programs and see if you meet the eligibility criteria.

Remember, paying off your student loans is a marathon, not a sprint. Create a realistic repayment plan, set achievable goals, and stay committed to your financial well-being. With discipline and determination, you can successfully manage your student loan debt and build a solid foundation for your future.

| Strategies for Avoiding Default and Paying Off Your Loans | Advantages |

|---|---|

| Keep track of your loans | – Stay organized and informed |

| Make payments on time | – Avoid default and late fees |

| Prioritize loans with the highest interest rates | – Pay off loans faster, save on interest |

| Consider loan consolidation | – Simplify repayment process |

| Prepay if possible | – Reduce principal balance, save on interest |

| Explore loan forgiveness and repayment assistance programs | – Potential debt reduction or elimination |

Conclusion

Managing student loan debt can be challenging, but with the right knowledge and strategies in place, you can successfully repay your loans and achieve financial independence. This article has provided tips and advice for recent graduates on how to effectively manage their student loan debt.

By knowing your loans and understanding their grace periods, you can stay on top of your repayment schedule. Staying in touch with your lender and choosing the right repayment option for your financial situation are also crucial steps.

Most importantly, it’s essential to avoid default by making payments on time and exploring options like deferment or forbearance if you experience financial hardship. To accelerate your repayment journey, consider prepaying when possible and prioritizing loans with the highest interest rates, or even exploring loan consolidation.

By following these tips and staying committed to your repayment plan, you can take control of your student loan debt and work towards a debt-free future. Remember, managing student loan debt is a marathon, not a sprint, but with perseverance and discipline, you can overcome the financial challenges and build a solid foundation for your future.

1 thought on “Managing Student Loan Debt: Tips for Recent Graduates”